Why You Might Be Interested In Nidaros Sparebank (OB:NISB) For Its Upcoming Dividend

Nidaros Sparebank (OB:NISB) stock is about to trade ex-dividend in three days. This means that investors who purchase shares on or after the 19th of March will not receive the dividend, which will be paid on the 25th of March.

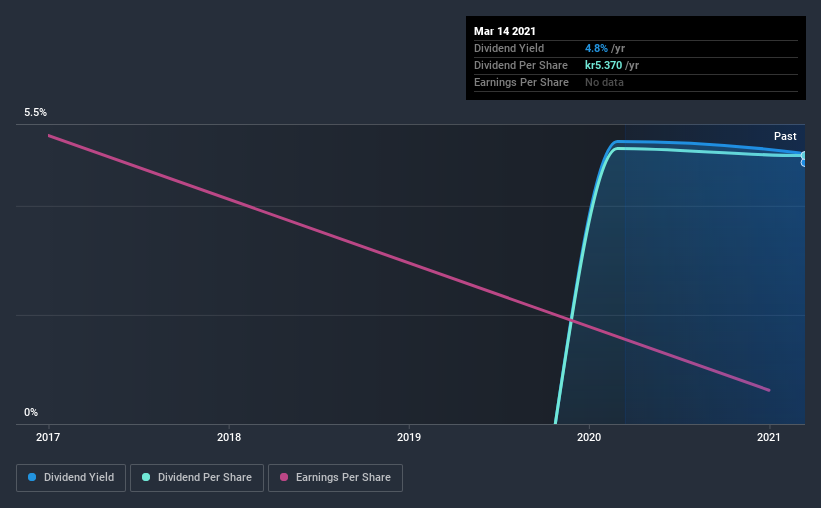

Nidaros Sparebank's next dividend payment will be kr5.37 per share, and in the last 12 months, the company paid a total of kr5.37 per share. Based on the last year's worth of payments, Nidaros Sparebank stock has a trailing yield of around 4.8% on the current share price of NOK112. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for Nidaros Sparebank

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Its dividend payout ratio is 87% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. It could become a concern if earnings started to decline.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see how much of its profit Nidaros Sparebank paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Earnings per share are basically flat over the past 12 months. The best dividend stocks all grow their earnings per share over the long run, but it is hard to draw strong conclusions from any one year period.

Nidaros Sparebank also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Unfortunately Nidaros Sparebank has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

The Bottom Line

Is Nidaros Sparebank worth buying for its dividend? Nidaros Sparebank's earnings are effectively flat over recent years, even as the company pays out more than half of its earnings to shareholders as dividends. We're unconvinced on the company's merits, and think there might be better opportunities out there.

However if you're still interested in Nidaros Sparebank as a potential investment, you should definitely consider some of the risks involved with Nidaros Sparebank. In terms of investment risks, we've identified 3 warning signs with Nidaros Sparebank and understanding them should be part of your investment process.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Nidaros Sparebank, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nidaros Sparebank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:NISB

Nidaros Sparebank

A savings bank, provides loans, savings, insurance, pension products, and payment services for private and corporate customers in Norway.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives