- Netherlands

- /

- Capital Markets

- /

- ENXTAM:CVC

Top Growth Companies With High Insider Ownership On Euronext Amsterdam September 2024

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, the Euronext Amsterdam has not been immune to the broader downturn, reflecting renewed fears about global economic growth. Despite this challenging environment, certain growth companies with high insider ownership continue to attract attention for their potential resilience and long-term prospects. In such volatile times, stocks with substantial insider ownership can be particularly appealing as they often signal strong confidence from those closest to the company's operations and strategic direction.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| Envipco Holding (ENXTAM:ENVI) | 36.7% | 79.2% |

| Ebusco Holding (ENXTAM:EBUS) | 33.2% | 107.8% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 77.1% |

| MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

| CVC Capital Partners (ENXTAM:CVC) | 20.2% | 32.6% |

| PostNL (ENXTAM:PNL) | 35.6% | 36.4% |

Let's uncover some gems from our specialized screener.

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €20.09 billion.

Operations: The firm's revenue segments include middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts.

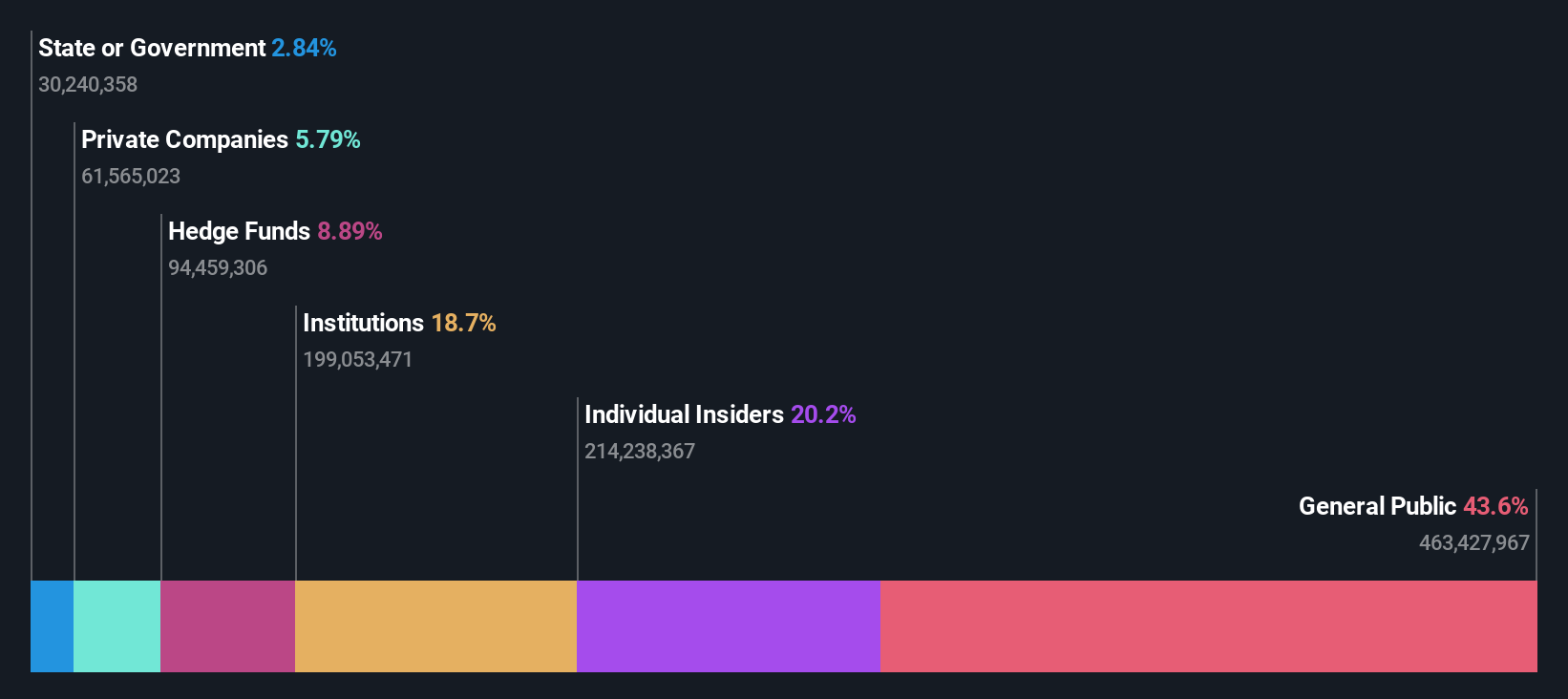

Insider Ownership: 20.2%

CVC Capital Partners, a major private equity firm in the Netherlands, is forecast to see significant earnings growth of 32.6% annually over the next three years, outpacing the Dutch market's 18.7%. Despite this strong profit outlook, its revenue growth is expected to be more modest at 13.6% per year. Recent M&A activity includes high-profile bids for DB Schenker and Aavas Financiers Limited, reflecting its aggressive expansion strategy amidst high insider ownership and substantial debt levels.

- Take a closer look at CVC Capital Partners' potential here in our earnings growth report.

- Our valuation report here indicates CVC Capital Partners may be overvalued.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc, with a market cap of €266.51 million, provides software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany and the Benelux Union.

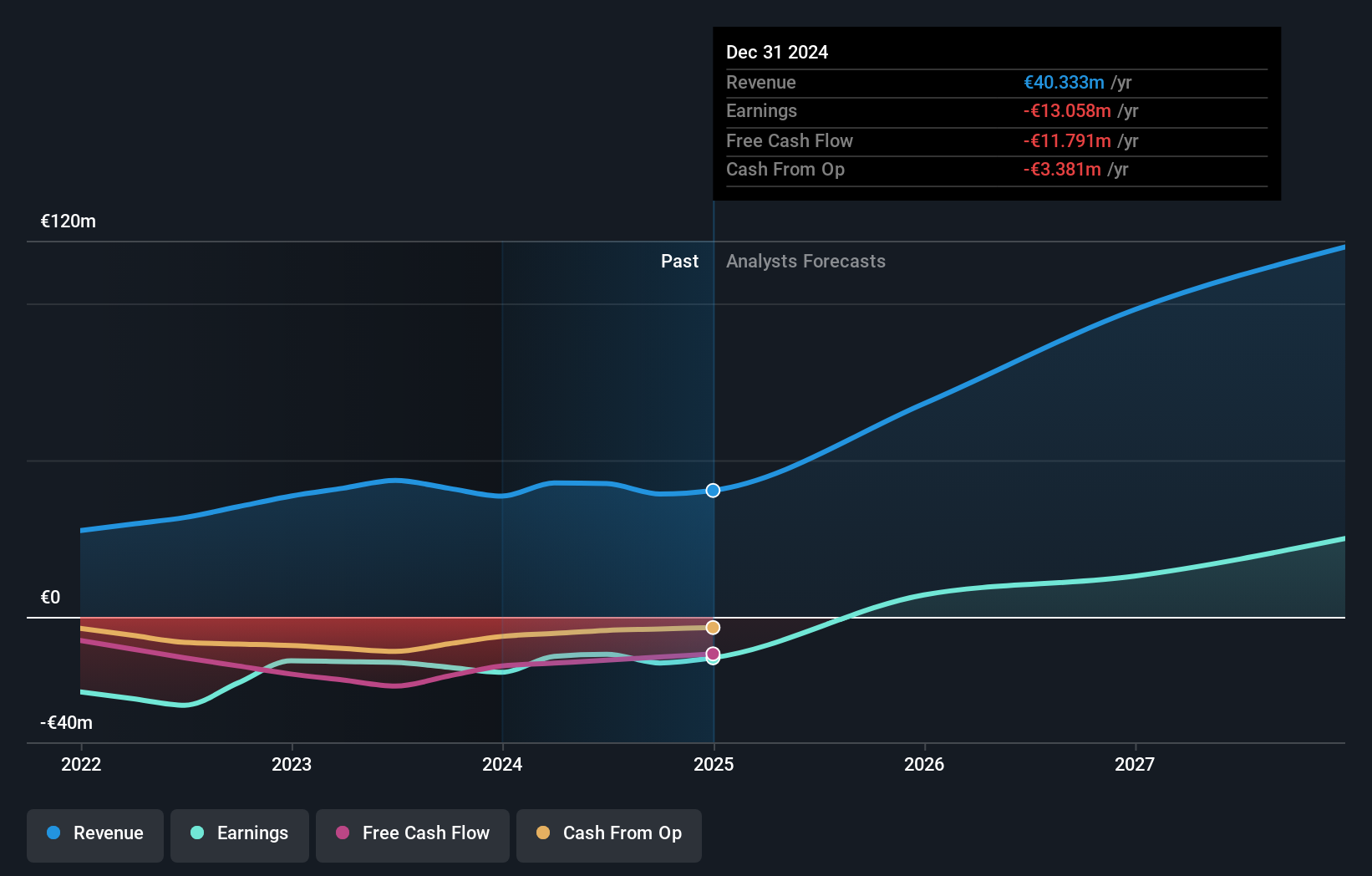

Operations: MotorK plc generates revenue of €42.50 million from its Software & Programming segment.

Insider Ownership: 35.7%

MotorK, a growth company with high insider ownership in the Netherlands, reported half-year sales of €21.46 million and a net loss of €6.48 million, showing improvement from the previous year. Earnings are forecast to grow 108.44% annually, with revenue expected to increase by 22.1% per year, outpacing the Dutch market's growth rate. A new CFO appointment and no recent substantial insider trading highlight stability amidst shareholder dilution over the past year.

- Navigate through the intricacies of MotorK with our comprehensive analyst estimates report here.

- The analysis detailed in our MotorK valuation report hints at an inflated share price compared to its estimated value.

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. provides postal and logistics services to businesses and consumers in the Netherlands, Europe, and internationally with a market cap of €604.04 million.

Operations: The company's revenue segments consist of Parcels (€2.28 billion) and Mail in the Netherlands (€1.35 billion).

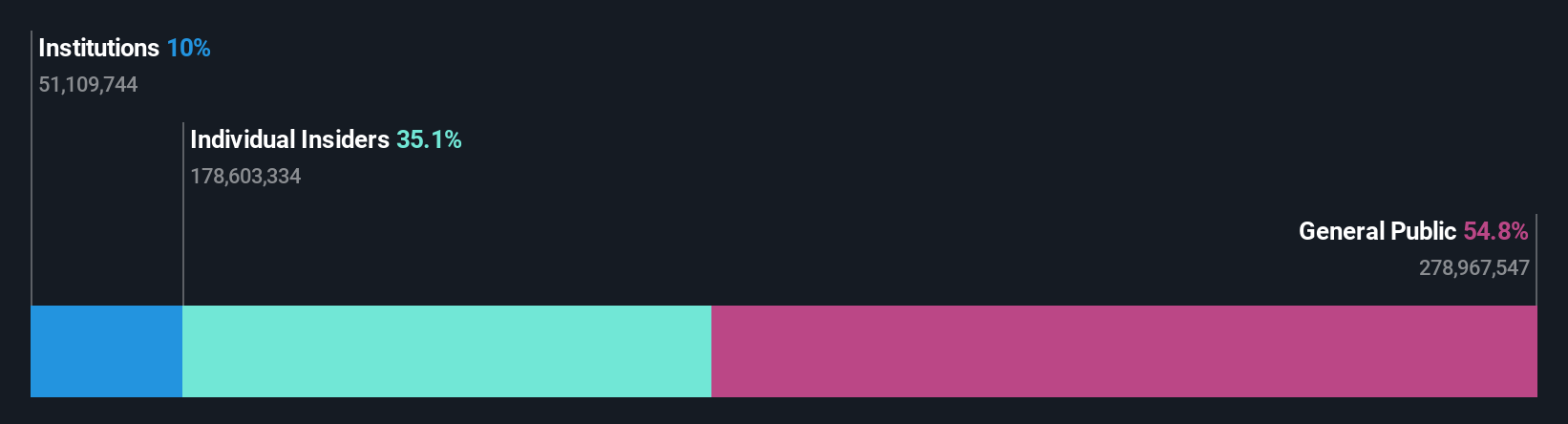

Insider Ownership: 35.6%

PostNL's recent earnings report showed modest revenue growth to €793 million for Q2 2024, while net income slightly declined to €10 million. Despite a net loss of €9 million for the first half of the year, its earnings are forecast to grow significantly at 36.38% per year, outpacing the Dutch market's 18.7%. Trading at approximately half its fair value and with high insider ownership, PostNL presents an intriguing growth prospect despite its high debt levels and slower revenue growth forecast.

- Dive into the specifics of PostNL here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, PostNL's share price might be too pessimistic.

Summing It All Up

- Unlock more gems! Our Fast Growing Euronext Amsterdam Companies With High Insider Ownership screener has unearthed 3 more companies for you to explore.Click here to unveil our expertly curated list of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CVC

CVC Capital Partners

A private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature, recapitalizations, strip sales, and spinouts.

High growth potential and slightly overvalued.