- Norway

- /

- Aerospace & Defense

- /

- OB:KOG

Does Kongsberg Gruppen's (OB:KOG) Extraordinary Dividend Reveal a Shift in Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- Earlier this month, Kongsberg Gruppen’s Board announced the distribution of an extraordinary dividend of NOK 2.40 per share, with the ex-date having been set for October 9, 2025, prompting NASDAQ Derivatives Markets to adjust related options and futures contracts.

- This extraordinary dividend represents a significant return of capital to shareholders and triggered immediate recalibration across financial derivatives linked to Kongsberg Gruppen shares.

- With the company's decision to distribute an extraordinary dividend, we will examine how this capital allocation move influences its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kongsberg Gruppen Investment Narrative Recap

To be a shareholder in Kongsberg Gruppen, you need to believe that sustained global defense spending, backed by a robust backlog and advanced product portfolio, will drive both top-line growth and recurring earnings. The extraordinary dividend announcement underscores financial strength but has no material impact on the critical short-term catalyst of defense contract execution, nor does it address the key risk of possible shifts in government spending priorities.

Among recent events, the NOK 12 billion NASAMS and NOMADS contract with the Netherlands directly reinforces the company's near-term order pipeline, a catalyst that keeps attention focused on conversion of backlog into timely, profitable revenue, irrespective of extraordinary capital returns. But even as new orders arrive, the durability of margin expansion depends on project mix and regulatory changes, which remain sources of uncertainty.

By contrast, investors should be alert to the possibility that government priorities shift unexpectedly and...

Read the full narrative on Kongsberg Gruppen (it's free!)

Kongsberg Gruppen's narrative projects NOK83.8 billion in revenue and NOK9.2 billion in earnings by 2028. This requires 16.4% yearly revenue growth and an increase of NOK2.5 billion in earnings from the current NOK6.7 billion.

Uncover how Kongsberg Gruppen's forecasts yield a NOK325.17 fair value, a 7% upside to its current price.

Exploring Other Perspectives

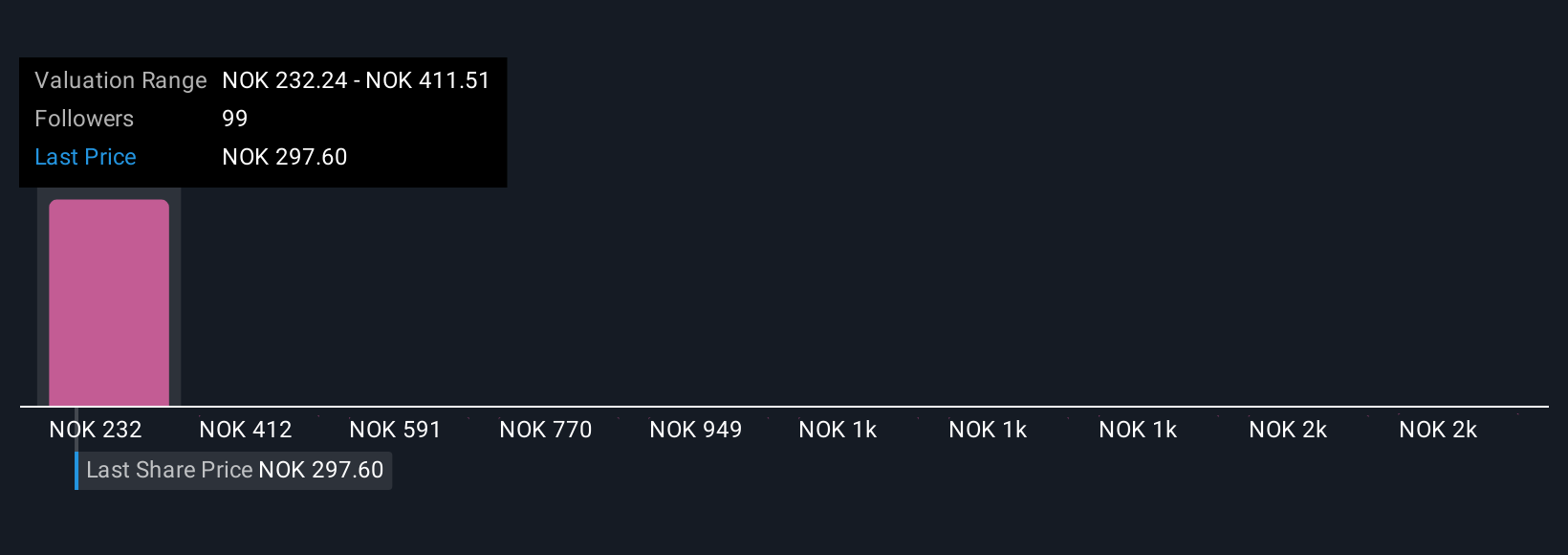

Fair value estimates from 11 members of the Simply Wall St Community range widely, from NOK 233.50 to NOK 2,024.99 per share. While many are focused on growth from the company’s multi-billion NOK contracts, future government policy changes could still reshape the outlook, prompting fresh debate among market participants and encouraging you to weigh several distinct perspectives.

Explore 11 other fair value estimates on Kongsberg Gruppen - why the stock might be worth 23% less than the current price!

Build Your Own Kongsberg Gruppen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kongsberg Gruppen research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Kongsberg Gruppen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kongsberg Gruppen's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kongsberg Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KOG

Kongsberg Gruppen

Provides high-tech systems and solutions primarily to customers in the maritime and defense markets.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives