- Netherlands

- /

- Software

- /

- ENXTAM:CMCOM

Strong week for CM.com (AMS:CMCOM) shareholders doesn't alleviate pain of three-year loss

While it may not be enough for some shareholders, we think it is good to see the CM.com N.V. (AMS:CMCOM) share price up 14% in a single quarter. Meanwhile over the last three years the stock has dropped hard. Regrettably, the share price slid 66% in that period. So the improvement may be a real relief to some. Perhaps the company has turned over a new leaf.

On a more encouraging note the company has added €18m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for CM.com

Given that CM.com didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, CM.com saw its revenue grow by 2.2% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 18% during the period. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). After all, growing a business isn't easy, and the process will not always be smooth.

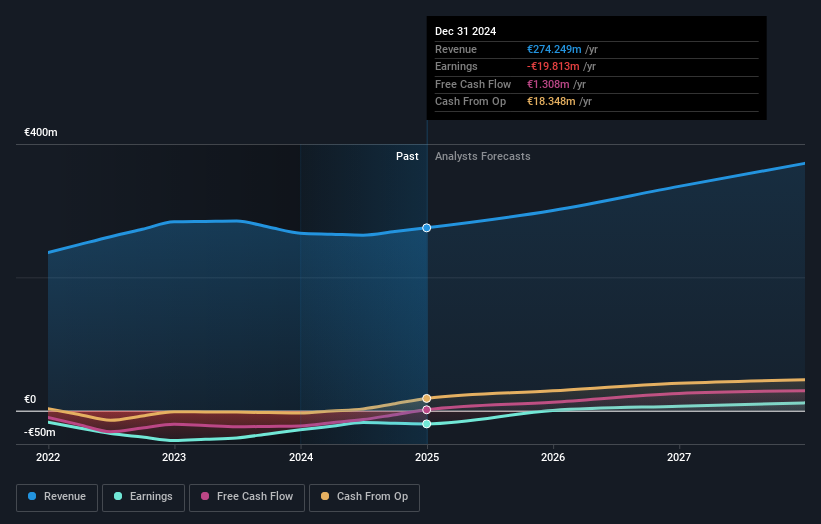

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling CM.com stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

CM.com shareholders are down 2.2% over twelve months, which isn't far from the market return of -2.2%. However, the loss over the last year isn't as bad as the 2% per annum loss investors have suffered over the last half decade. It could well be that the business has begun to stabilize, although we'd be hesitant to buy without clear information suggesting the company will grow. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for CM.com that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:CMCOM

CM.com

Provides cloud software for conversational commerce worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Rocket Lab (RKLB): A Rising Challenger in the Space Economy

Coinbase and the anniversary of the Bybit hack: Lessons for Investors

Alphabet will shine

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion