- Norway

- /

- Industrials

- /

- OB:AFK

Here's Why We Think Arendals Fossekompani (OB:AFK) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Arendals Fossekompani (OB:AFK). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Arendals Fossekompani

Arendals Fossekompani's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Arendals Fossekompani's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 41%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Arendals Fossekompani did well to grow revenue over the last year, EBIT margins were dampened at the same time. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

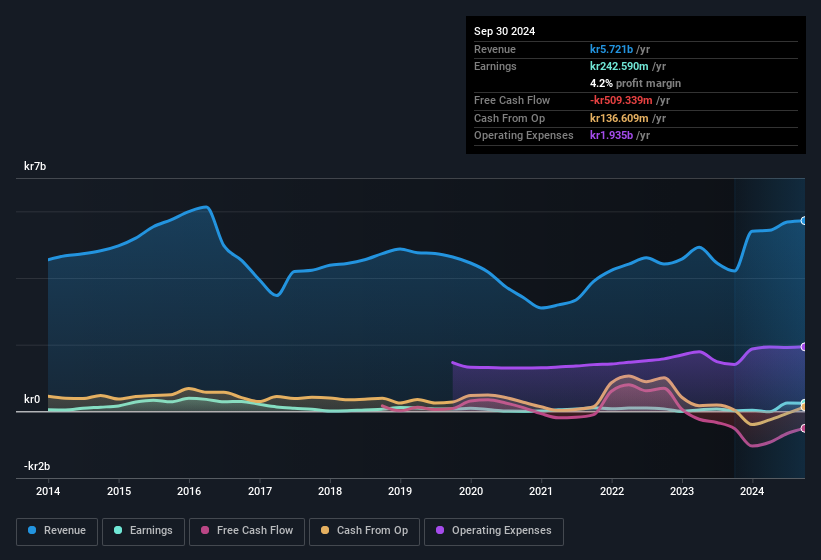

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Arendals Fossekompani's balance sheet strength, before getting too excited.

Are Arendals Fossekompani Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Arendals Fossekompani top brass are certainly in sync, not having sold any shares, over the last year. But the real excitement comes from the kr1.5m that Executive Vice President Hakon Tanem spent buying shares (at an average price of about kr164). Strong buying like that could be a sign of opportunity.

It's commendable to see that insiders have been buying shares in Arendals Fossekompani, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Arendals Fossekompani with market caps between kr4.4b and kr18b is about kr6.2m.

Arendals Fossekompani offered total compensation worth kr3.9m to its CEO in the year to December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Arendals Fossekompani Deserve A Spot On Your Watchlist?

Arendals Fossekompani's earnings per share growth have been climbing higher at an appreciable rate. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests Arendals Fossekompani may be at an inflection point. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. It is worth noting though that we have found 1 warning sign for Arendals Fossekompani that you need to take into consideration.

The good news is that Arendals Fossekompani is not the only stock with insider buying. Here's a list of small cap, undervalued companies in NO with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:AFK

Arendals Fossekompani

An industrial investment company, owns and operates hydropower plants in Norway, rest of Europe, Asia, and North America.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives