If EPS Growth Is Important To You, SpareBank 1 SMN (OB:MING) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like SpareBank 1 SMN (OB:MING). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for SpareBank 1 SMN

How Fast Is SpareBank 1 SMN Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. It certainly is nice to see that SpareBank 1 SMN has managed to grow EPS by 17% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

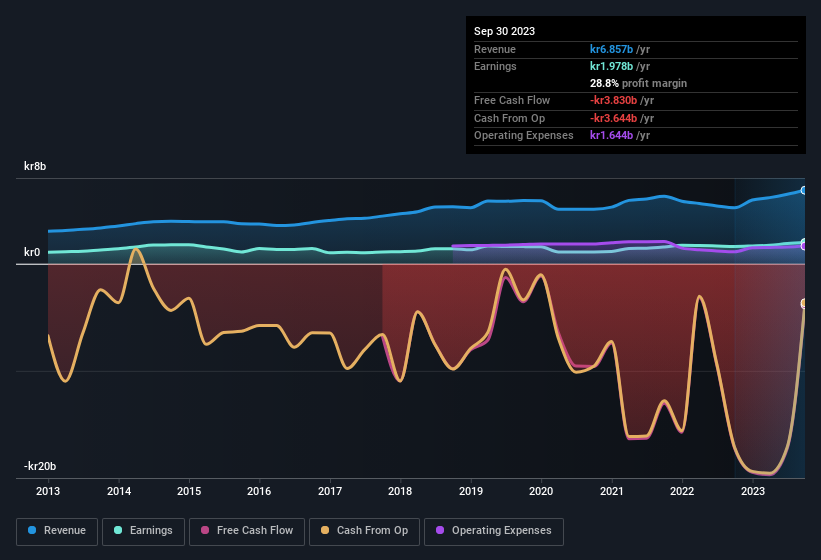

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of SpareBank 1 SMN's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note SpareBank 1 SMN achieved similar EBIT margins to last year, revenue grew by a solid 31% to kr6.9b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of SpareBank 1 SMN's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are SpareBank 1 SMN Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it SpareBank 1 SMN shareholders can gain quiet confidence from the fact that insiders shelled out kr3.0m to buy stock, over the last year. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. It is also worth noting that it was Executive Director of Group Finance & Governance Trond Soraas who made the biggest single purchase, worth kr1.2m, paying kr116 per share.

Does SpareBank 1 SMN Deserve A Spot On Your Watchlist?

For growth investors, SpareBank 1 SMN's raw rate of earnings growth is a beacon in the night. Growth in EPS isn't the only striking feature with company insiders adding to their holdings being another noteworthy vote of confidence for the company. To put it succinctly; SpareBank 1 SMN is a strong candidate for your watchlist. However, before you get too excited we've discovered 1 warning sign for SpareBank 1 SMN that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of SpareBank 1 SMN, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:MING

SpareBank 1 SMN

Provides various banking, accounting, and real estate products and services to private individuals and companies in Norway and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives