We Think HydrogenPro (OB:HYPRO) Can Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should HydrogenPro (OB:HYPRO) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for HydrogenPro

How Long Is HydrogenPro's Cash Runway?

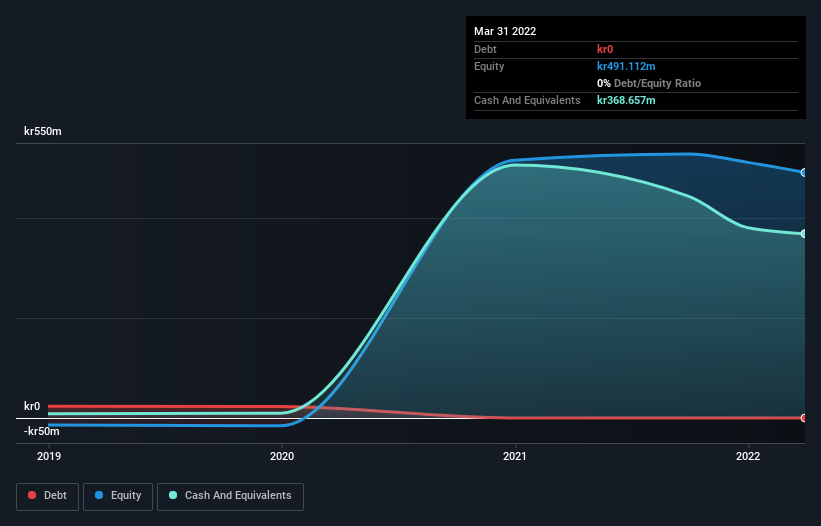

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In March 2022, HydrogenPro had kr369m in cash, and was debt-free. Importantly, its cash burn was kr73m over the trailing twelve months. Therefore, from March 2022 it had 5.1 years of cash runway. Importantly, though, the one analyst we see covering the stock thinks that HydrogenPro will reach cashflow breakeven before then. If that happens, then the length of its cash runway, today, would become a moot point. Depicted below, you can see how its cash holdings have changed over time.

How Well Is HydrogenPro Growing?

Notably, HydrogenPro actually ramped up its cash burn very hard and fast in the last year, by 154%, signifying heavy investment in the business. While operating revenue was up over the same period, the 5.7% gain gives us scant comfort. Taken together, we think these growth metrics are a little worrying. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can HydrogenPro Raise Cash?

HydrogenPro seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

HydrogenPro's cash burn of kr73m is about 5.1% of its kr1.4b market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is HydrogenPro's Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought HydrogenPro's cash runway was relatively promising. One real positive is that at least one analyst is forecasting that the company will reach breakeven. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Taking an in-depth view of risks, we've identified 1 warning sign for HydrogenPro that you should be aware of before investing.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Valuation is complex, but we're here to simplify it.

Discover if HydrogenPro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HYPRO

HydrogenPro

Engages in designing and delivering hydrogen technology and systems in Norway, Europe, the United States, and the Asia Pacific.

High growth potential with excellent balance sheet.