- Norway

- /

- Industrials

- /

- OB:AKER

Aker (OB:AKER) Valuation in Focus After Landmark AI Infrastructure Deal With Microsoft

Reviewed by Kshitija Bhandaru

Trying to figure out what to do next with Aker (OB:AKER) shares? You are not alone. Today’s headlines landed with a jolt as the Norwegian industrial group has just inked a huge five-year deal with Microsoft and Nscale Global Holdings to deliver high-performance, renewable-powered AI infrastructure in Northern Norway. With a headline value of around USD 6.2 billion, the contract is not just sizeable; it underscores Aker’s push into cutting-edge, sustainable technology ventures and signals a long-term pivot that could reshape its earnings profile.

This Microsoft agreement comes as Aker shares have seen strong momentum. The stock has climbed 50% in the past year and is up more than 33% year-to-date, hinting that investors are warming to its evolving story. Cash flow from the new project will support capital spending and help secure the joint venture’s future growth, adding another layer of anticipation around Aker’s next moves. Even after this rally, multi-year returns suggest the market sees further potential but is at the same time assessing the risks that come with such transformative deals.

So after such a year of gains and big news, the question is front and center: is the stock undervalued at this stage, or is the market already factoring in the next wave of growth?

Price-to-Sales of 4.2x: Is it justified?

On a price-to-sales basis, Aker currently trades at 4.2 times its revenues, indicating that the market values the company well above both the industry and peer averages.

The price-to-sales multiple measures how much investors are willing to pay for a company's revenue. It is especially relevant for industrial groups like Aker, where profit numbers may be volatile due to large, long-term contracts and cyclical swings. In these cases, sales provide a more stable comparison metric.

This elevated multiple suggests that the market is placing a premium on Aker’s growth prospects or its ability to convert recent strategic wins into higher sales, rather than just rewarding current financial performance. However, with Aker’s figure far exceeding the industry standard, investors may be significantly overestimating its short-term revenue potential or are betting on substantial growth well ahead of sector peers.

Result: Fair Value of $N/A (OVERVALUED)

See our latest analysis for Aker.However, persistent questions remain over Aker’s slim profit margins and whether earnings will keep pace with the market’s rapid shift in expectations.

Find out about the key risks to this Aker narrative.Another Angle: SWS DCF Model Says Undervalued

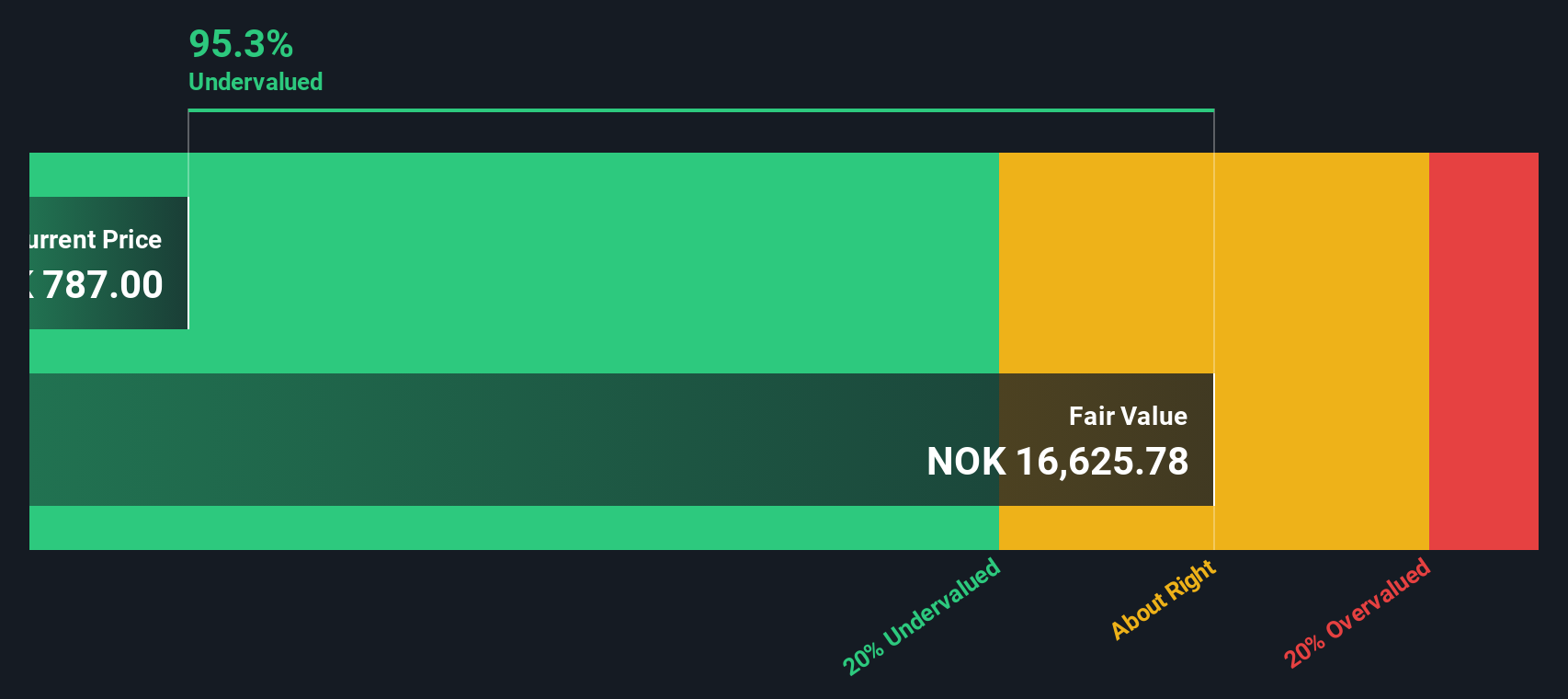

Looking at things from a different angle, our DCF model tells a very different story. It points to Aker trading below its fair value. This stands in stark contrast to what revenue multiples suggest. Is the truth somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aker Narrative

If you want to dive deeper or arrive at your own conclusions, you can easily put together your own assessment in a matter of minutes. Do it your way

A great starting point for your Aker research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one great opportunity. The market is packed with stocks redefining entire industries. Now is an excellent time to get ahead of the curve using the Simply Wall Street Screener.

- Unlock growth potential by exploring digital currency trends and discover tomorrow’s leaders in innovation with cryptocurrency and blockchain stocks.

- Find opportunities for steady income by checking out companies offering impressive yields above 3 percent in our handpicked list of dividend stocks with yields > 3%.

- Take advantage of advances in AI by reviewing a tailored selection of fast-moving technology firms showing momentum through AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKER

Aker

Operates as an industrial investment company in Norway, Europa, North America, South America, and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives