Is Nidaros Sparebank (OB:NISB) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

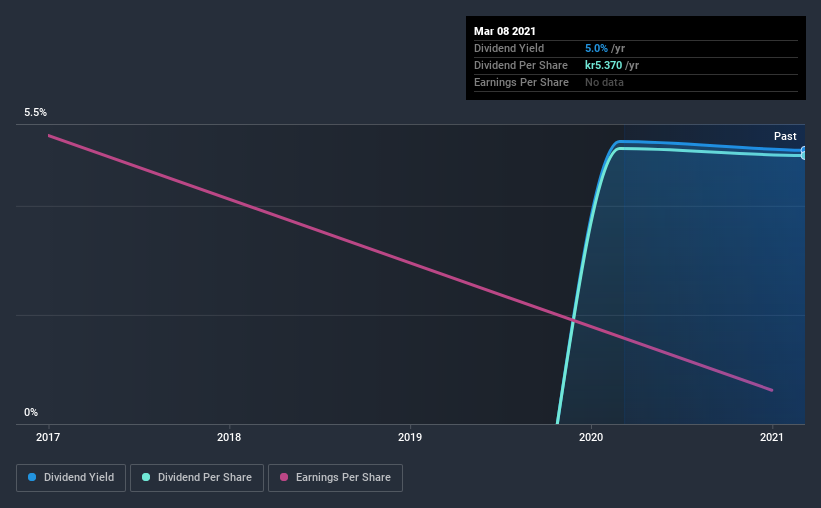

Nidaros Sparebank has only been paying a dividend for a year or so, so investors might be curious about its 5.0% yield. Some simple analysis can reduce the risk of holding Nidaros Sparebank for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Nidaros Sparebank!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 87% of Nidaros Sparebank's profits were paid out as dividends in the last 12 months. Paying out a majority of its earnings limits the amount that can be reinvested in the business. This may indicate a commitment to paying a dividend, or a dearth of investment opportunities.

Consider getting our latest analysis on Nidaros Sparebank's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. This works out to be a decline of approximately 2.5% per year over that time.

We struggle to make a case for buying Nidaros Sparebank for its dividend, given that payments have shrunk over the past one years.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Nidaros Sparebank's payout ratio is within normal bounds. Second, the company has not been able to generate earnings growth, and its history of dividend payments is shorter than we consider ideal (from a reliability perspective). Nidaros Sparebank might not be a bad business, but it doesn't show all of the characteristics we look for in a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 3 warning signs for Nidaros Sparebank that investors need to be conscious of moving forward.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you decide to trade Nidaros Sparebank, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nidaros Sparebank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:NISB

Nidaros Sparebank

A savings bank, provides loans, savings, insurance, pension products, and payment services for private and corporate customers in Norway.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives