The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Bonheur ASA (OB:BONHR) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Bonheur

What Is Bonheur's Debt?

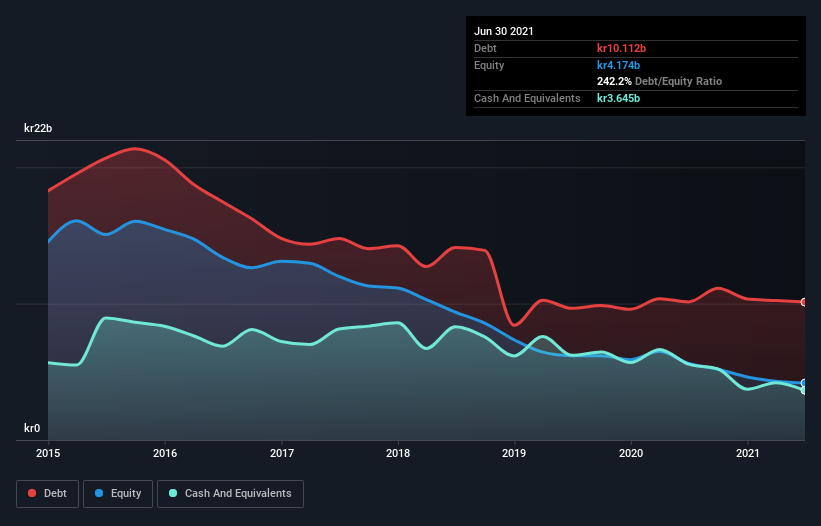

As you can see below, Bonheur had kr10.1b of debt, at June 2021, which is about the same as the year before. You can click the chart for greater detail. However, it does have kr3.65b in cash offsetting this, leading to net debt of about kr6.47b.

A Look At Bonheur's Liabilities

The latest balance sheet data shows that Bonheur had liabilities of kr4.01b due within a year, and liabilities of kr10.6b falling due after that. On the other hand, it had cash of kr3.65b and kr2.37b worth of receivables due within a year. So its liabilities total kr8.54b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of kr12.9b, so it does suggest shareholders should keep an eye on Bonheur's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Bonheur can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Bonheur had a loss before interest and tax, and actually shrunk its revenue by 20%, to kr5.9b. We would much prefer see growth.

Caveat Emptor

Not only did Bonheur's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). To be specific the EBIT loss came in at kr80m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled kr1.6b in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for Bonheur that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Bonheur might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:BONHR

Bonheur

Engages in the renewable energy, wind service, and cruise businesses in the United Kingdom, Norway, Europe, Asia, the Americas, Africa, and Internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives