- Netherlands

- /

- Capital Markets

- /

- ENXTAM:CVC

Euronext Amsterdam Boasts 3 Top Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The Euronext Amsterdam has shown resilience amid global economic uncertainties, with the pan-European STOXX Europe 600 Index recently experiencing a decline due to renewed fears about global growth. Despite these challenges, the Dutch market continues to offer promising opportunities, particularly in growth companies with high insider ownership. In times of market volatility, stocks with strong insider ownership can be appealing as they often indicate confidence from those who know the company best. This article highlights three top growth companies listed on Euronext Amsterdam that exhibit significant insider ownership, making them noteworthy in today's economic landscape.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| Envipco Holding (ENXTAM:ENVI) | 36.7% | 82.7% |

| Ebusco Holding (ENXTAM:EBUS) | 33.2% | 107.8% |

| MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 77.1% |

| CVC Capital Partners (ENXTAM:CVC) | 20.2% | 32.6% |

| PostNL (ENXTAM:PNL) | 35.6% | 36.4% |

Here we highlight a subset of our preferred stocks from the screener.

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm specializing in various investment strategies including middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts with a market cap of €20.38 billion.

Operations: CVC Capital Partners plc generates revenue through diverse investment strategies including middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts.

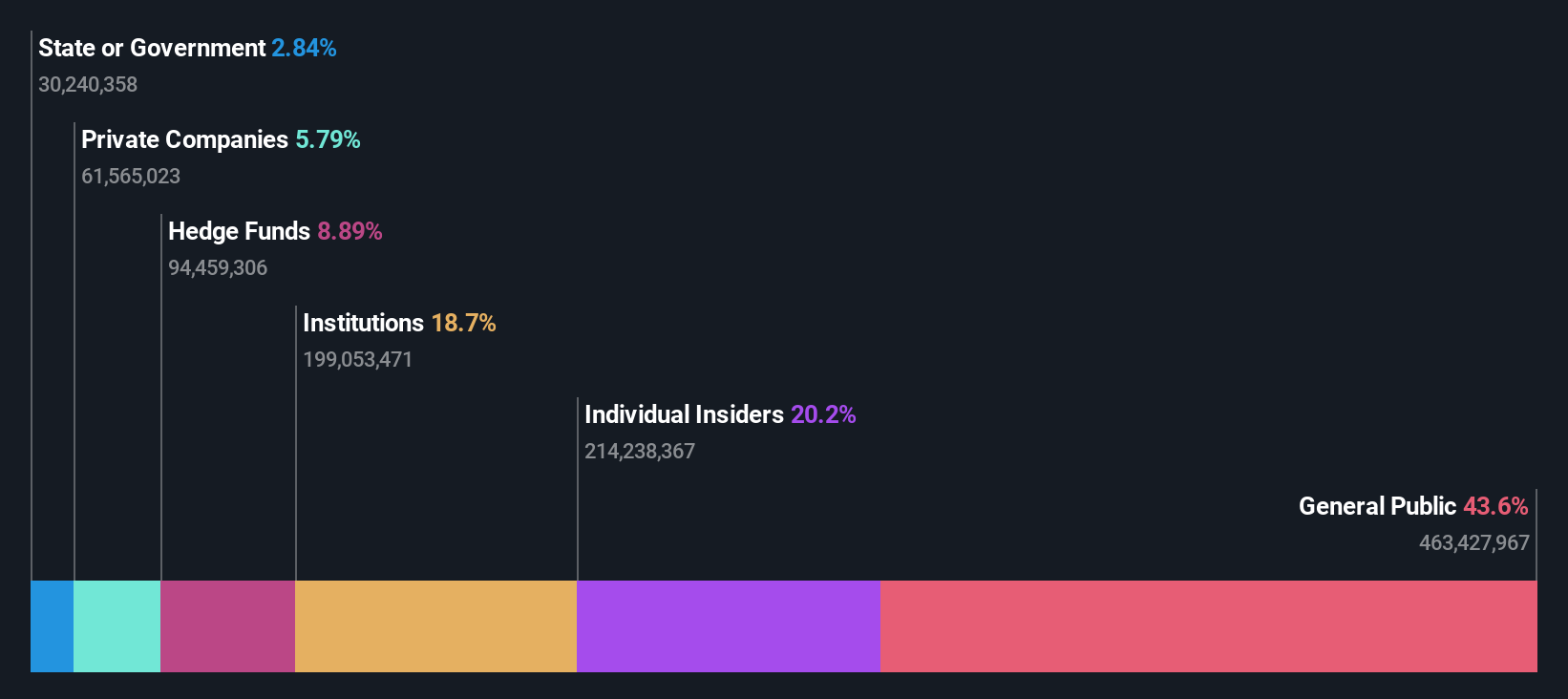

Insider Ownership: 20.2%

CVC Capital Partners, a prominent private equity firm in the Netherlands, is forecasted to experience significant earnings growth of 32.6% annually over the next three years, outpacing the Dutch market's 19%. Despite its high debt levels, CVC trades at 30% below its estimated fair value and boasts substantial insider ownership. Recent activity includes leading bids for DB Schenker and Aavas Financiers, highlighting its aggressive expansion strategy.

- Navigate through the intricacies of CVC Capital Partners with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that CVC Capital Partners' current price could be inflated.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

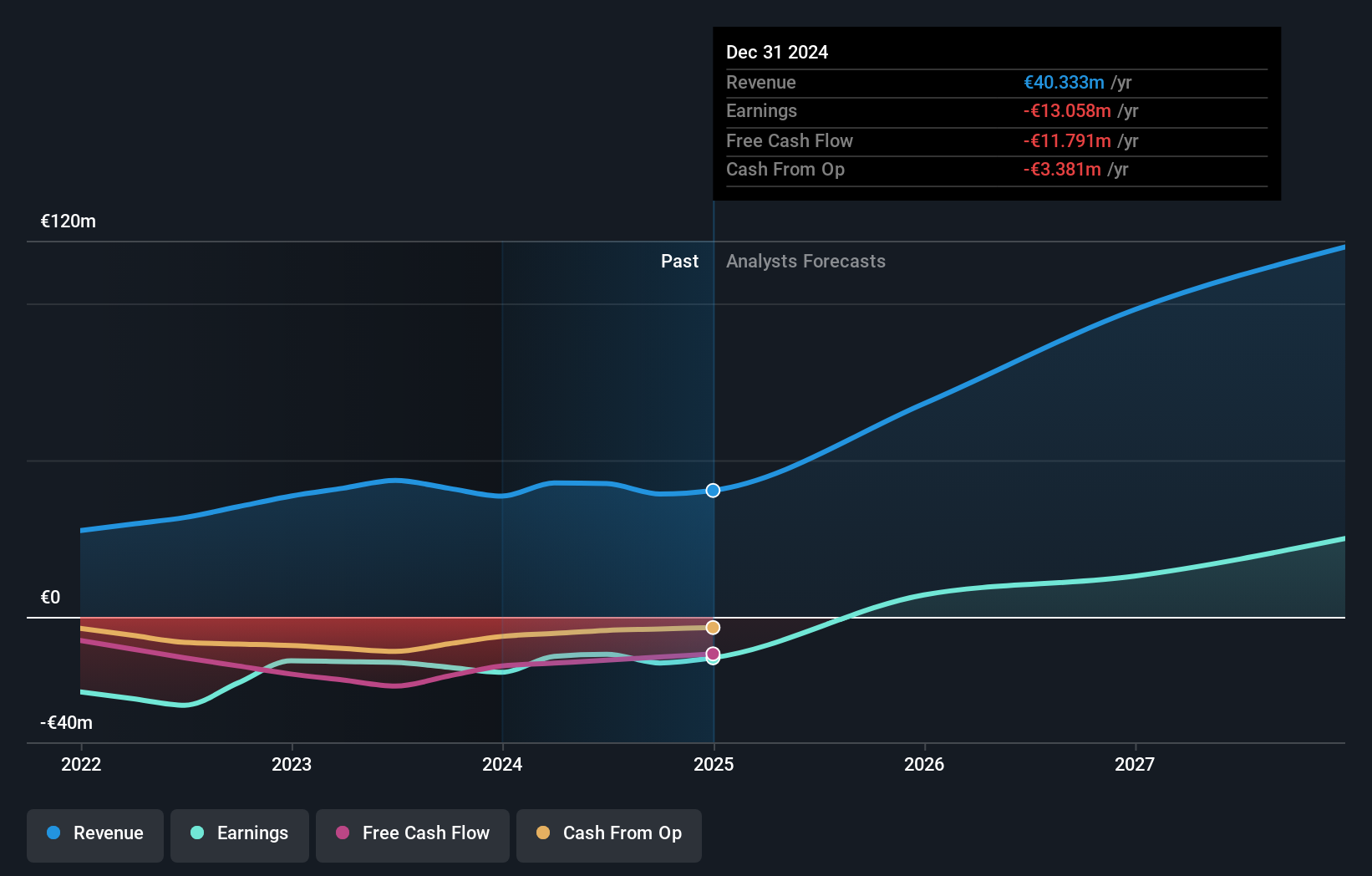

Overview: MotorK plc, with a market cap of €264.69 million, provides software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union.

Operations: MotorK plc generates €42.50 million in revenue from its Software & Programming segment.

Insider Ownership: 35.7%

MotorK, a Netherlands-based company, is anticipated to achieve profitability within the next three years with an annual revenue growth forecast of 22.1%, surpassing the Dutch market average. Despite recent earnings showing a net loss of €6.48 million for H1 2024, this is an improvement from €7.8 million in H1 2023. The appointment of Zoltan Gelencser as CFO brings experienced leadership amid high insider ownership and volatile share prices over the past three months.

- Take a closer look at MotorK's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that MotorK is priced higher than what may be justified by its financials.

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. provides postal and logistics services to businesses and consumers in the Netherlands, rest of Europe, and internationally, with a market cap of approximately €6 billion.

Operations: The company generates revenue from Parcels (€2.28 billion) and Mail in The Netherlands (€1.35 billion).

Insider Ownership: 35.6%

PostNL, a Dutch company with high insider ownership, reported Q2 2024 sales of €793 million, up from €768 million a year ago. Despite a net income drop to €10 million from €11 million, earnings are forecast to grow 36.38% annually over the next three years. However, revenue growth is expected at only 2.6% per year and the company has significant debt levels. The dividend yield of 5.02% is not well covered by earnings.

- Click to explore a detailed breakdown of our findings in PostNL's earnings growth report.

- Our expertly prepared valuation report PostNL implies its share price may be lower than expected.

Taking Advantage

- Reveal the 6 hidden gems among our Fast Growing Euronext Amsterdam Companies With High Insider Ownership screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CVC

CVC Capital Partners

A private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature, recapitalizations, strip sales, and spinouts.

High growth potential and slightly overvalued.