In a week marked by market fluctuations driven by political uncertainties and shifting economic policies, investors are increasingly looking for stability amid volatility. As global markets navigate these turbulent waters, dividend stocks offering high yields can provide a sense of security and income potential. In this context, selecting reliable dividend stocks becomes crucial as they offer not only attractive yields but also the potential for steady returns in an uncertain economic environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.68% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.74% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.47% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.83% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.55% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

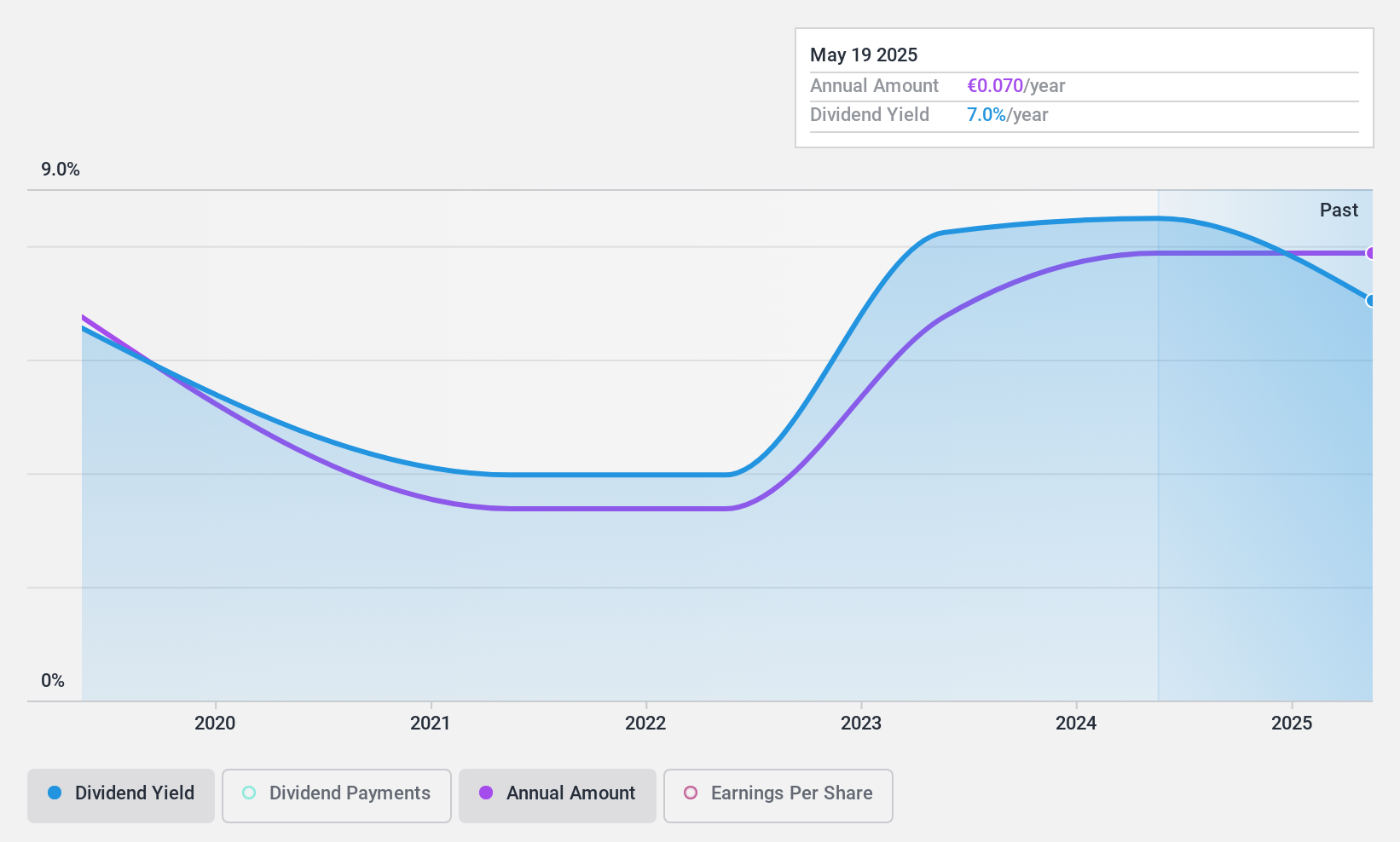

RCS MediaGroup (BIT:RCS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: RCS MediaGroup S.p.A. offers multimedia publishing services both in Italy and internationally, with a market cap of €356.68 million.

Operations: RCS MediaGroup S.p.A.'s revenue is primarily derived from Italy Newspapers (€371 million), Advertising and Sport (€286.10 million), Unidad Editorial (€220.60 million), Magazines Italy (€65.20 million), and Corporate and Other Activities (€80.80 million).

Dividend Yield: 8.4%

RCS MediaGroup's dividend is well-covered by earnings with a payout ratio of 58.6% and cash flows with a cash payout ratio of 34.3%, indicating sustainability. However, its dividend history is less than ten years and has been volatile, making reliability a concern despite recent growth in payments. The current yield stands at 8.35%, placing it among the top Italian market payers, yet past volatility may pose risks for consistent income seekers.

- Navigate through the intricacies of RCS MediaGroup with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of RCS MediaGroup shares in the market.

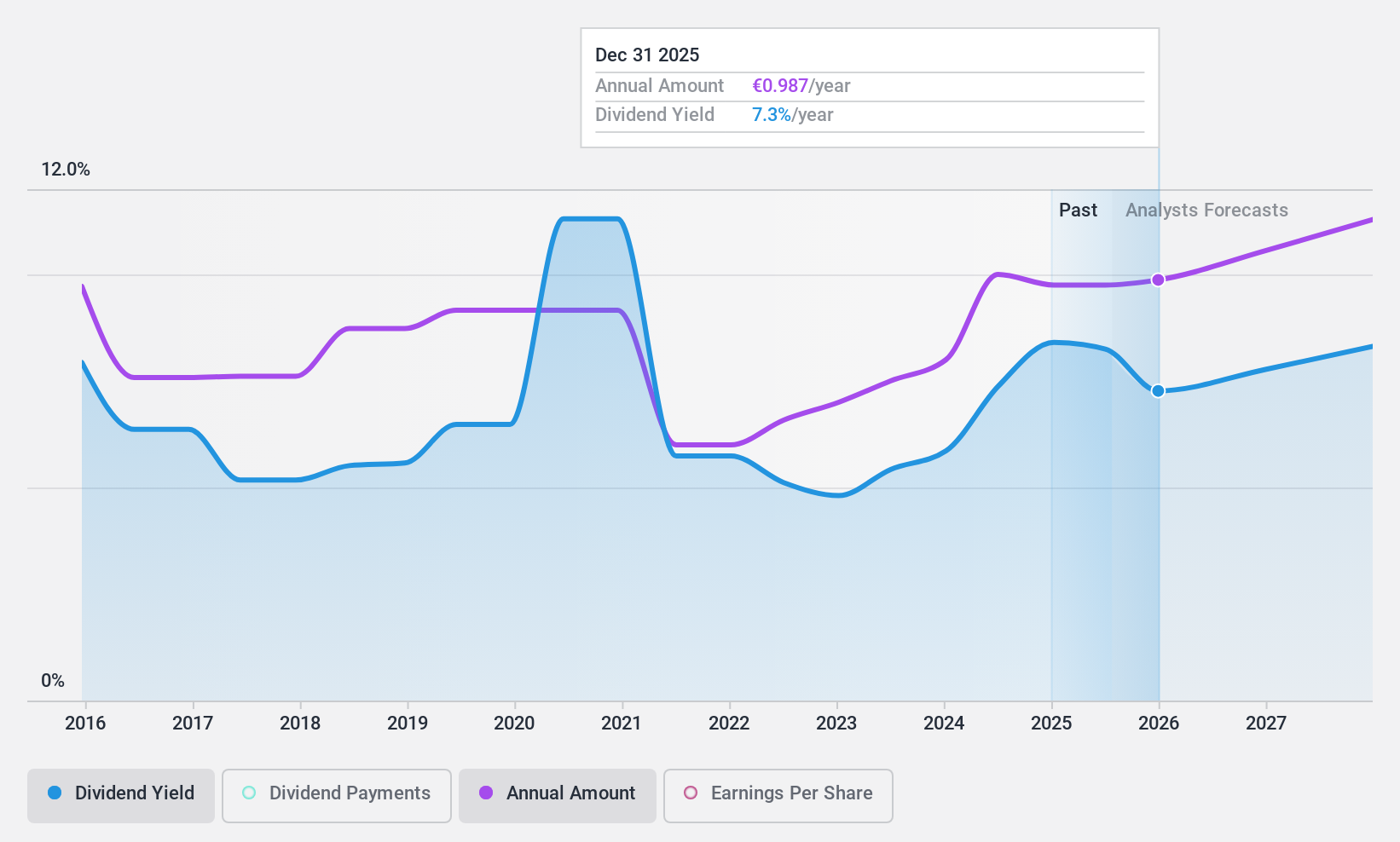

Repsol (BME:REP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Repsol, S.A. is a global multi-energy company with a market cap of €13.75 billion, engaging in various energy operations worldwide.

Operations: Repsol, S.A.'s revenue is primarily derived from its Industrial segment (€47.56 billion), followed by Customer (€26.17 billion), Upstream (€4.87 billion), and Low Carbon Generation (€762 million).

Dividend Yield: 8.2%

Repsol's dividend yield of 8.17% ranks in the top 25% of Spanish market payers, yet its history shows volatility and unreliability over the past decade. While dividends are well-covered by earnings with a low payout ratio of 35.9%, they aren't supported by cash flows due to a high cash payout ratio of 346.8%. Recent strategic alliances, like with Baker Hughes for AI-driven efficiency improvements, could influence future operational performance but don't directly address current dividend sustainability concerns.

- Dive into the specifics of Repsol here with our thorough dividend report.

- The valuation report we've compiled suggests that Repsol's current price could be quite moderate.

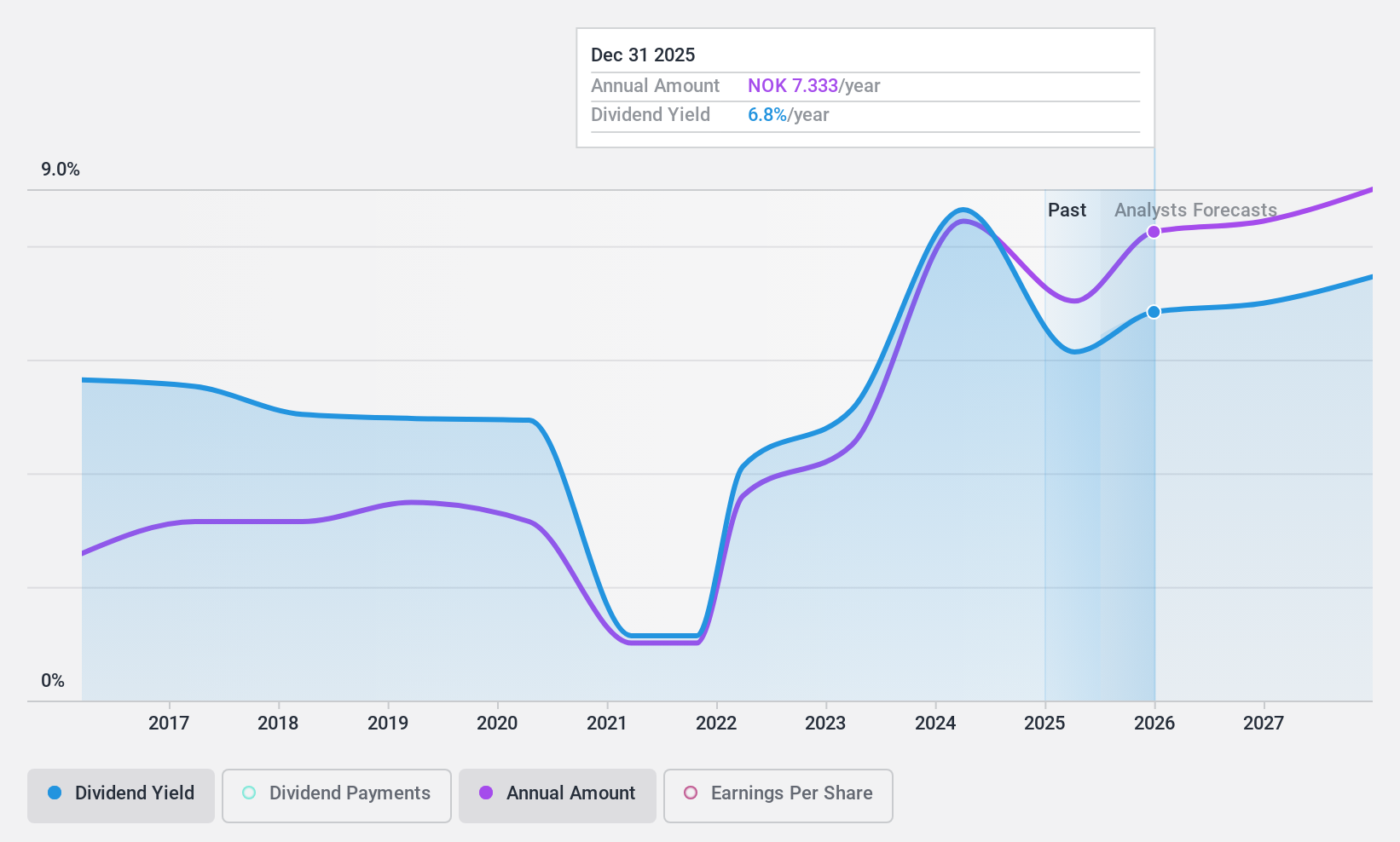

Sparebanken Møre (OB:MORG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sparebanken Møre, along with its subsidiaries, offers banking services to both retail and corporate customers in Norway and has a market cap of NOK4.44 billion.

Operations: Sparebanken Møre generates its revenue primarily through its Retail segment with NOK1.06 billion and Corporate segment with NOK1.00 billion, along with a contribution from Real Estate Brokerage amounting to NOK43 million.

Dividend Yield: 8%

Sparebanken Møre's dividend yield of 8.05% places it among the top 25% in Norway, though its track record shows volatility and unreliability over the past decade. Despite this, dividends are currently covered by earnings with a payout ratio of 66.8%, expected to remain sustainable at 68.5% in three years. The bank's recent earnings growth supports its capacity to maintain payouts, but historical dividend instability remains a concern for investors seeking reliability.

- Click to explore a detailed breakdown of our findings in Sparebanken Møre's dividend report.

- Our expertly prepared valuation report Sparebanken Møre implies its share price may be lower than expected.

Make It Happen

- Investigate our full lineup of 1962 Top Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RCS

RCS MediaGroup

Provides multimedia publishing services in Italy and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives