- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

Euronext Amsterdam Growth Stocks With Insider Ownership And Earnings Growth Up To 108%

Reviewed by Simply Wall St

As the European Central Bank's recent rate cuts have buoyed expectations for further monetary easing, major stock indexes across Europe, including the Netherlands, have seen positive momentum. Against this backdrop, identifying growth companies with high insider ownership can be particularly appealing to investors seeking robust earnings potential and alignment of interests between management and shareholders.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| Ebusco Holding (ENXTAM:EBUS) | 31% | 107.8% |

| Envipco Holding (ENXTAM:ENVI) | 36.7% | 84% |

| MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 77.7% |

| CVC Capital Partners (ENXTAM:CVC) | 20.2% | 33.5% |

| PostNL (ENXTAM:PNL) | 35.6% | 38.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., along with its subsidiaries, operates fitness clubs and has a market cap of €1.66 billion.

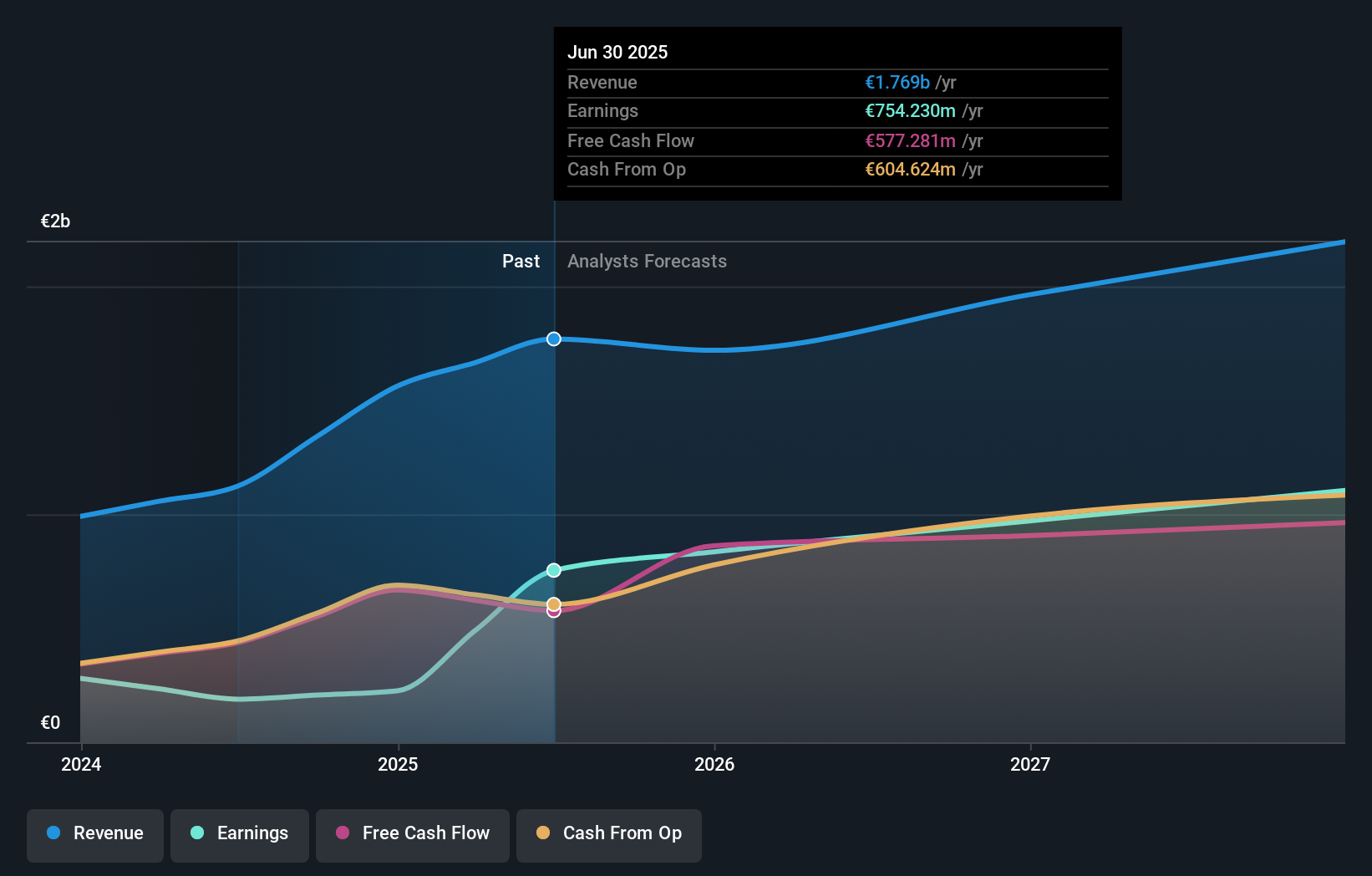

Operations: The company generates revenue from its fitness clubs primarily in two segments: Benelux, contributing €505.17 million, and France, Spain & Germany, accounting for €626.41 million.

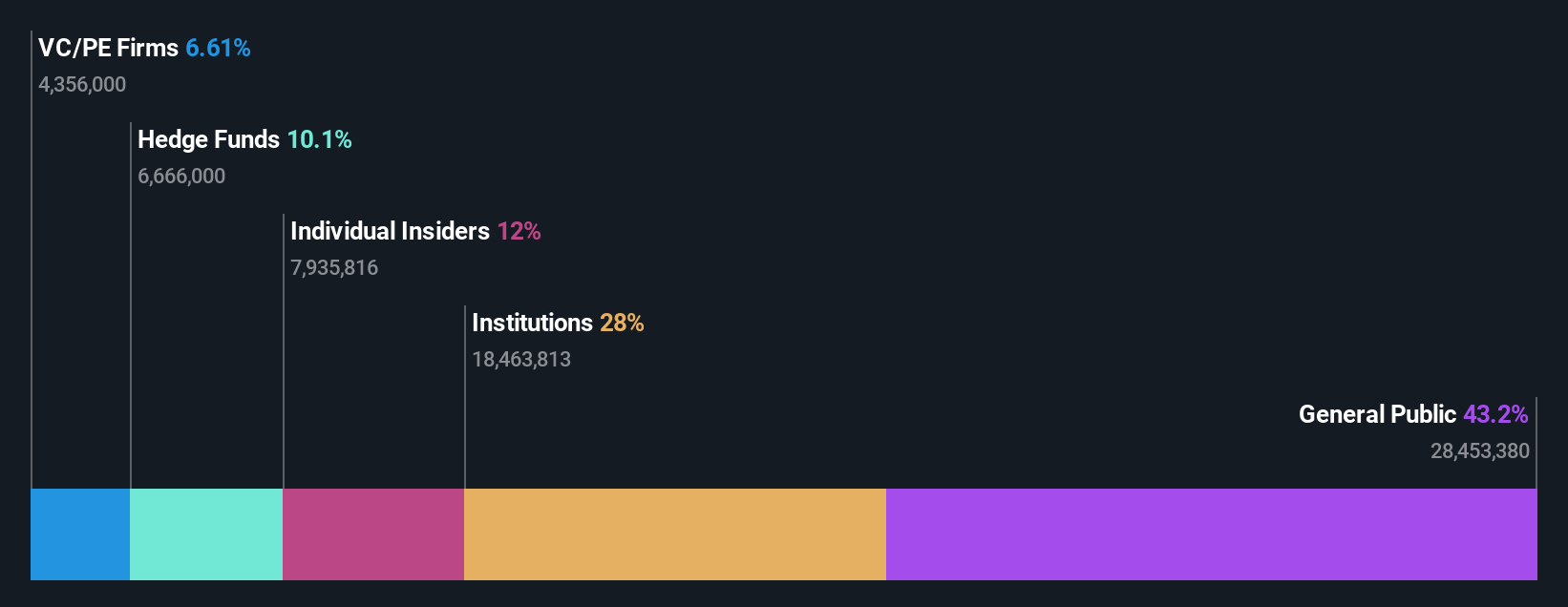

Insider Ownership: 12%

Earnings Growth Forecast: 77.7% p.a.

Basic-Fit, a Dutch fitness chain, is expected to see significant earnings growth of 77.7% annually over the next three years, outpacing the Dutch market. However, its revenue growth forecast at 14.8% lags behind its earnings potential and interest payments are not well covered by earnings. Recent investor activism from Buckley Capital Management highlights concerns about management's reluctance to consider a sale despite high private equity interest, suggesting potential value-creation opportunities remain unexplored.

- Click here to discover the nuances of Basic-Fit with our detailed analytical future growth report.

- According our valuation report, there's an indication that Basic-Fit's share price might be on the expensive side.

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts with a market cap of €21.93 billion.

Operations: CVC Capital Partners plc generates revenue through its operations in private equity and venture capital, specializing in areas such as middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity investments, recapitalizations, strip sales, and spinouts.

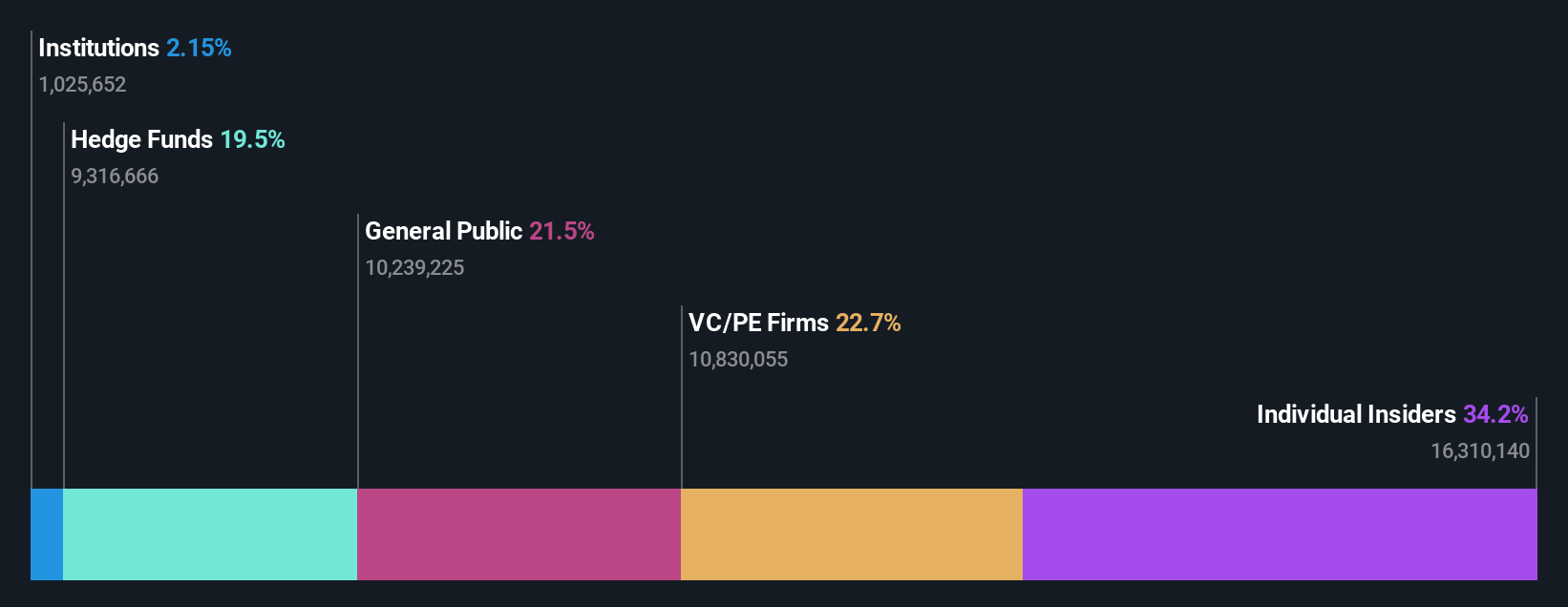

Insider Ownership: 20.2%

Earnings Growth Forecast: 33.5% p.a.

CVC Capital Partners, a private equity firm, is trading below its estimated fair value and is poised for significant earnings growth of 33.5% annually over the next three years, outpacing the Dutch market. Despite high debt levels, CVC's return on equity is expected to be very high at 44.7%. Recent M&A activities include interest in acquiring HPS Investment Partners and DB Schenker, indicating strategic expansion efforts amidst competitive bidding scenarios.

- Click here and access our complete growth analysis report to understand the dynamics of CVC Capital Partners.

- Upon reviewing our latest valuation report, CVC Capital Partners' share price might be too optimistic.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc, along with its subsidiaries, offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market cap of €260.21 million.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating €42.50 million.

Insider Ownership: 35.7%

Earnings Growth Forecast: 108.4% p.a.

MotorK, a tech firm in the automotive sector, has high insider ownership and is forecast to achieve profitability within three years with earnings expected to grow 108.44% annually. Despite recent financial challenges, including a net loss of €6.48 million for the first half of 2024, revenue growth is projected at 22.1% per year—outpacing the Dutch market's average growth rate. However, past shareholder dilution and a volatile share price pose potential concerns for investors.

- Get an in-depth perspective on MotorK's performance by reading our analyst estimates report here.

- The analysis detailed in our MotorK valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Unlock more gems! Our Fast Growing Euronext Amsterdam Companies With High Insider Ownership screener has unearthed 3 more companies for you to explore.Click here to unveil our expertly curated list of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Basic-Fit, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Basic-Fit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BFIT

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives