- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

Basic-Fit Leads Trio Of Growth Stocks With High Insider Ownership On Euronext Amsterdam

Reviewed by Simply Wall St

As global markets experience varied trends, the Netherlands' stock market remains a focal point for investors seeking growth opportunities. In this context, companies like Basic-Fit, with significant insider ownership, are particularly noteworthy as they often signal strong confidence in the company's future prospects from those who know it best.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| BenevolentAI (ENXTAM:BAI) | 27.8% | 62.8% |

| Ebusco Holding (ENXTAM:EBUS) | 33.2% | 114.0% |

| Envipco Holding (ENXTAM:ENVI) | 36.2% | 68.9% |

| MotorK (ENXTAM:MTRK) | 35.8% | 105.8% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 64.8% |

| PostNL (ENXTAM:PNL) | 35.8% | 23.9% |

Let's explore several standout options from the results in the screener.

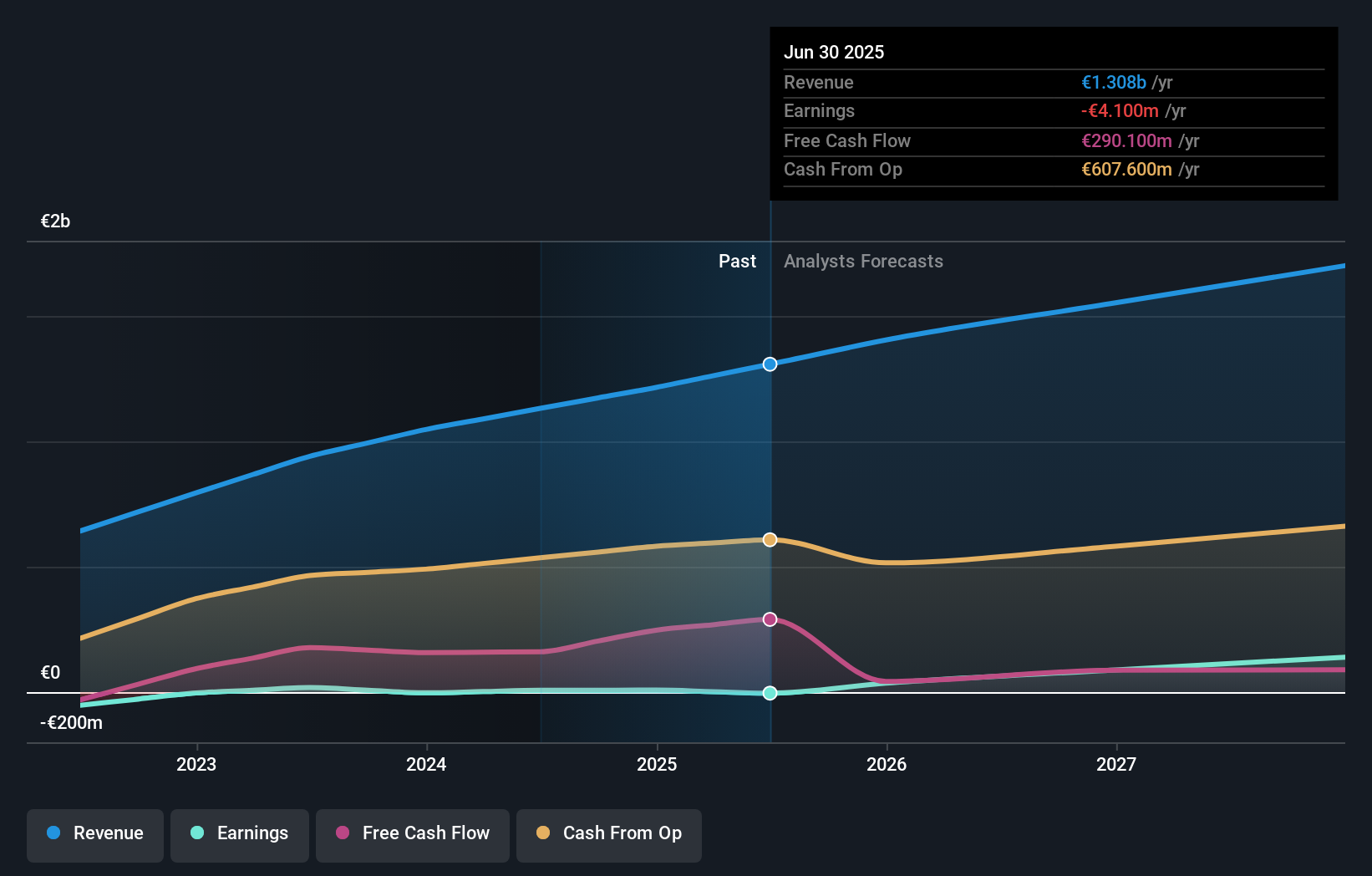

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V. operates a chain of fitness clubs across Europe and has a market capitalization of approximately €1.35 billion.

Operations: The company generates revenue primarily through its fitness clubs in two key segments: Benelux at €479.04 million and France, Spain & Germany at €568.21 million.

Insider Ownership: 12%

Basic-Fit, a prominent fitness club operator in the Netherlands, shows promising growth potential with earnings expected to increase significantly. Insider activities reveal a balanced scenario with more buying than selling over recent months, though not in large volumes. The company is forecasted to achieve profitability within three years, outpacing average market growth. Additionally, Basic-Fit's revenue growth projections exceed those of the broader Dutch market. Analysts predict a substantial rise in its stock price, underscoring confidence in its future performance.

- Unlock comprehensive insights into our analysis of Basic-Fit stock in this growth report.

- In light of our recent valuation report, it seems possible that Basic-Fit is trading beyond its estimated value.

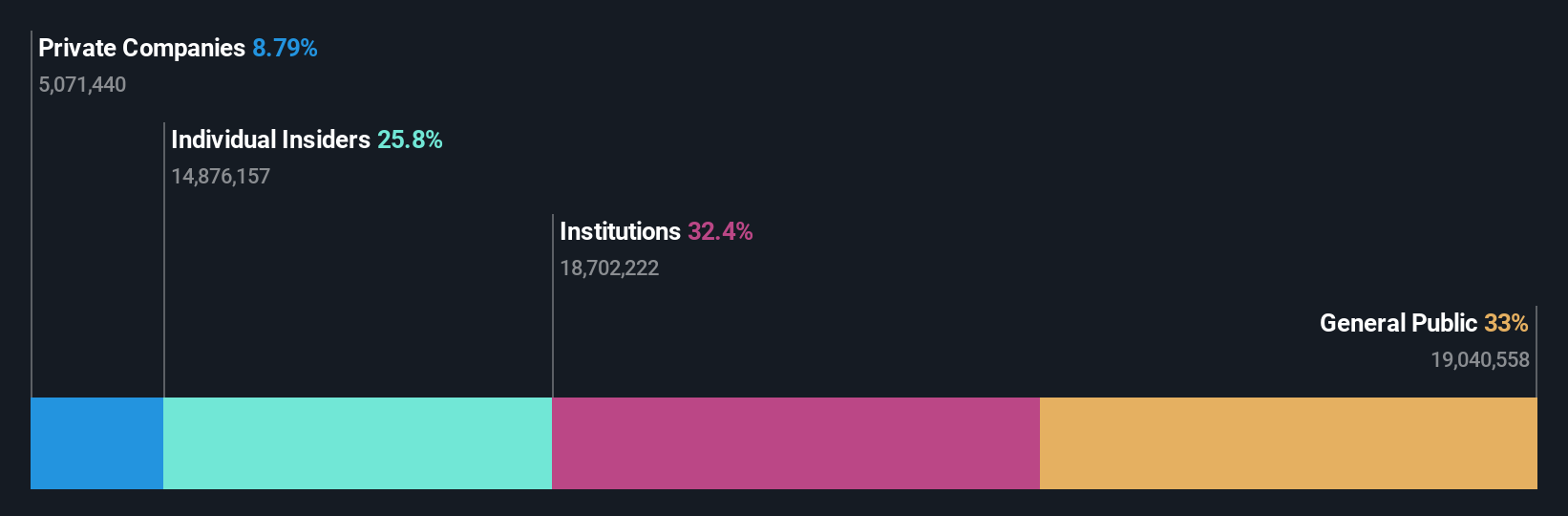

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers, primarily operating in the Netherlands, North America, and Europe with a market capitalization of approximately €331.72 million.

Operations: The company generates revenue by designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers across the Netherlands, North America, and Europe.

Insider Ownership: 36.2%

Envipco Holding N.V. has demonstrated significant growth, with revenue expected to rise by 33.3% annually, outperforming the Dutch market's 9.9%. Earnings are also set to increase sharply at 68.9% per year, far exceeding the market average of 18.1%. Recently, Envipco turned profitable and reported a substantial increase in sales from €10.41 million to €27.44 million in Q1 2024, alongside a shift from a net loss to a net income of €0.147 million.

- Click here and access our complete growth analysis report to understand the dynamics of Envipco Holding.

- Our valuation report unveils the possibility Envipco Holding's shares may be trading at a premium.

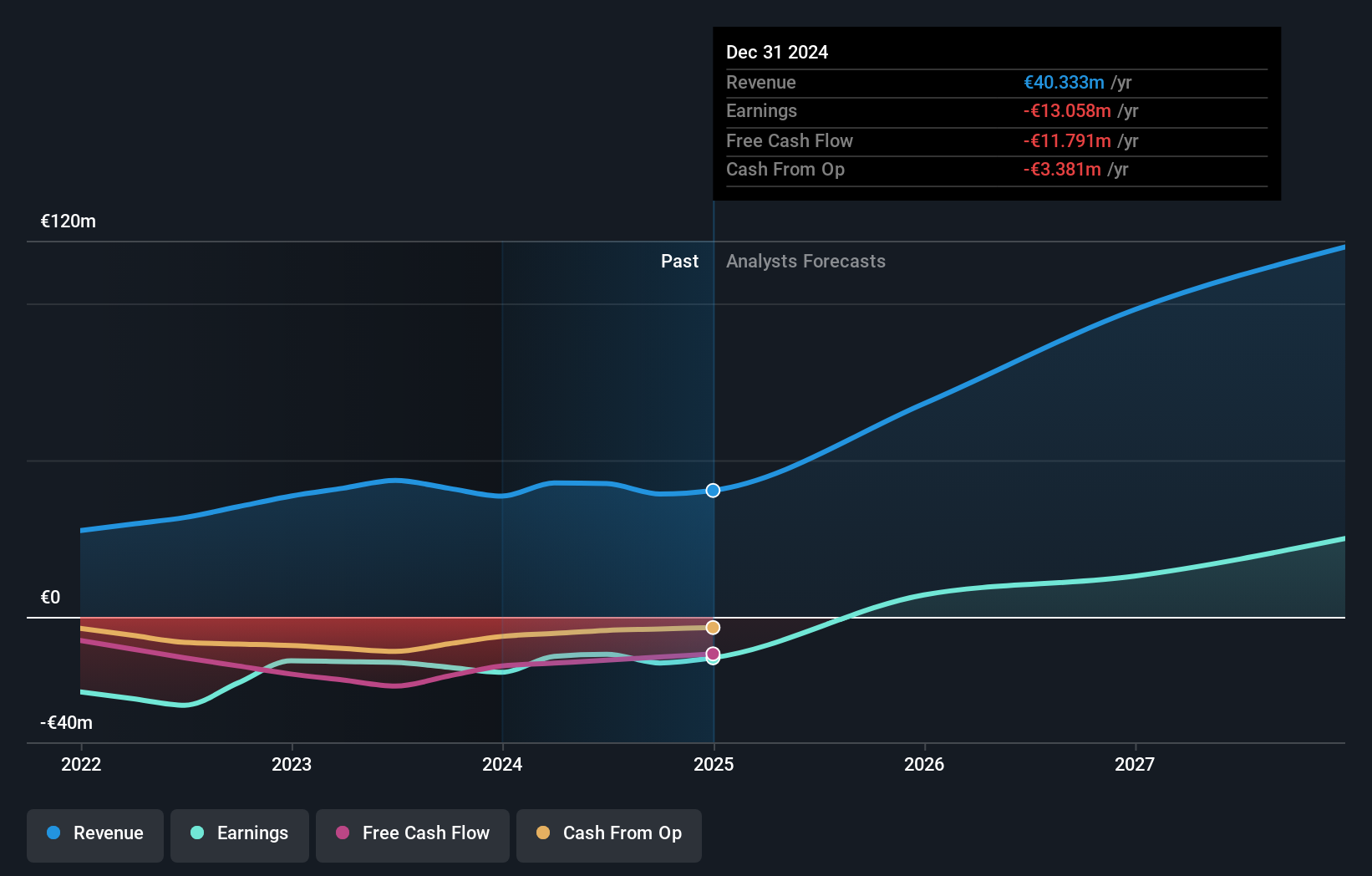

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc operates as a software-as-a-service provider for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market capitalization of approximately €266.64 million.

Operations: The company generates revenue primarily through its Software & Programming segment, amounting to €42.94 million.

Insider Ownership: 35.8%

MotorK is on a trajectory to profitability within three years, aligning with an anticipated annual profit growth that surpasses average market expectations. Despite recent shareholder dilution, revenue forecasts are robust, projecting a 24% yearly increase—outstripping the Dutch market's 9.9%. Recent board changes, including the appointment of Helen Protopapas and the resignation of Mauro Pretolani, underscore a period of executive transition coinciding with a slight dip in Q1 revenue to €11.25 million from €11.43 million year-over-year.

- Click here to discover the nuances of MotorK with our detailed analytical future growth report.

- According our valuation report, there's an indication that MotorK's share price might be on the expensive side.

Summing It All Up

- Click here to access our complete index of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines (RVM) to collect and process used beverage containers primarily in the Netherlands, North America, and rest of Europe.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives