Cambi ASA (OB:CAMBI) Stock Rockets 31% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Cambi ASA (OB:CAMBI) shares have been powering on, with a gain of 31% in the last thirty days. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

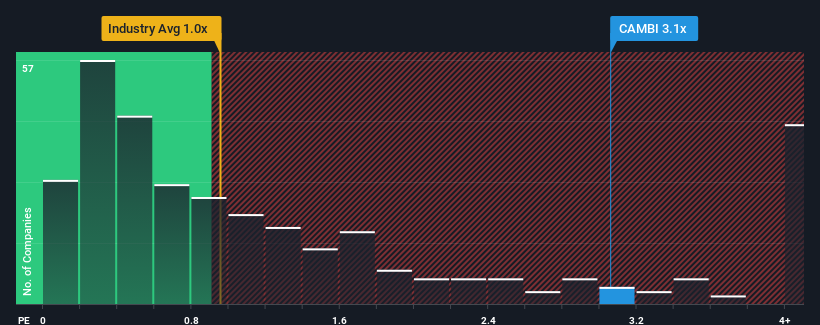

Following the firm bounce in price, you could be forgiven for thinking Cambi is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.1x, considering almost half the companies in Norway's Machinery industry have P/S ratios below 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Cambi

How Cambi Has Been Performing

Recent times have been advantageous for Cambi as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Cambi's future stacks up against the industry? In that case, our free report is a great place to start.How Is Cambi's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Cambi's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 135% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the two analysts watching the company. With the industry predicted to deliver 13% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's curious that Cambi's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Cambi's P/S?

Cambi shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Cambi's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Cambi (1 is potentially serious) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:CAMBI

Cambi

Provides thermal hydrolysis solutions for sewage sludge and organic waste management solutions in Europe, the United States, Asia, Africa, and Oceania.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives