Investors might be losing patience for Philly Shipyard's (OB:PHLY) increasing losses, as stock sheds 87% over the past week

No-one enjoys it when they lose money on a stock. But no-one can make money on every call, especially in a declining market. The Philly Shipyard ASA (OB:PHLY) is down 80% over three years, but the total shareholder return is 81% once you include the dividend. And that total return actually beats the market return of 24%. On top of that, the share price is down 87% in the last week.

After losing 87% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Philly Shipyard

Philly Shipyard didn't have any revenue in the last year, so it's fair to say it doesn't yet have a proven product (or at least not one people are paying for). We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. Investors will be hoping that Philly Shipyard can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Philly Shipyard investors have already had a taste of the bitterness stocks like this can leave in the mouth.

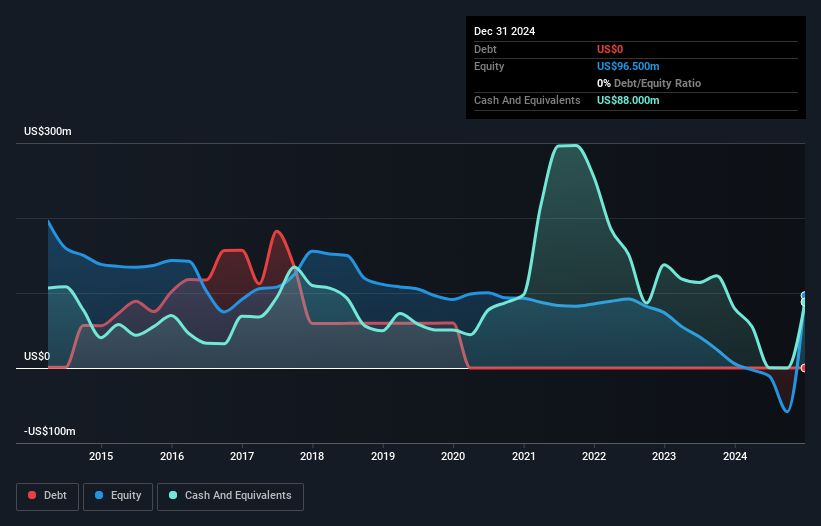

When it last reported its balance sheet in December 2024, Philly Shipyard could boast a strong position, with cash in excess of all liabilities of US$86m. This gives management the flexibility to drive business growth, without worrying too much about cash reserves. But since the share price has dropped 22% per year, over 3 years , it seems like the market might have been over-excited previously. The image below shows how Philly Shipyard's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Philly Shipyard's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Philly Shipyard's TSR of 81% over the last 3 years is better than the share price return.

A Different Perspective

We're pleased to report that Philly Shipyard shareholders have received a total shareholder return of 131% over one year. That gain is better than the annual TSR over five years, which is 15%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Philly Shipyard better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Philly Shipyard you should be aware of, and 3 of them are potentially serious.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:PHLY

Philly Shipyard

Operates a commercial shipyard that builds and repairs vessels for the United States Jones Act market and government.

Flawless balance sheet and good value.

Market Insights

Community Narratives