- Netherlands

- /

- Logistics

- /

- ENXTAM:PNL

3 Stocks That May Be Trading Below Estimated Value In January 2025

Reviewed by Simply Wall St

As global markets navigate the final days of 2024, major stock indices have shown moderate gains despite a dip in U.S. consumer confidence and mixed economic signals from key regions like Europe and Japan. In this environment, investors often seek stocks that appear to be trading below their estimated value, as these can offer potential opportunities for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.8% |

| First Solar (NasdaqGS:FSLR) | US$176.24 | US$350.71 | 49.7% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7309.53 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 50% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.66 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7652.96 | 49.9% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.71 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.15 | US$129.60 | 49.7% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

We'll examine a selection from our screener results.

PostNL (ENXTAM:PNL)

Overview: PostNL N.V. is a company that offers postal and logistics services to businesses and consumers in the Netherlands, Europe, and internationally, with a market cap of €523.20 million.

Operations: PostNL generates its revenue from postal and logistics services provided to businesses and consumers across the Netherlands, Europe, and international markets.

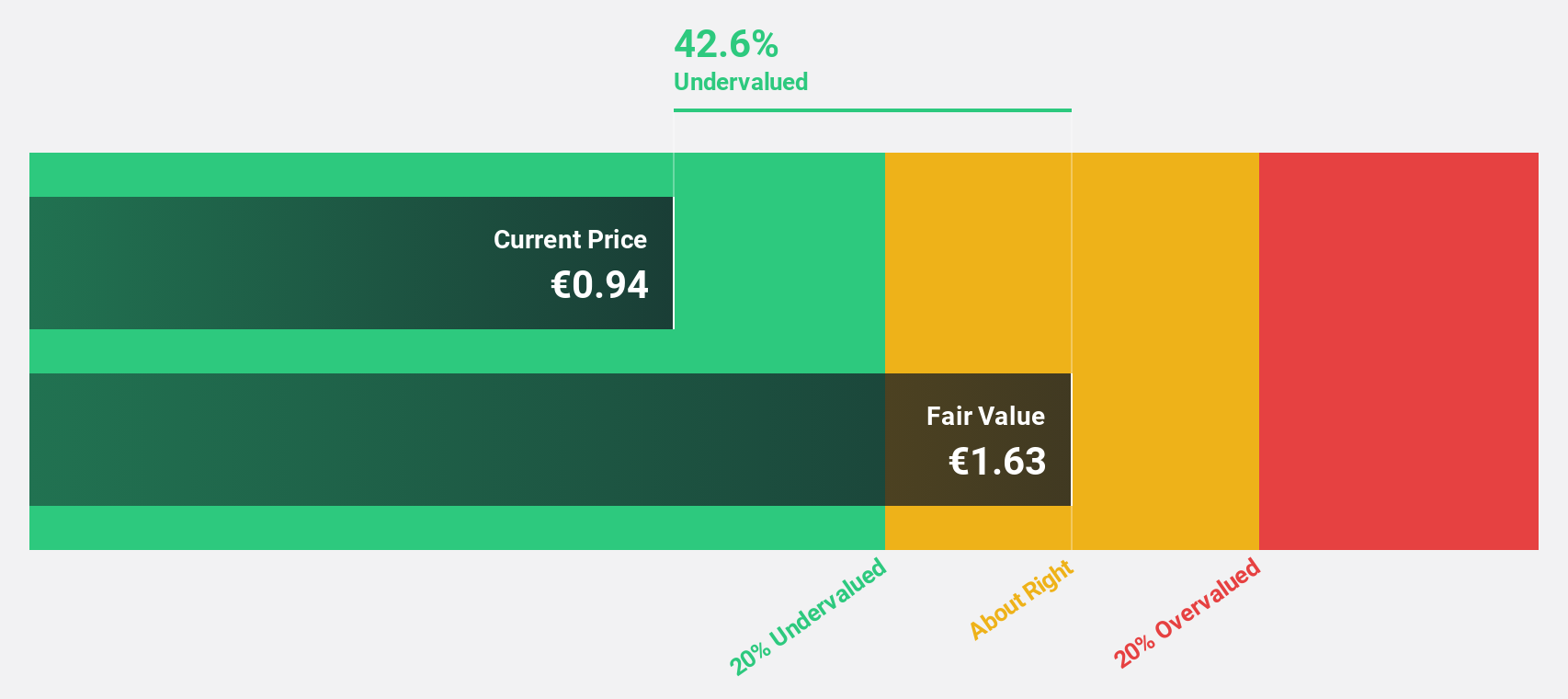

Estimated Discount To Fair Value: 48%

PostNL is trading at €1.04, significantly below its estimated fair value of €2.01, suggesting it may be undervalued based on cash flows despite recent challenges. The company has become profitable this year and forecasts suggest earnings growth of 58.08% annually, outpacing the Dutch market's 15.7%. However, PostNL faces high debt levels and unsustainable dividends, with a third-quarter net loss of €21 million compared to last year's €10 million loss.

- Our earnings growth report unveils the potential for significant increases in PostNL's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of PostNL.

Beijing Huafeng Test & Control TechnologyLtd (SHSE:688200)

Overview: Beijing Huafeng Test & Control Technology Co., Ltd. operates in the field of test and control technology, with a market cap of CN¥14.14 billion.

Operations: The company's revenue primarily comes from the manufacturing of special equipment for semiconductor devices, amounting to CN¥793.33 million.

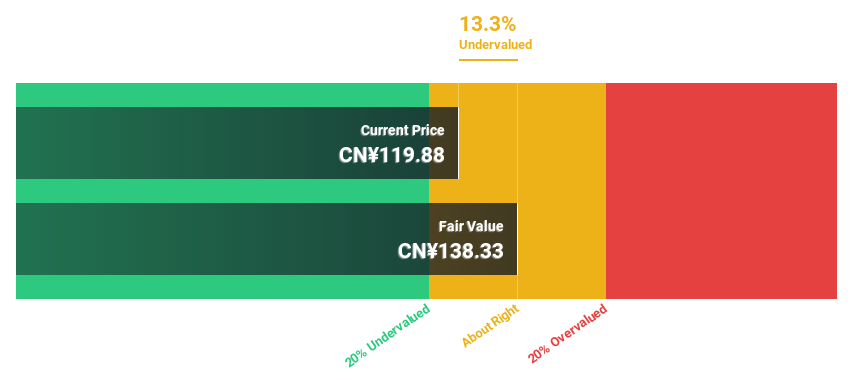

Estimated Discount To Fair Value: 26.3%

Beijing Huafeng Test & Control Technology Ltd. is trading at CN¥104.5, well below its estimated fair value of CN¥141.81, reflecting potential undervaluation based on cash flows. The company reported nine-month revenue of CN¥621.2 million, up from CN¥518.73 million the previous year, with net income rising to CN¥213.09 million from CN¥197.06 million despite stable earnings per share figures. Expected annual profit growth is projected at 33.56%, surpassing market averages but return on equity remains modest at 13.1%.

- The growth report we've compiled suggests that Beijing Huafeng Test & Control TechnologyLtd's future prospects could be on the up.

- Dive into the specifics of Beijing Huafeng Test & Control TechnologyLtd here with our thorough financial health report.

Medley (TSE:4480)

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States, with a market cap of ¥124.58 billion.

Operations: The company's revenue is primarily derived from its Human Resource Platform Business at ¥19.45 billion and its Medical Platform Business at ¥6.52 billion, with additional contributions from New Services totaling ¥713 million.

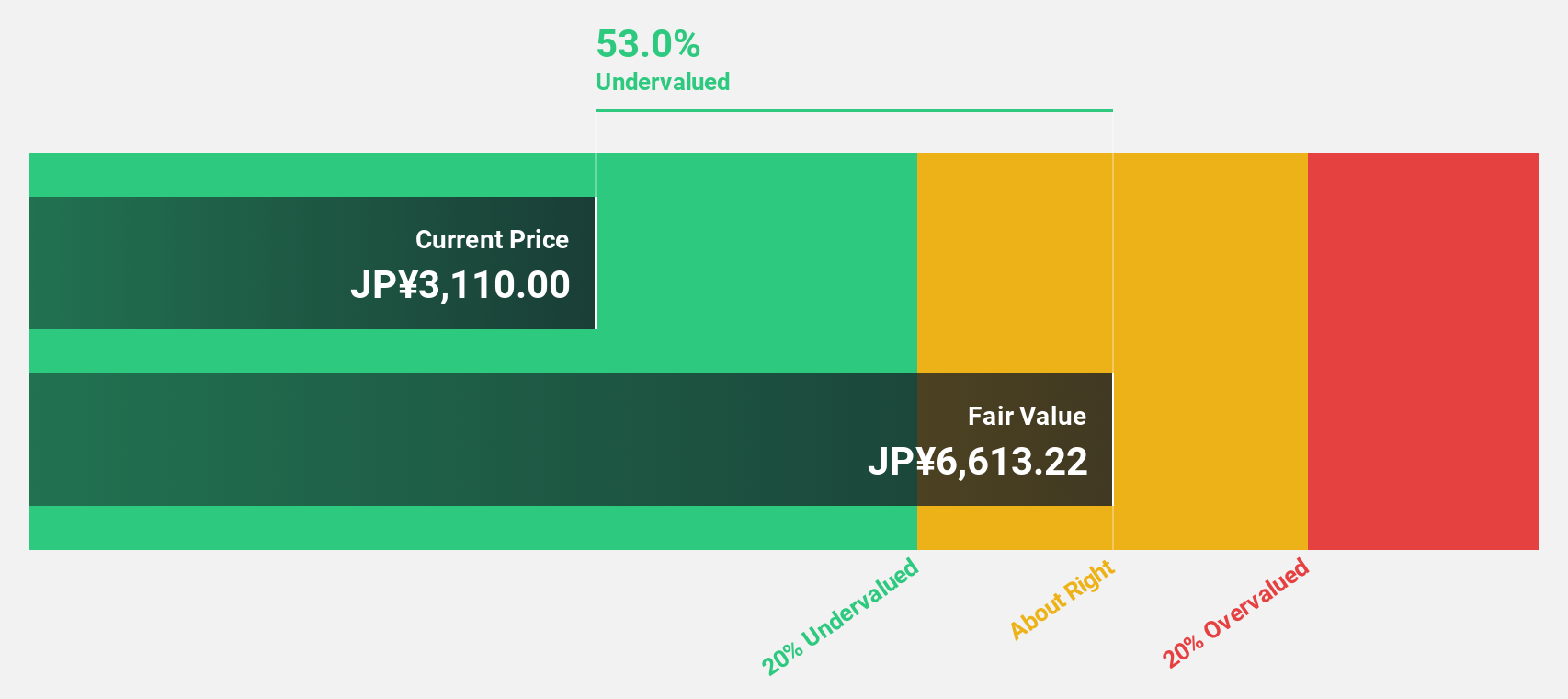

Estimated Discount To Fair Value: 49.9%

Medley is trading at ¥3835, significantly below its estimated fair value of ¥7652.96, indicating undervaluation based on cash flows. Earnings are projected to grow 31.67% annually, outpacing the JP market's growth rate of 7.9%. Revenue growth is also expected to exceed market averages at 22.4% per year. However, recent financial results include large one-off items affecting earnings quality and share price volatility remains high over the past three months.

- Our expertly prepared growth report on Medley implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Medley.

Turning Ideas Into Actions

- Navigate through the entire inventory of 870 Undervalued Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PNL

PostNL

Provides postal and logistics services to businesses and consumers in the Netherlands, rest of Europe, and internationally.

Reasonable growth potential with adequate balance sheet.