Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Hexagon Composites ASA (OB:HEX) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Hexagon Composites

What Is Hexagon Composites's Net Debt?

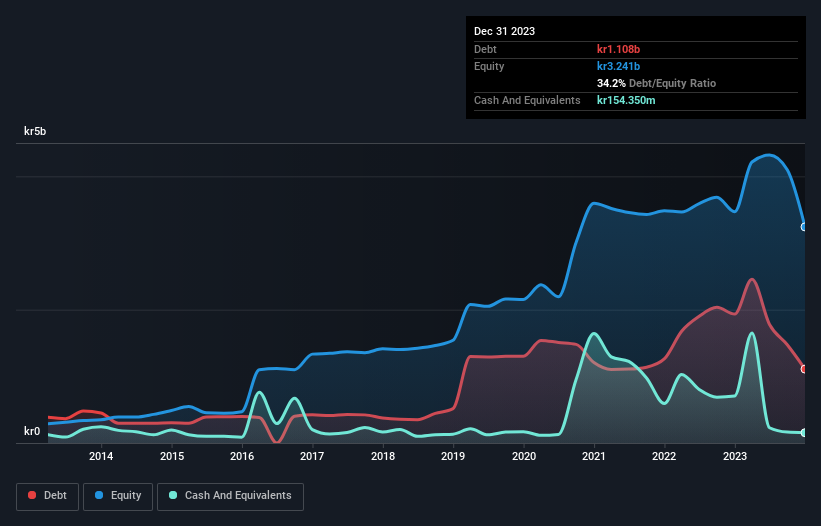

As you can see below, Hexagon Composites had kr1.11b of debt at December 2023, down from kr1.93b a year prior. On the flip side, it has kr154.4m in cash leading to net debt of about kr954.1m.

How Strong Is Hexagon Composites' Balance Sheet?

According to the last reported balance sheet, Hexagon Composites had liabilities of kr2.69b due within 12 months, and liabilities of kr528.5m due beyond 12 months. Offsetting this, it had kr154.4m in cash and kr551.4m in receivables that were due within 12 months. So it has liabilities totalling kr2.51b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of kr3.93b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Even though Hexagon Composites's debt is only 2.3, its interest cover is really very low at 0.77. This does have us wondering if the company pays high interest because it is considered risky. Either way there's no doubt the stock is using meaningful leverage. We also note that Hexagon Composites improved its EBIT from a last year's loss to a positive kr221m. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Hexagon Composites's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Hexagon Composites reported free cash flow worth 20% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Mulling over Hexagon Composites's attempt at covering its interest expense with its EBIT, we're certainly not enthusiastic. But at least its EBIT growth rate is not so bad. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Hexagon Composites stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Hexagon Composites might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HEX

Hexagon Composites

Engages in the manufacture and sale of composite pressure cylinders and fuel systems for alternative fuels worldwide.

Excellent balance sheet and good value.