We Ran A Stock Scan For Earnings Growth And SpareBank 1 SR-Bank (OB:SRBNK) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in SpareBank 1 SR-Bank (OB:SRBNK). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for SpareBank 1 SR-Bank

How Fast Is SpareBank 1 SR-Bank Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Recognition must be given to the that SpareBank 1 SR-Bank has grown EPS by 40% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

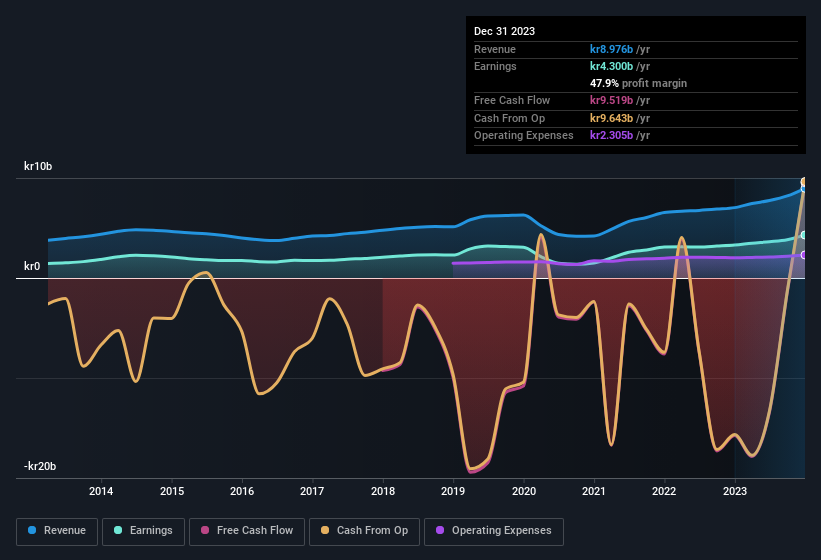

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that SpareBank 1 SR-Bank's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. SpareBank 1 SR-Bank maintained stable EBIT margins over the last year, all while growing revenue 28% to kr9.0b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of SpareBank 1 SR-Bank's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are SpareBank 1 SR-Bank Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that SpareBank 1 SR-Bank insiders spent kr756k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading.

Does SpareBank 1 SR-Bank Deserve A Spot On Your Watchlist?

SpareBank 1 SR-Bank's earnings have taken off in quite an impressive fashion. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If this is the case, then keeping a watch over SpareBank 1 SR-Bank could be in your best interest. Before you take the next step you should know about the 2 warning signs for SpareBank 1 SR-Bank that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of SpareBank 1 SR-Bank, you'll probably love this curated collection of companies in NO that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SB1NO

SpareBank 1 Sør-Norge

Provides various financial products and services for personal and corporate customers primarily in Rogaland, Agder, Vestland, Oslo, and Viken.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives