- Netherlands

- /

- Semiconductors

- /

- ENXTAM:BESI

European Stocks That May Be Trading At A Discount In May 2025

Reviewed by Simply Wall St

As European markets continue to navigate the complexities of global trade tensions and monetary policy adjustments, the pan-European STOXX Europe 600 Index has shown resilience with a modest gain, marking its fourth consecutive week of growth. Amidst these mixed signals from major stock indexes and central bank rate decisions, investors are increasingly on the lookout for stocks that may be trading at a discount. Identifying undervalued stocks can be particularly appealing in such an environment where economic uncertainty prevails, as these investments might offer potential for value appreciation once market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ILPRA (BIT:ILP) | €4.54 | €8.76 | 48.2% |

| adidas (XTRA:ADS) | €223.80 | €440.87 | 49.2% |

| Lectra (ENXTPA:LSS) | €24.30 | €47.47 | 48.8% |

| Tesmec (BIT:TES) | €0.0564 | €0.11 | 49.7% |

| Vestas Wind Systems (CPSE:VWS) | DKK111.75 | DKK215.27 | 48.1% |

| Claranova (ENXTPA:CLA) | €2.745 | €5.40 | 49.2% |

| MilDef Group (OM:MILDEF) | SEK227.60 | SEK440.23 | 48.3% |

| illimity Bank (BIT:ILTY) | €3.618 | €7.21 | 49.8% |

| Martela Oyj (HLSE:MARAS) | €0.758 | €1.50 | 49.5% |

| Expert.ai (BIT:EXAI) | €1.33 | €2.58 | 48.5% |

Underneath we present a selection of stocks filtered out by our screen.

BE Semiconductor Industries (ENXTAM:BESI)

Overview: BE Semiconductor Industries N.V. is a company that develops, manufactures, markets, sells, and services semiconductor assembly equipment for the semiconductor and electronics industries globally, with a market cap of €9.53 billion.

Operations: The company generates its revenue primarily from its Semiconductor Equipment and Services segment, which accounted for €605.30 million.

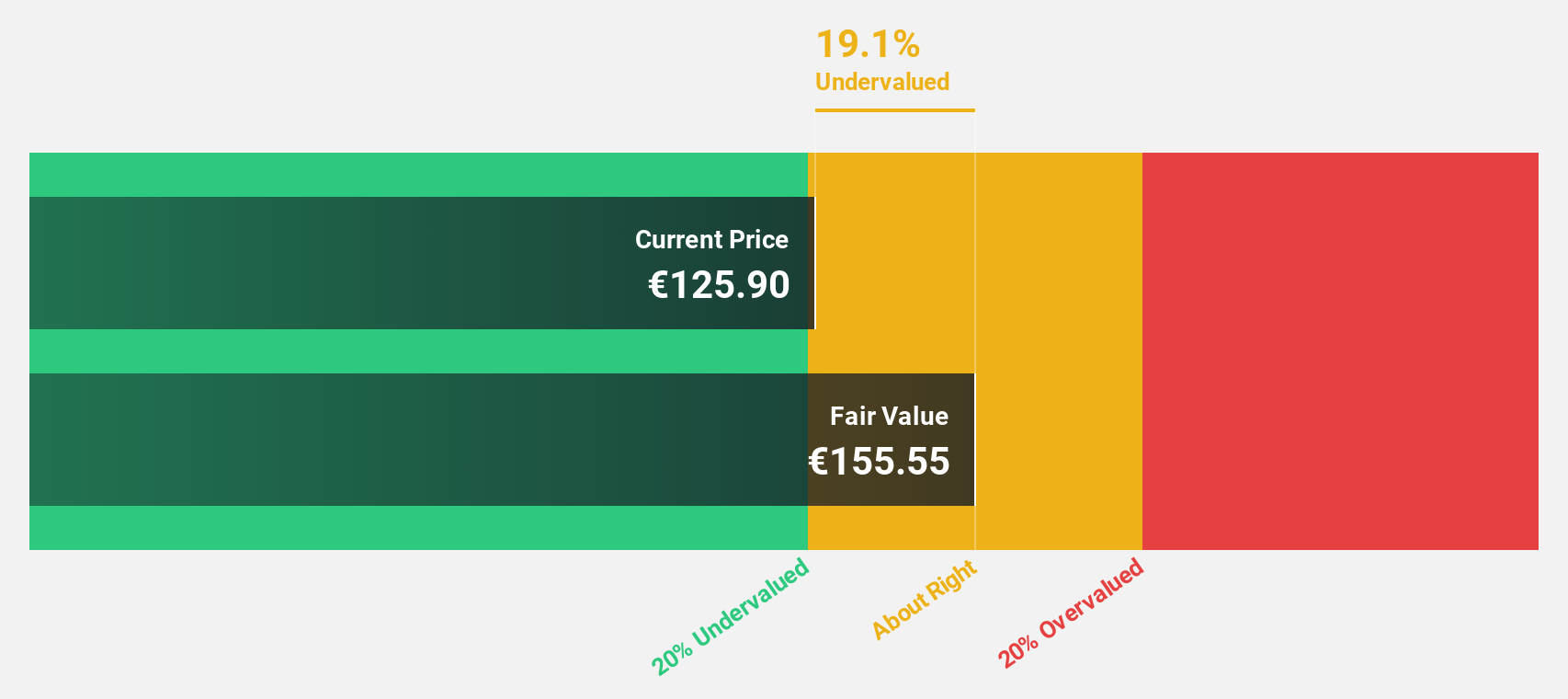

Estimated Discount To Fair Value: 24.4%

BE Semiconductor Industries appears undervalued, trading over 20% below its estimated fair value of €159.02. Despite recent volatility, the company has shown stable earnings growth of 1.7% last year and forecasts suggest a significant annual profit growth rate of 24.4%, outpacing the Dutch market's average. The firm recently approved a €172.5 million dividend payout for 2024 and completed share buybacks worth €51.5 million, reflecting robust cash flow management amidst flat revenue guidance for Q1 2025.

- Our growth report here indicates BE Semiconductor Industries may be poised for an improving outlook.

- Get an in-depth perspective on BE Semiconductor Industries' balance sheet by reading our health report here.

Surgical Science Sweden (OM:SUS)

Overview: Surgical Science Sweden AB (publ) develops and markets virtual reality simulators for evidence-based medical training globally, with a market cap of approximately SEK7.69 billion.

Operations: Surgical Science Sweden AB generates revenue from two main segments: Industry/OEM at SEK441.59 million and Educational Products at SEK442.50 million.

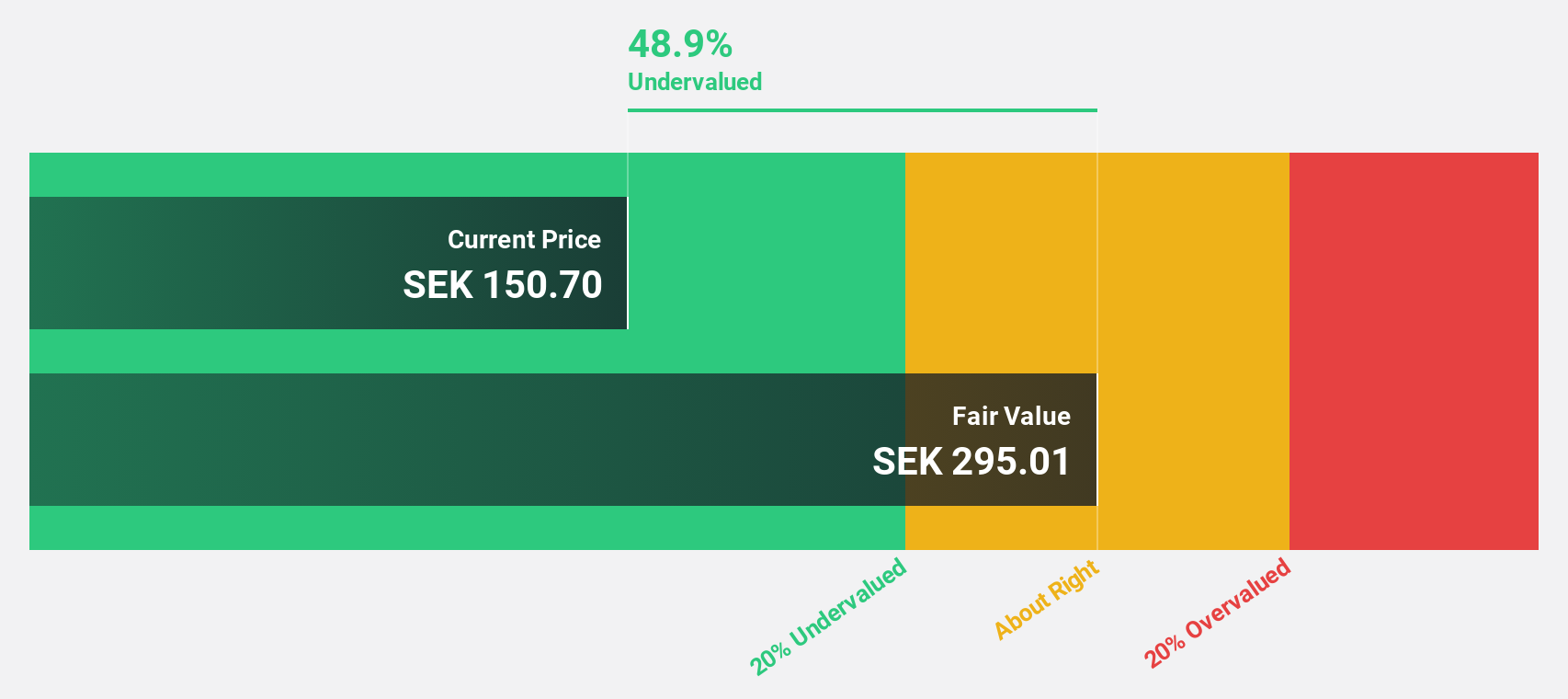

Estimated Discount To Fair Value: 44.8%

Surgical Science Sweden AB is trading at SEK 150.7, significantly below its estimated fair value of SEK 273.16, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from last year's 26.5% to 14.9%, the company reported strong Q1 earnings growth, with net income rising to SEK 33.24 million from SEK 23.79 million year-on-year and forecasts indicating robust annual earnings growth of over 20%, surpassing Swedish market averages.

- The growth report we've compiled suggests that Surgical Science Sweden's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Surgical Science Sweden's balance sheet health report.

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, develops, manufactures, and sells components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific with a market cap of approximately €3.87 billion.

Operations: The company's revenue segments include Vehicle Lifetime Solutions with €2.73 billion and Bearings & Industrial Solutions with €6.53 billion.

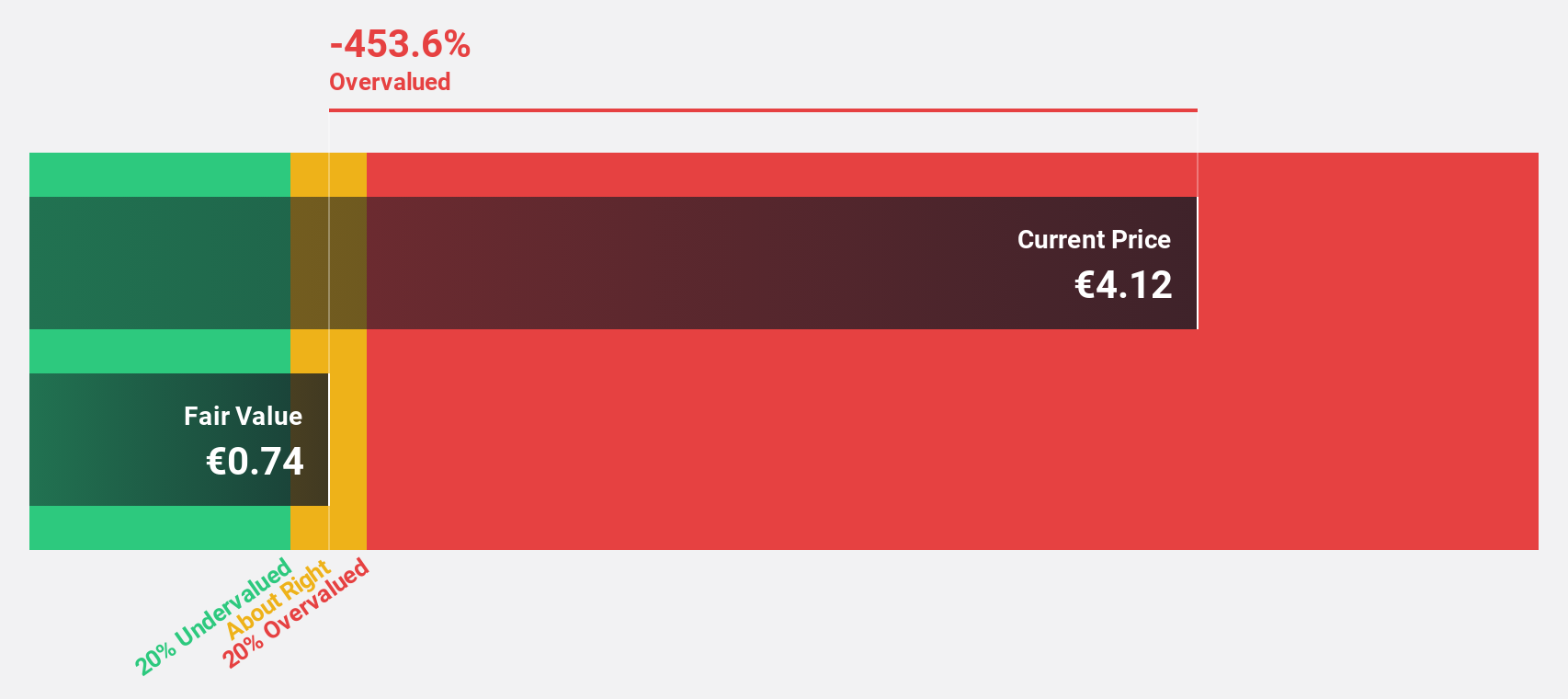

Estimated Discount To Fair Value: 27.5%

Schaeffler is trading at €4.10, significantly below its estimated fair value of €5.65, suggesting undervaluation based on cash flows. Despite recent challenges, including a decline in net income from €231 million to €83 million year-on-year for Q1 2025, the company anticipates becoming profitable within three years. Schaeffler's strategic shift towards cloud-based solutions and its merger with Vitesco Technologies may enhance operational efficiencies and support future growth prospects amidst industry competition.

- Insights from our recent growth report point to a promising forecast for Schaeffler's business outlook.

- Click here to discover the nuances of Schaeffler with our detailed financial health report.

Where To Now?

- Get an in-depth perspective on all 173 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade BE Semiconductor Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BE Semiconductor Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BESI

BE Semiconductor Industries

Develops, manufactures, markets, sells, and services semiconductor assembly equipment for the semiconductor and electronics industries in the Netherlands, Switzerland, Austria, Singapore, Malaysia, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives