- Netherlands

- /

- Software

- /

- ENXTAM:TOM2

Shareholders May Be More Conservative With TomTom N.V.'s (AMS:TOM2) CEO Compensation For Now

Key Insights

- TomTom's Annual General Meeting to take place on 17th of April

- Salary of €565.0k is part of CEO Harold C. Goddijn's total remuneration

- The overall pay is 146% above the industry average

- TomTom's EPS grew by 58% over the past three years while total shareholder loss over the past three years was 8.9%

As many shareholders of TomTom N.V. (AMS:TOM2) will be aware, they have not made a gain on their investment in the past three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 17th of April. They could also influence management through voting on resolutions such as executive remuneration. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for TomTom

How Does Total Compensation For Harold C. Goddijn Compare With Other Companies In The Industry?

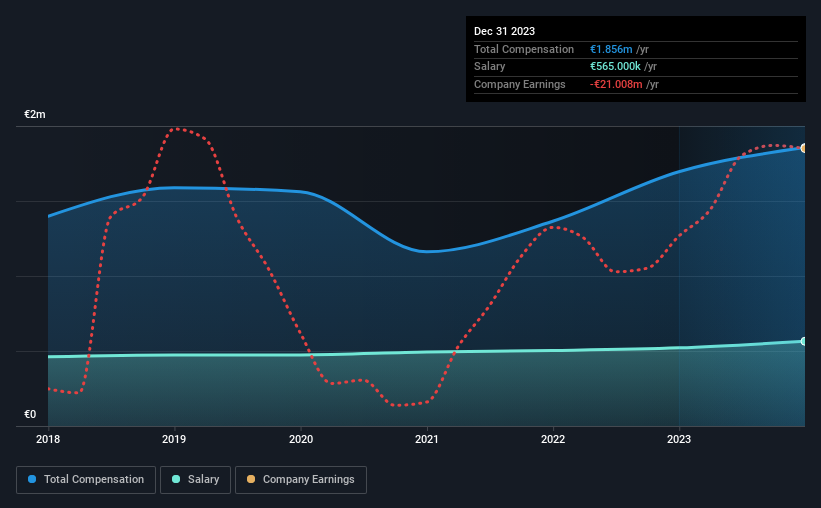

At the time of writing, our data shows that TomTom N.V. has a market capitalization of €952m, and reported total annual CEO compensation of €1.9m for the year to December 2023. That's a notable increase of 9.5% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €565k.

On examining similar-sized companies in the the Netherlands Software industry with market capitalizations between €372m and €1.5b, we discovered that the median CEO total compensation of that group was €755k. This suggests that Harold C. Goddijn is paid more than the median for the industry. Moreover, Harold C. Goddijn also holds €115m worth of TomTom stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €565k | €521k | 30% |

| Other | €1.3m | €1.2m | 70% |

| Total Compensation | €1.9m | €1.7m | 100% |

Speaking on an industry level, nearly 67% of total compensation represents salary, while the remainder of 33% is other remuneration. In TomTom's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at TomTom N.V.'s Growth Numbers

TomTom N.V. has seen its earnings per share (EPS) increase by 58% a year over the past three years. In the last year, its revenue is up 9.0%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has TomTom N.V. Been A Good Investment?

With a three year total loss of 8.9% for the shareholders, TomTom N.V. would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

So you may want to check if insiders are buying TomTom shares with their own money (free access).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TomTom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:TOM2

TomTom

Develops and sells navigation and location-based products and services in Europe, the Americas, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion