- Norway

- /

- Electrical

- /

- OB:ZAP

Investors Appear Satisfied With Zaptec ASA's (OB:ZAP) Prospects As Shares Rocket 27%

Despite an already strong run, Zaptec ASA (OB:ZAP) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 108% in the last year.

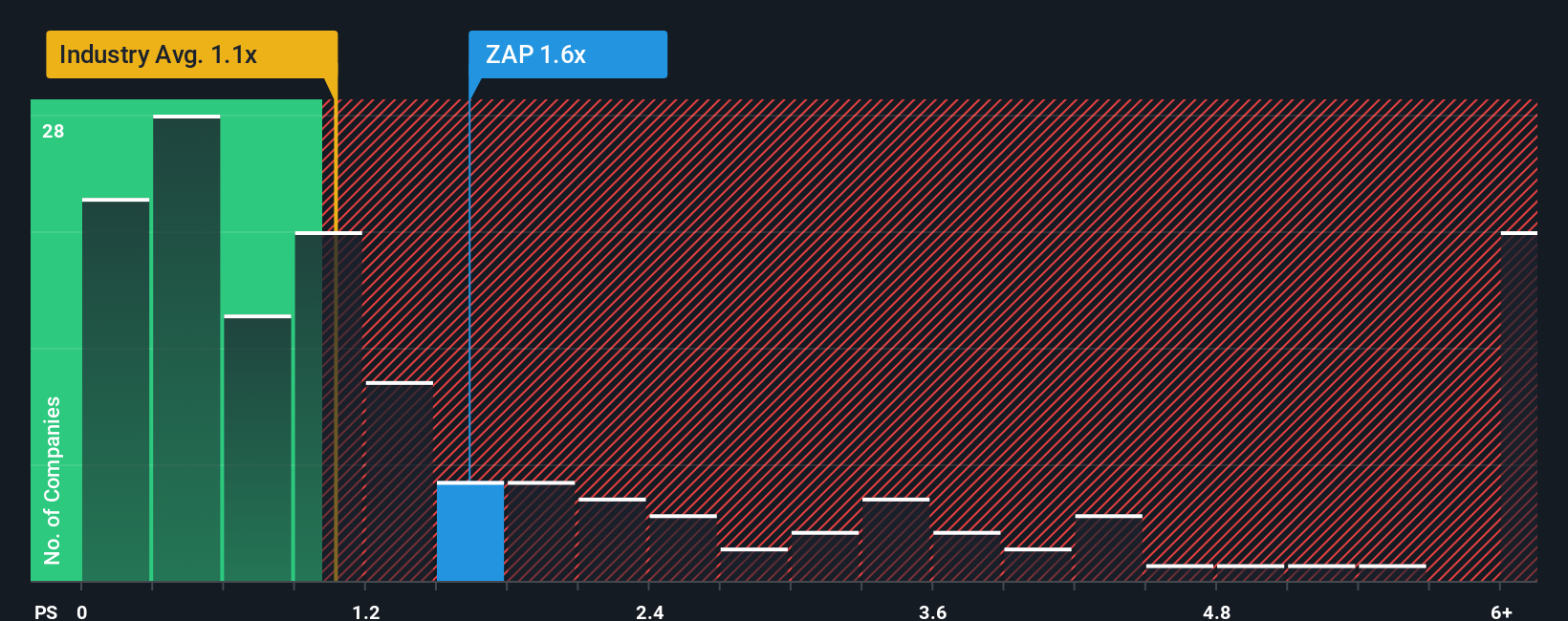

Since its price has surged higher, you could be forgiven for thinking Zaptec is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.6x, considering almost half the companies in Norway's Electrical industry have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Zaptec

How Has Zaptec Performed Recently?

Zaptec hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zaptec.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Zaptec's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 8.7% decrease to the company's top line. Still, the latest three year period has seen an excellent 140% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 13% as estimated by the one analyst watching the company. With the industry only predicted to deliver 7.2%, the company is positioned for a stronger revenue result.

With this information, we can see why Zaptec is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Zaptec's P/S

Zaptec shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Zaptec maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Zaptec with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zaptec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ZAP

Zaptec

Engages in the development and sale of chargers, charging systems, and services for electric car charging in Norway, Sweden, Switzerland, Denmark, Iceland, rest of Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives