- Norway

- /

- Industrials

- /

- OB:AKER

Is Now the Right Moment for Aker After Its 53% Surge and Quarterly Results?

Reviewed by Bailey Pemberton

If you are watching Aker right now, you are definitely not alone. With a steady climb over the past year and a last close at 797.0, the stock has caught the eye of many looking for momentum, value, or simply the next big move. In the past five years, investors have seen a stunning 158.8% return. Even the more recent numbers are impressive: up 14.0% over the last month and boasting a 53.0% jump in the past year. These gains speak to optimism around Aker’s strategies and the market's view of its future potential. At the same time, these big swings have made the question of whether Aker is undervalued or overvalued even tougher to answer.

Some of this enthusiasm ties back to broader market developments that have benefited industrial and energy-adjacent names like Aker, as investors have looked for opportunities tied to long-term global trends. Whether it is increased focus on sustainable solutions or renewed interest in diversified conglomerates, Aker has clearly been in the crosshairs of shifting sentiment. Still, not every metric signals that it is undervalued. According to our standard valuation scorecard, where the company earns one point for each check it passes, Aker comes in at a 2 out of 6, suggesting selective value rather than a deep bargain.

Of course, pure numbers rarely tell the whole story on their own. In the next section, we will dig into how analysts evaluate Aker with different valuation methods. Later, we will reveal an even more insightful way to think about the company’s true worth, one you will not want to miss.

Aker scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Aker Discounted Cash Flow (DCF) Analysis

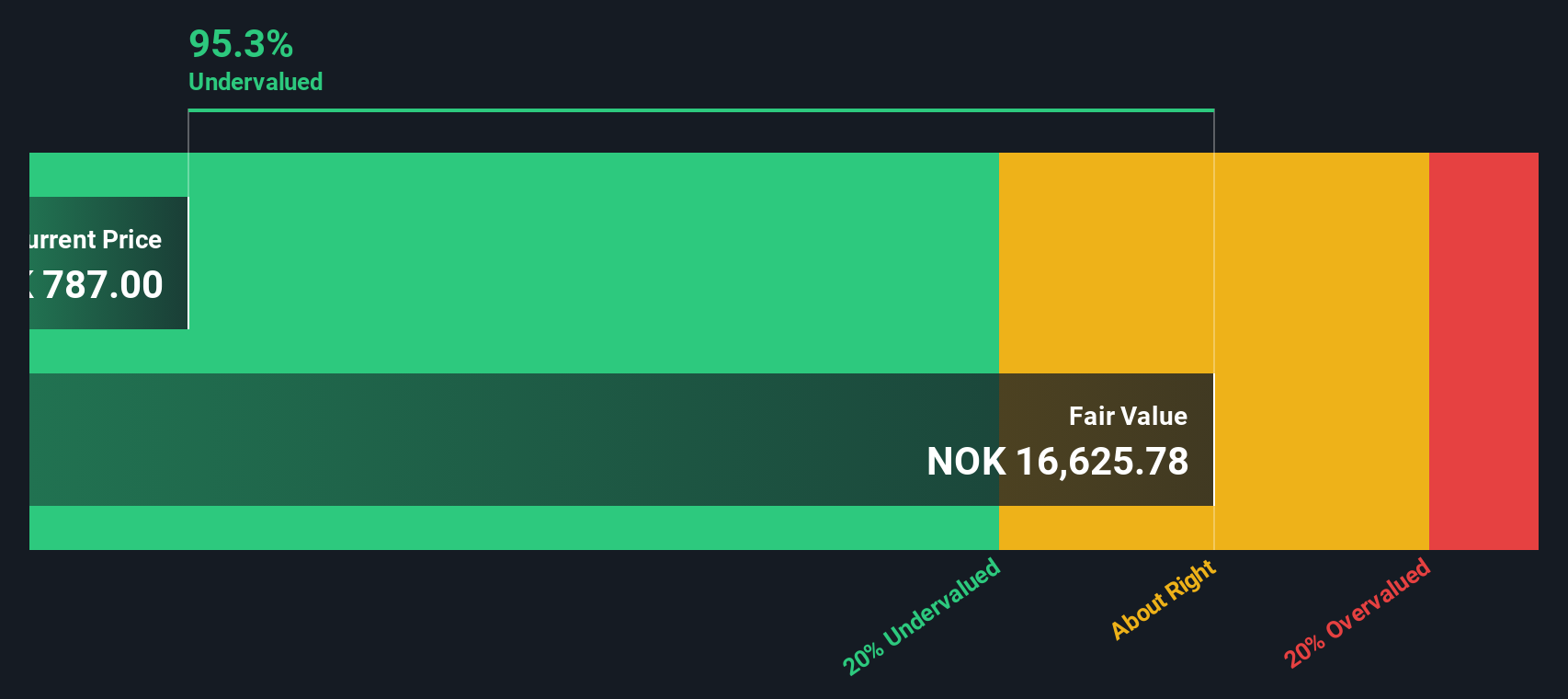

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today. This provides an investor-focused measure of what the company is truly worth. For Aker, this approach starts with its latest reported Free Cash Flow (FCF) of 6.8 Billion NOK. Based on current estimates and long-term extrapolation, analysts project that Aker's annual FCF will grow substantially over the coming decade, reaching over 91.4 Billion NOK by 2035.

Only the first five years of these projections are grounded in analyst estimates. Further growth beyond that point is extrapolated to provide a complete picture. The DCF aggregates and discounts these annual numbers, ultimately resulting in an estimated intrinsic value of 16,523 Billion NOK for Aker.

When compared to the recent share price, the DCF calculation implies that Aker could be undervalued by a striking 95.2%. Based on these robust projections, Aker’s current valuation appears highly attractive under this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Aker is undervalued by 95.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Aker Price vs Sales

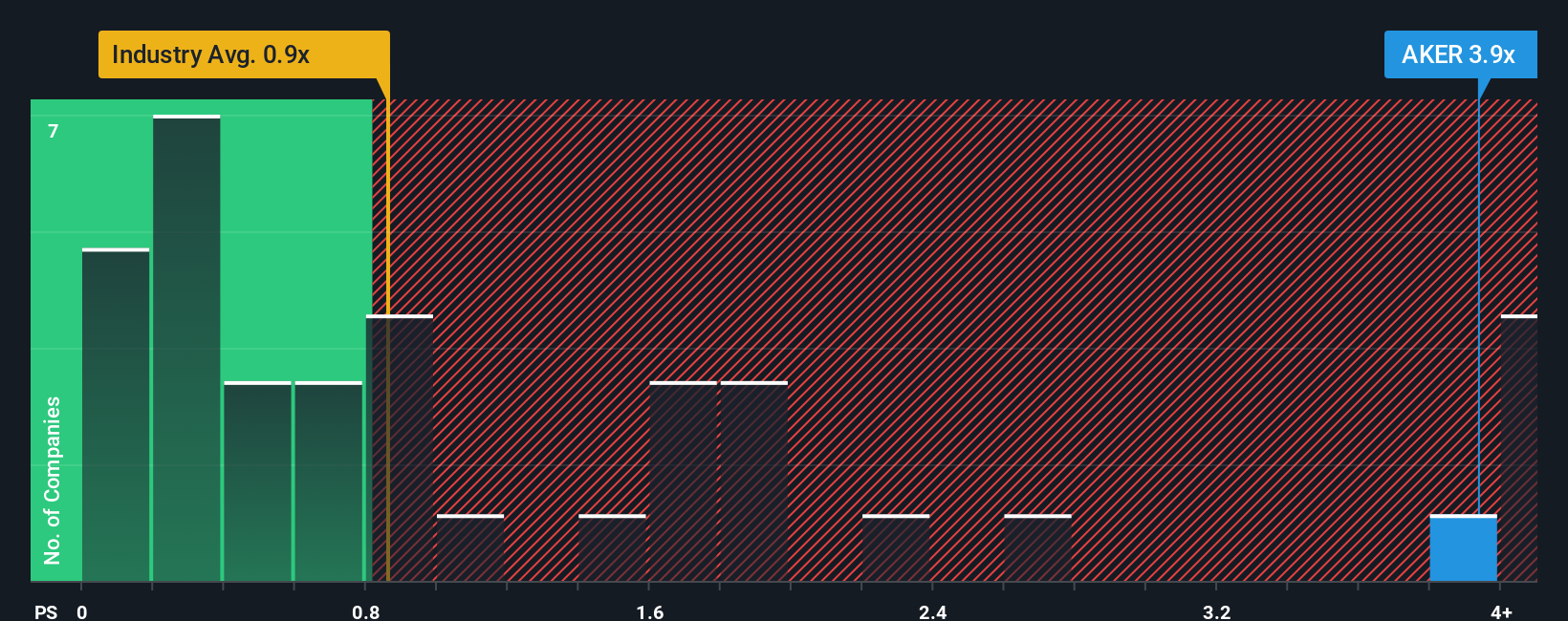

For companies like Aker, which have complex business models and may report uneven earnings, the Price-to-Sales (P/S) ratio is often a preferred valuation metric. This multiple offers a clear view by comparing the company’s total market value to its revenues, sidestepping the volatility that can skew profit-based ratios. The P/S ratio is especially helpful for assessing firms where growth prospects are strong but reported profits may not tell the whole story.

Industry norms matter when evaluating what is a "fair" P/S ratio. Growth expectations and company risks both play a big role. Higher growth typically justifies a higher P/S ratio, while increased risk or thinner profit margins warrant a lower ratio. Right now, Aker trades at a P/S of 4.33x, notably higher than its industry average of 0.81x and the peer average of 2.89x. This signals that investors are paying a premium for each kroner of Aker’s sales compared to most industrial names.

Simply Wall St's Fair Ratio provides deeper context. Unlike simple comparisons, the Fair Ratio incorporates not just industry or peer data, but also factors like company size, growth potential, profitability, and unique risk profiles. This holistic gauge offers a more customized sense of whether a stock’s valuation makes sense. In Aker’s case, the actual P/S ratio sits well above what would be expected from these fundamentals and indicates the stock is currently overvalued on a sales basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Aker Narrative

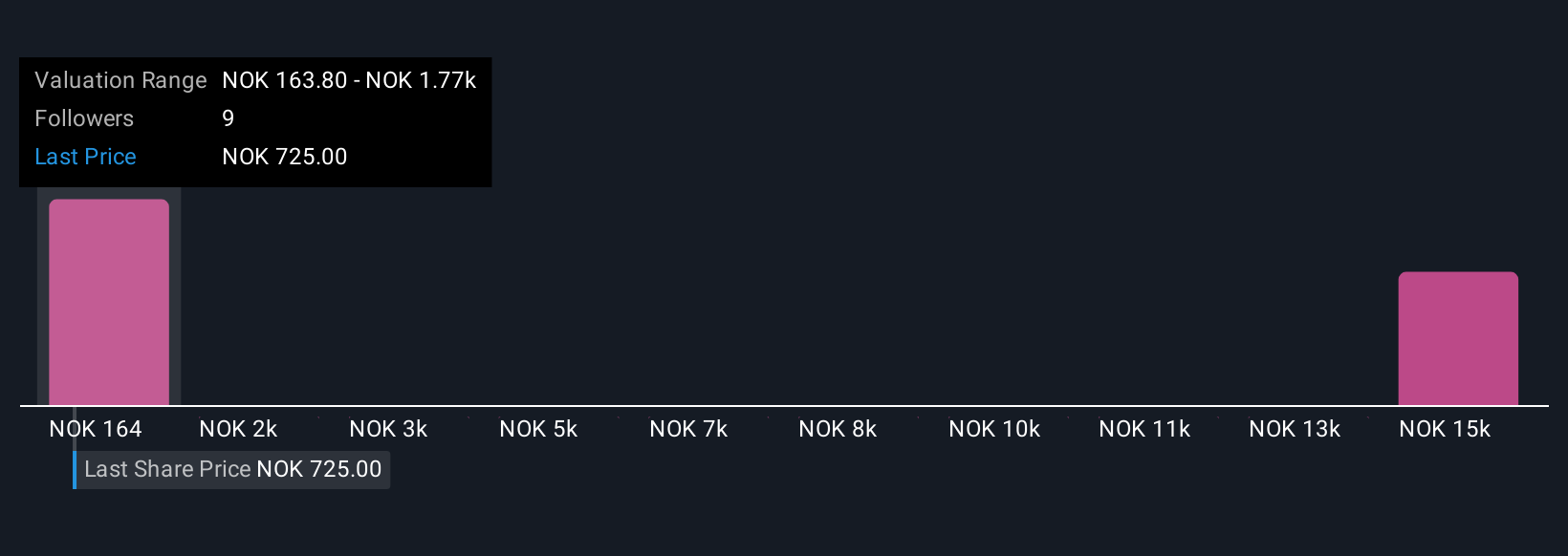

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just a number. It's your personal story and outlook woven into the financials, your fair value, growth forecasts, and assumptions about Aker’s future. Narratives connect what you believe about the business, translate it into forecasts, and reveal what that means for its fair value.

On Simply Wall St's Community page, Narratives are an easy, accessible tool used by millions of investors to bridge the gap between news, financial models, and actionable decisions. They empower you to compare your Fair Value with the current Price, making it clear when you might want to buy, hold, or sell. This happens in real time as new information, such as company news or earnings, updates your Narrative automatically.

For example, one investor’s Narrative might see Aker’s fair value at the very top end of analyst forecasts due to high growth expectations. Another might view it at the lowest estimate owing to greater caution. Narratives make it simple to see these differences and confidently decide your next move.

Do you think there's more to the story for Aker? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKER

Aker

Operates as an industrial investment company in Norway, Europa, North America, South America, and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives