Consider This Before Buying SpareBank 1 BV (OB:SBVG) For The 7.8% Dividend

Is SpareBank 1 BV (OB:SBVG) a good dividend stock? How would you know? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

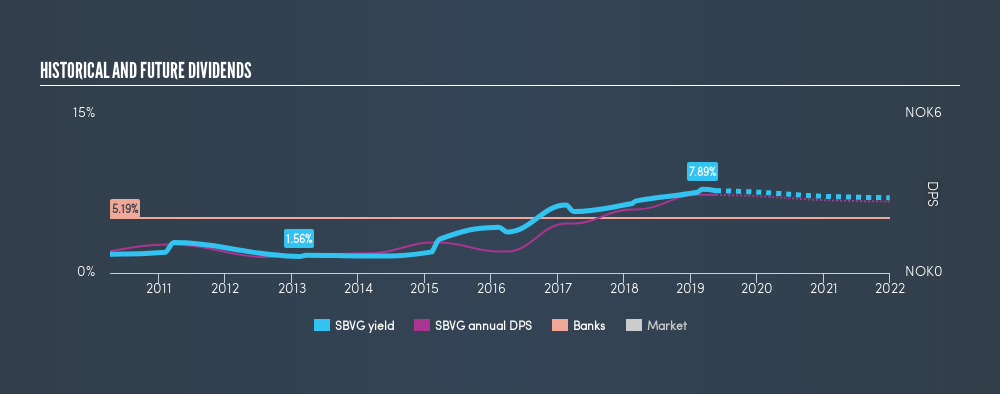

In this case, SpareBank 1 BV likely looks attractive to dividend investors, given its 7.8% dividend yield and nine-year payment history. We'd agree the yield does look enticing. The company also bought back stock during the year, equivalent to approximately 4.1% of the company's market capitalisation at the time. Some simple research can reduce the risk of buying SpareBank 1 BV for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on SpareBank 1 BV!

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. SpareBank 1 BV paid out 54% of its profit as dividends, over the trailing twelve month period. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

Remember, you can always get a snapshot of SpareBank 1 BV's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the last decade of data, we can see that SpareBank 1 BV paid its first dividend at least nine years ago. It's good to see that SpareBank 1 BV has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past nine-year period, the first annual payment was øre0.82 in 2010, compared to øre2.95 last year. This works out to be a compound annual growth rate (CAGR) of approximately 15% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

SpareBank 1 BV has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, but it might be worth considering if the business has turned a corner.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? It's not great to see that SpareBank 1 BV's have fallen at approximately 14% over the past five years. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

To summarise, shareholders should always check that SpareBank 1 BV's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. SpareBank 1 BV's payout ratio is within normal bounds. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. In short, we're not keen on SpareBank 1 BV from a dividend perspective. Businesses can change, but we've spotted a few too many concerns with this one to get comfortable.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in SpareBank 1 BV stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:SOON

SpareBank 1 Sørøst-Norge

Provides various banking products and services for private and corporate customers in Norway.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives