- Norway

- /

- Electrical

- /

- OB:NEL

Market Participants Recognise Nel ASA's (OB:NEL) Revenues Pushing Shares 53% Higher

Nel ASA (OB:NEL) shareholders have had their patience rewarded with a 53% share price jump in the last month. But the last month did very little to improve the 53% share price decline over the last year.

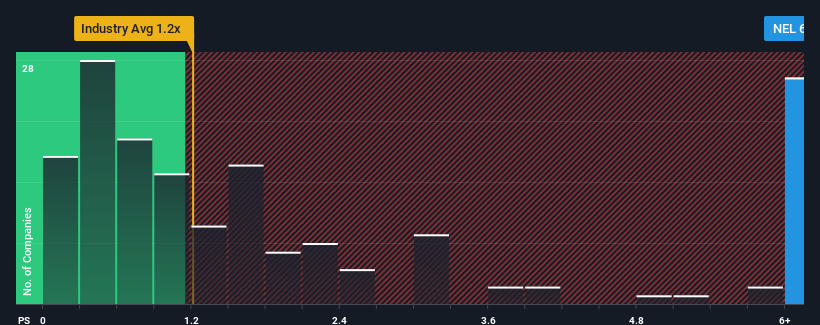

Following the firm bounce in price, given around half the companies in Norway's Electrical industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Nel as a stock to avoid entirely with its 6.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Nel

How Has Nel Performed Recently?

Nel's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Nel will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Nel's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 61%. The strong recent performance means it was also able to grow revenue by 185% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 38% per year during the coming three years according to the analysts following the company. With the industry only predicted to deliver 11% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Nel's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Nel's P/S

The strong share price surge has lead to Nel's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Nel's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Nel, and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Nel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NEL

Nel

A hydrogen company, provides solutions to produce, store, and distribute hydrogen from renewable energy in Norway and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives