- Sweden

- /

- Aerospace & Defense

- /

- OM:GOMX

Discover 3 European Growth Stocks With Strong Insider Backing

Reviewed by Simply Wall St

As European markets show resilience with major indices like the FTSE MIB and DAX posting gains, investors are carefully evaluating interest rate policies amid renewed trade uncertainties. In this environment, growth companies with substantial insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| XTPL (WSE:XTP) | 23.3% | 107.3% |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.7% |

| KebNi (OM:KEBNI B) | 38% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

We'll examine a selection from our screener results.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc provides software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market cap of €214.94 million.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated €40.62 million.

Insider Ownership: 33.4%

Revenue Growth Forecast: 37% p.a.

MotorK's recent earnings report shows improving financials, with sales slightly increasing to €20.26 million and a reduced net loss of €5.47 million. The company is on track to become profitable within three years, with revenue expected to grow at 37% annually, outpacing the Dutch market's growth rate. However, its share price has been highly volatile recently and it faces challenges with a limited cash runway of less than one year.

- Click to explore a detailed breakdown of our findings in MotorK's earnings growth report.

- The analysis detailed in our MotorK valuation report hints at an inflated share price compared to its estimated value.

Andfjord Salmon Group (OB:ANDF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Andfjord Salmon Group AS is involved in the land-based farming of Atlantic salmon in Norway, with a market cap of NOK3.12 billion.

Operations: The company's revenue segment primarily consists of its livestock operations, generating NOK0.94 million.

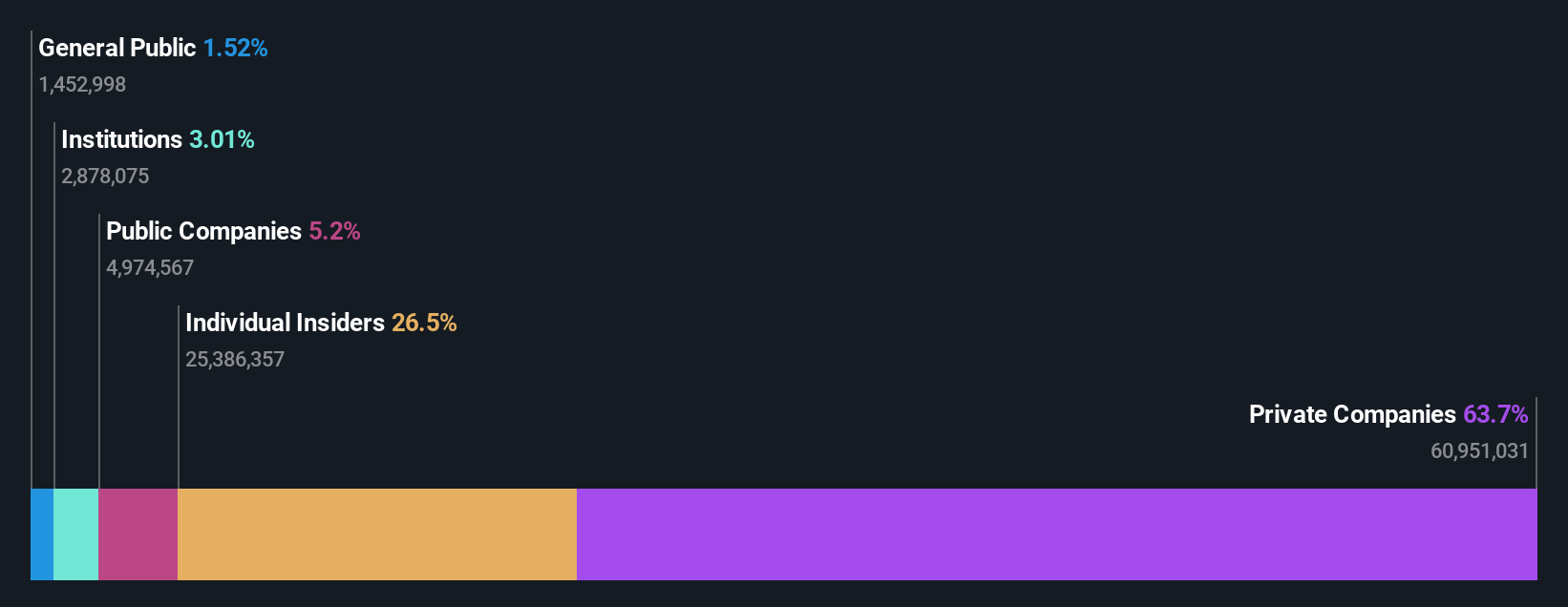

Insider Ownership: 26.5%

Revenue Growth Forecast: 58.7% p.a.

Andfjord Salmon Group's revenue is forecast to grow 58.7% annually, surpassing the Norwegian market's growth. Despite making less than US$1 million in revenue and a net loss of NOK 44.82 million for the half year ending June 2025, it is expected to become profitable within three years, showing above-market profit growth potential. The company has experienced substantial shareholder dilution recently but no significant insider trading activity over the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of Andfjord Salmon Group.

- Our comprehensive valuation report raises the possibility that Andfjord Salmon Group is priced lower than what may be justified by its financials.

GomSpace Group (OM:GOMX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GomSpace Group AB (publ) manufactures and sells nanosatellites, components, and turnkey satellite solutions across Europe, the United States, Asia, and internationally with a market cap of SEK2.41 billion.

Operations: GomSpace Group AB generates revenue through the manufacturing and sale of nanosatellites, components, and comprehensive satellite solutions across various regions including Europe, the United States, and Asia.

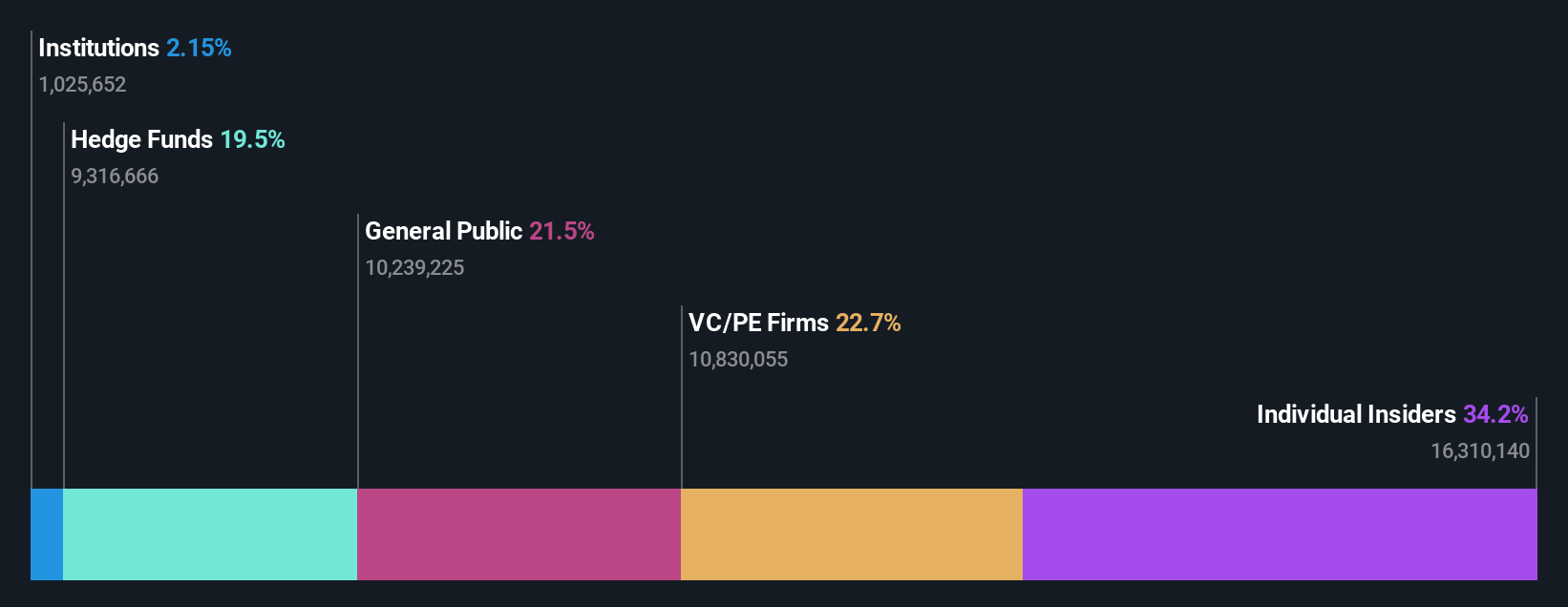

Insider Ownership: 26.9%

Revenue Growth Forecast: 25.9% p.a.

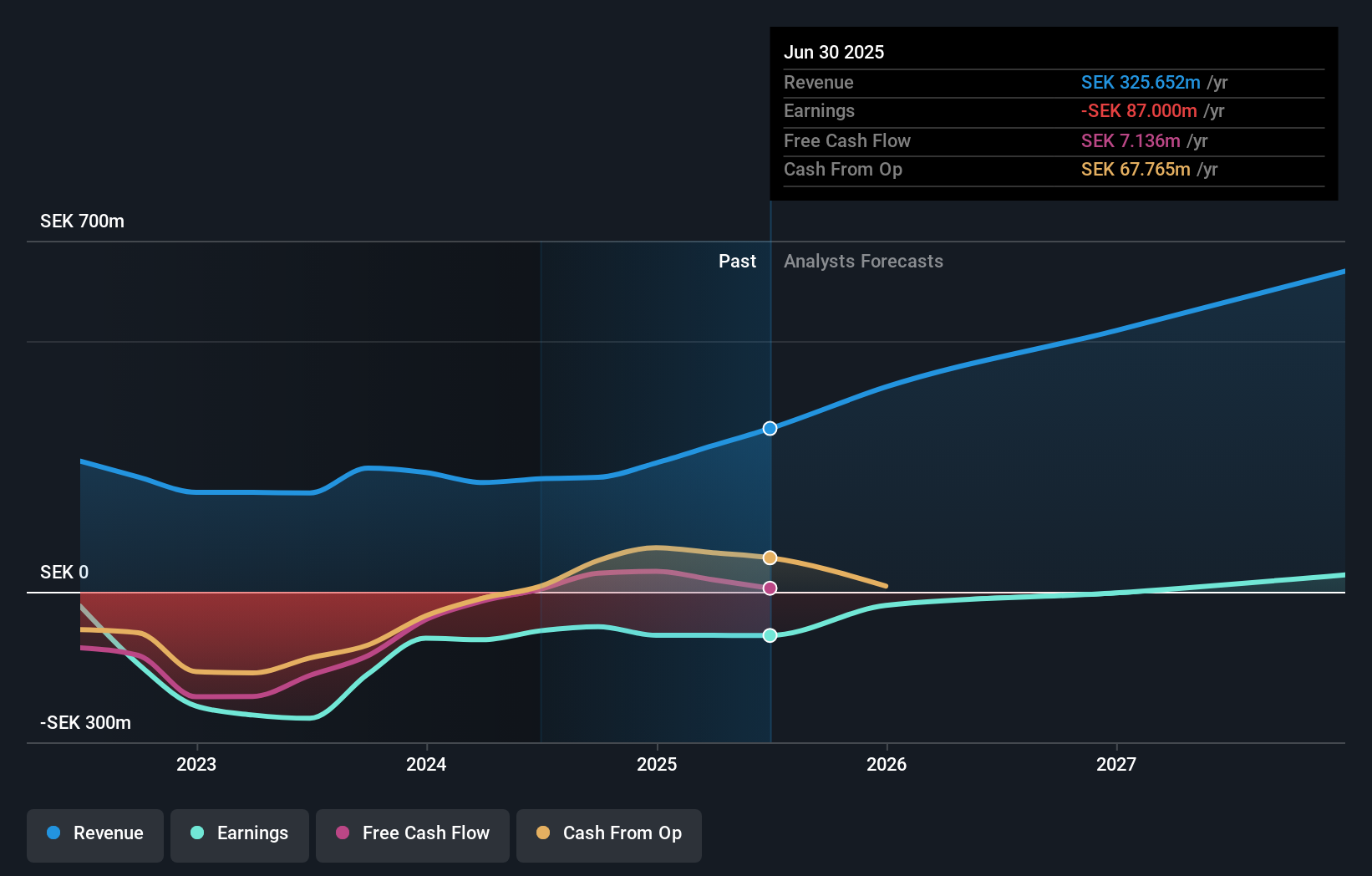

GomSpace Group is positioned for rapid growth, with revenue expected to increase by 25.9% annually, outpacing the Swedish market. Recent insider buying activity suggests confidence, though not in substantial volumes. The company faces challenges with negative equity and past shareholder dilution but aims for profitability within three years. Strategic initiatives include a new EUR 18 million credit facility from its main shareholder to support operational cash flow and growth efforts in the space technology sector.

- Get an in-depth perspective on GomSpace Group's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of GomSpace Group shares in the market.

Next Steps

- Get an in-depth perspective on all 219 Fast Growing European Companies With High Insider Ownership by using our screener here.

- Ready To Venture Into Other Investment Styles? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:GOMX

GomSpace Group

Through its subsidiaries, manufactures and sells nanosatellites and components, and turnkey solutions for satellites in Denmark, Sweden, France, rest of Europe, the United States, Asia, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives