Tomra Systems (OB:TOM): Valuation in Focus After Oslo OBX Index Inclusion

Reviewed by Kshitija Bhandaru

Tomra Systems (OB:TOM) has just joined the Oslo OBX Total Return Index, a move that generally brings increased attention from investors. Index inclusion often leads to portfolio shifts as funds tracking the index add new members.

See our latest analysis for Tomra Systems.

Tomra Systems’ latest inclusion in the Oslo OBX Total Return Index puts a spotlight on its performance, but it comes after a muted run. Over the last year, total shareholder return was almost flat and has trailed off further over the past three and five years. Momentum hasn’t picked up in share price terms either, signaling some caution from the market even as strategic developments unfold.

If index changes have you thinking about new opportunities, now’s an ideal time to broaden your scope and discover fast growing stocks with high insider ownership

Given Tomra’s recent lackluster returns but strong underlying revenue and net income growth, is the market overlooking its future prospects, or is the current valuation already capturing all the company’s potential upside?

Most Popular Narrative: 15.2% Undervalued

With Tomra Systems closing at NOK148.4 and the most followed narrative putting fair value at NOK174.98, there is a notable gap suggesting hidden upside potential. What is driving this valuation premium, and how do the core business shifts factor in?

The upcoming implementation of new deposit return systems in multiple countries (including Poland, Portugal, Spain, Moldova, and ongoing progress in the UK) is set to significantly expand Tomra's addressable market for reverse vending machines and services. This supports strong future revenue growth and higher recurring service revenues.

Curious how booming regulation and operational pivots could suddenly accelerate Tomra’s revenue machine? The secret sauce in this valuation could be bold margin expansion forecasts and profit leaps that set the company apart from typical recyclers. Are you ready to uncover the headline numbers and learn what might turbocharge Tomra’s market value?

Result: Fair Value of $174.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, order slowdowns in recycling and unpredictable global demand could challenge Tomra’s growth story and put pressure on its long-term margin outlook.

Find out about the key risks to this Tomra Systems narrative.

Another View: Multiples Paint a Tougher Picture

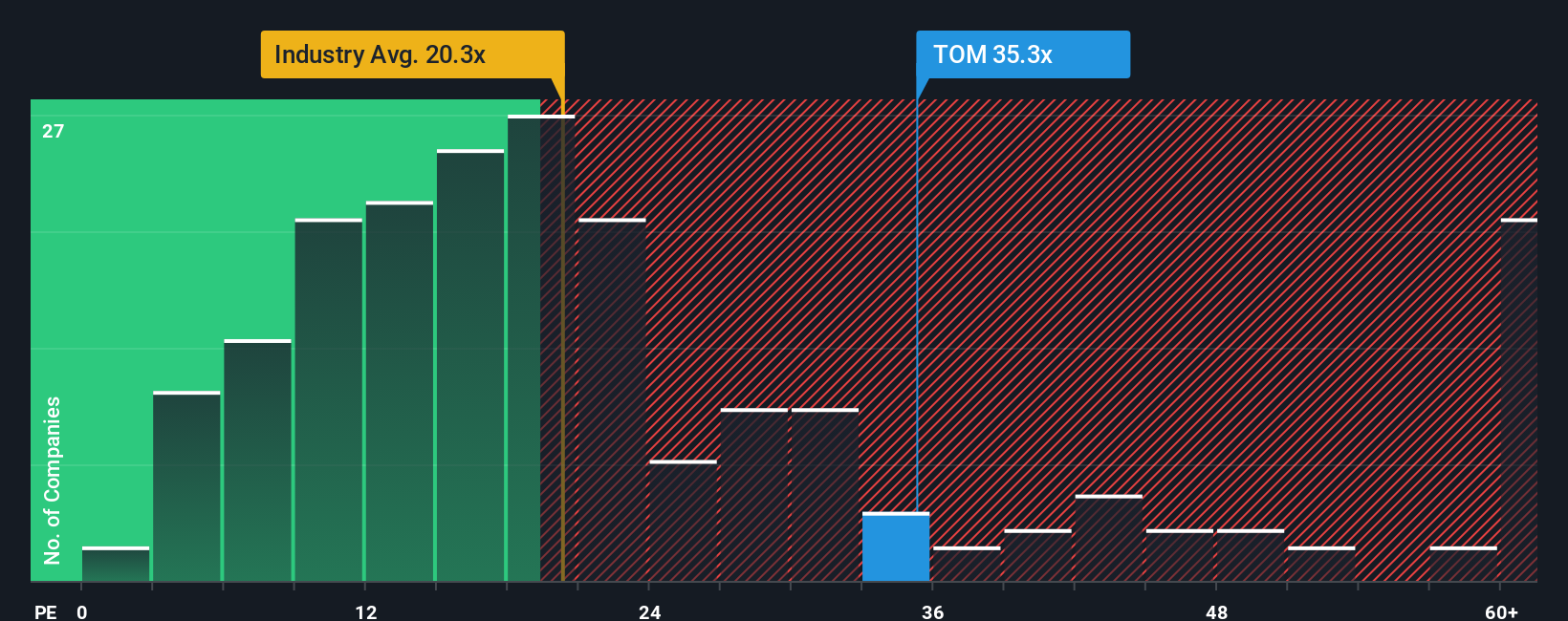

While the consensus forecast sees Tomra as undervalued, a look at its price-to-earnings ratio tells a different story. Tomra trades at 35.9 times earnings, which is much higher than both its peer average of 23.1x and the European Machinery industry norm of 20.2x. Compared with its fair ratio of 35.3x, the stock appears expensive. This suggests the market may already be pricing in significant future gains. Does this premium signal confidence in Tomra's growth story, or could it expose shareholders to valuation risk if growth falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tomra Systems Narrative

If you see Tomra differently or want to dig into the figures on your own terms, shaping your own analysis can take less than three minutes. Do it your way

A great starting point for your Tomra Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit yourself to just one stock when entire markets are shifting. The best moves often come from spotting trends early in areas others overlook.

- Unlock high yields and income growth by checking out these 19 dividend stocks with yields > 3% with robust returns over 3% from established market leaders.

- Capitalize on the explosive potential of artificial intelligence by reviewing these 24 AI penny stocks set to transform areas ranging from automation to analytics.

- Catch undervalued gems before the crowd by scanning these 895 undervalued stocks based on cash flows offering strong cash flow prospects at compelling prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tomra Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TOM

Tomra Systems

Provides sensor-based solutions for optimal resource productivity worldwide.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives