We Ran A Stock Scan For Earnings Growth And SpareBank 1 SR-Bank (OB:SRBNK) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in SpareBank 1 SR-Bank (OB:SRBNK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide SpareBank 1 SR-Bank with the means to add long-term value to shareholders.

Check out our latest analysis for SpareBank 1 SR-Bank

SpareBank 1 SR-Bank's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that SpareBank 1 SR-Bank has managed to grow EPS by 21% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

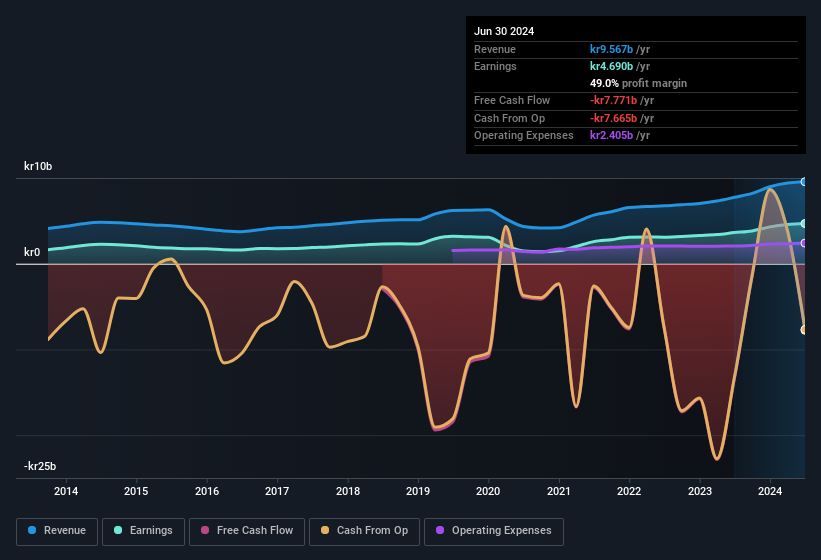

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of SpareBank 1 SR-Bank's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note SpareBank 1 SR-Bank achieved similar EBIT margins to last year, revenue grew by a solid 24% to kr9.6b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for SpareBank 1 SR-Bank's future profits.

Are SpareBank 1 SR-Bank Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did SpareBank 1 SR-Bank insiders refrain from selling stock during the year, but they also spent kr756k buying it. This is a good look for the company as it paints an optimistic picture for the future.

Should You Add SpareBank 1 SR-Bank To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into SpareBank 1 SR-Bank's strong EPS growth. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. In essence, your time will not be wasted checking out SpareBank 1 SR-Bank in more detail. We should say that we've discovered 2 warning signs for SpareBank 1 SR-Bank that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of SpareBank 1 SR-Bank, you'll probably love this curated collection of companies in NO that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SB1NO

SpareBank 1 Sør-Norge

Provides various financial products and services for personal and corporate customers in Norway.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives