HydrogenPro ASA (OB:HYPRO) Soars 35% But It's A Story Of Risk Vs Reward

Those holding HydrogenPro ASA (OB:HYPRO) shares would be relieved that the share price has rebounded 35% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

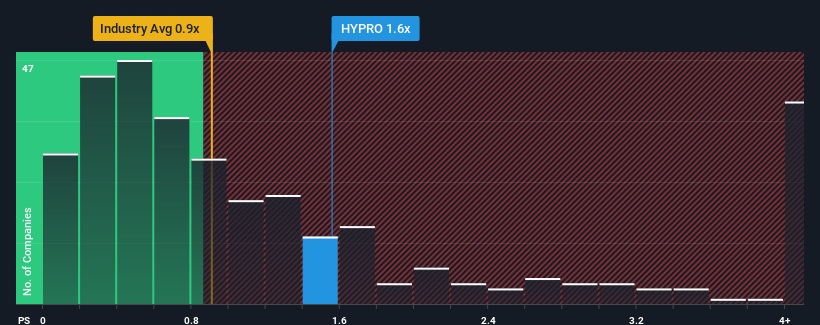

In spite of the firm bounce in price, there still wouldn't be many who think HydrogenPro's price-to-sales (or "P/S") ratio of 1.6x is worth a mention when the median P/S in Norway's Machinery industry is similar at about 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for HydrogenPro

What Does HydrogenPro's P/S Mean For Shareholders?

HydrogenPro certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think HydrogenPro's future stacks up against the industry? In that case, our free report is a great place to start.How Is HydrogenPro's Revenue Growth Trending?

In order to justify its P/S ratio, HydrogenPro would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 95% each year as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 13% per year growth forecast for the broader industry.

With this information, we find it interesting that HydrogenPro is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does HydrogenPro's P/S Mean For Investors?

Its shares have lifted substantially and now HydrogenPro's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that HydrogenPro currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It is also worth noting that we have found 3 warning signs for HydrogenPro (1 is a bit concerning!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if HydrogenPro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HYPRO

HydrogenPro

Engages in designing and delivering hydrogen technology and systems in Norway, Europe, the United States, and the Asia Pacific.

High growth potential with excellent balance sheet.