- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

How Investors May Respond To ASML Holding (ENXTAM:ASML) Posting Strong Results and Navigating China Headwinds

Reviewed by Sasha Jovanovic

- ASML Holding recently reported strong third-quarter 2025 results, including €7.5 billion in sales and a gross margin of 51.6%, while announcing new Q4 guidance and an interim dividend payable in November 2025.

- An interesting element of the announcement was ASML's ongoing commitment to shareholder returns through both dividends and share buybacks, despite warning of a significant decline in China-related sales in 2026 due to export controls.

- We'll examine how ASML's upbeat outlook amid China headwinds influences the company's investment narrative and future earnings forecasts.

Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

ASML Holding Investment Narrative Recap

To be a shareholder in ASML, you need to believe that the company’s dominance in EUV lithography puts it at the center of semiconductor innovation, benefitting from AI-driven chip demand and customer adoption of advanced tools. The strong Q3 and upbeat guidance reinforce this catalyst, but management’s warning of a significant drop in China sales for 2026 brings renewed attention to geopolitical and export risks, though Q4 guidance suggests the near-term risk to revenue appears limited for now.

Among recent announcements, the completed share buyback program stands out as most relevant, signaling ongoing confidence in capital return even as ASML braces for China-related headwinds. This capital allocation may offer support to the investment case in the face of potential volatility if order flows or market conditions shift on export controls or tariffs.

Yet, in contrast, investors should watch how shifts in export policy and changes in demand from major regions could...

Read the full narrative on ASML Holding (it's free!)

ASML Holding's narrative projects €39.6 billion revenue and €12.1 billion earnings by 2028. This requires 7.2% yearly revenue growth and a €2.7 billion increase in earnings from €9.4 billion today.

Uncover how ASML Holding's forecasts yield a €809.45 fair value, a 7% downside to its current price.

Exploring Other Perspectives

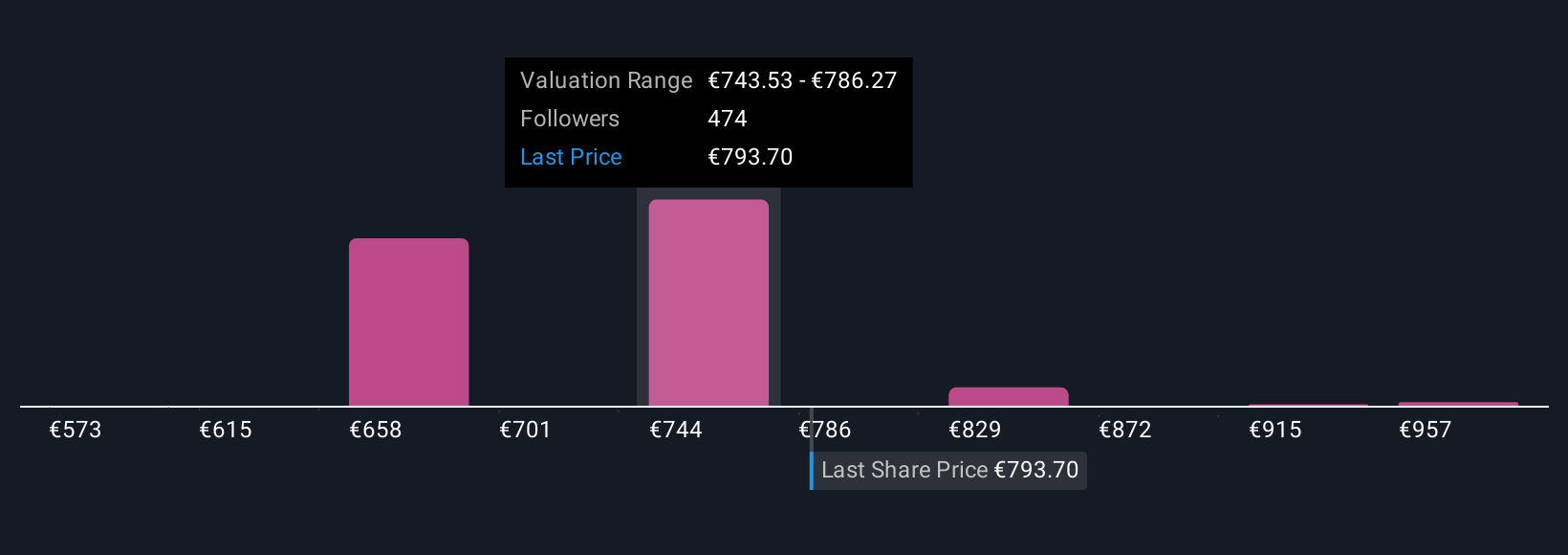

With 88 different fair value estimates from the Simply Wall St Community ranging from €572.55 to €1,000, views on ASML’s share price potential are far apart. Many participants are weighing accelerated AI-driven demand against the risk of lower China sales and their effect on future growth, so explore several perspectives when considering your own outlook.

Explore 88 other fair value estimates on ASML Holding - why the stock might be worth as much as 15% more than the current price!

Build Your Own ASML Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASML Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ASML Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASML Holding's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives