Tomra Systems (OB:TOM): Evaluating Valuation After Q3 Miss and Poland Deposit Return System Launch

Reviewed by Kshitija Bhandaru

Tomra Systems (OB:TOM) is in the spotlight after its third-quarter update, which showed earnings trailing market expectations, largely due to ongoing softness in Recycling. At the same time, momentum is building with a major order tied to Poland’s new deposit return system.

See our latest analysis for Tomra Systems.

Tomra’s share price has taken a sharp hit in the wake of its Q3 results, falling 24% over the past month and down 21% year-to-date, as investors react to recent earnings misses and headwinds in the Recycling division. Despite the market’s short-term caution, Tomra’s long-term strategy around deposit return systems and strong order intake in newer markets like Poland suggest potential for renewed momentum ahead, even after a one-year total shareholder return of -17.9%.

If you’re weighing where growth could pick up next, now is an ideal moment to broaden your outlook and discover fast growing stocks with high insider ownership

With shares sharply lower and forecasts for strong medium-term growth, the key question is whether Tomra’s recent slump means the stock is now undervalued or if the market is already taking the company’s future prospects into account.

Most Popular Narrative: 27% Undervalued

Tomra Systems is trading well below the most widely followed narrative's fair value estimate, with last close at NOK118.5 compared to a projected value of NOK163.26. This gap highlights a significant divergence between current investor sentiment and the future expectations driving the narrative's valuation model.

The upcoming implementation of new deposit return systems in multiple countries, including Poland, Portugal, Spain, Moldova, and ongoing progress in the UK, is set to significantly expand Tomra's addressable market for reverse vending machines and services. This is expected to support strong future revenue growth and higher recurring service revenues.

Want to know what’s fueling such bullish numbers? The narrative points to bold revenue growth, improving margins, and future profit multiples that could reset expectations for Tomra. Ready to see the exact forecasts redefining this company’s fair value? Dive deeper for the quantitative details behind this market-moving perspective.

Result: Fair Value of $163.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weak order intake in Recycling and continued macroeconomic uncertainty could quickly challenge the bullish outlook if customer investment remains subdued.

Find out about the key risks to this Tomra Systems narrative.

Another View: Are the Ratios Telling a Different Story?

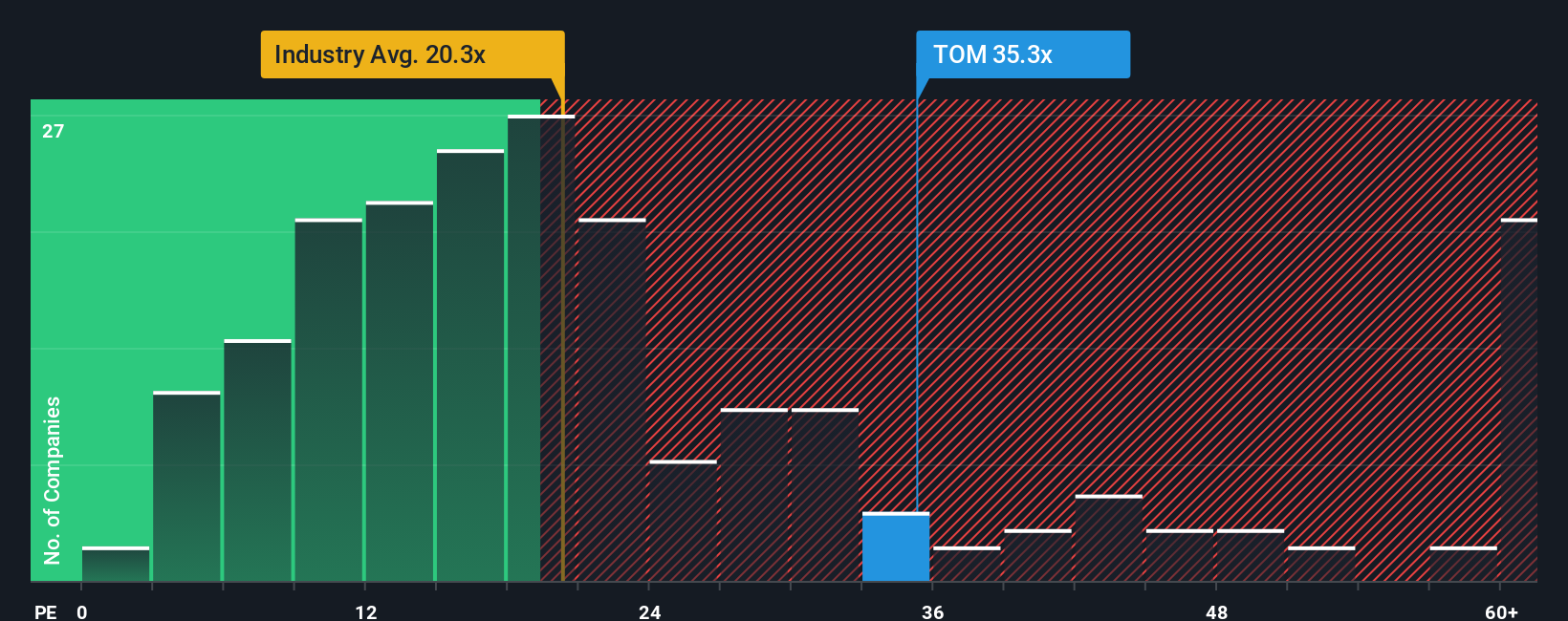

While fair value models highlight Tomra as undervalued, a glance at the price-to-earnings ratio suggests caution. Tomra trades at 30 times earnings, noticeably higher than the industry average of 19.9 and the peer average of 22.6. Even so, it is below the fair ratio of 38, a mark the market may eventually revisit. This raises an important question for investors: will Tomra's premium hold up, or is there risk of a valuation pullback?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tomra Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tomra Systems Narrative

If the consensus view does not align with your thinking, or you want to dig into the numbers yourself, you can easily develop your own take on Tomra in just a few minutes. Do it your way

A great starting point for your Tomra Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to step up your strategy and catch tomorrow’s winners before they’re mainstream? Use these expert-curated shortcuts to start building a smarter, stronger portfolio now.

- Unlock future healthcare breakthroughs by tapping into these 33 healthcare AI stocks, featuring companies at the forefront of medical AI and diagnostics innovation.

- Amplify your income with these 18 dividend stocks with yields > 3%, spotlighting stocks that pay generous yields over 3% and offer stable cash returns for long-term growth.

- Ride the next wave in digital assets with these 79 cryptocurrency and blockchain stocks, unveiling stocks set to benefit from the evolution of cryptocurrencies and blockchain technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tomra Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TOM

Tomra Systems

Provides sensor-based solutions for optimal resource productivity worldwide.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives