- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

ASML (ENXTAM:ASML): Assessing Valuation After a Recent 18% One-Month Rally

Reviewed by Kshitija Bhandaru

ASML Holding (ENXTAM:ASML) stock has seen a bump over the past month, rising 18%, even as the company’s recent trading sessions show minor pullbacks. Investors are watching for clues on what could sustain this momentum.

See our latest analysis for ASML Holding.

ASML Holding has captured plenty of attention with its recent 18% one-month share price return, capping a strong run that stands out in today's volatile market. While the last few sessions saw some short-term pullbacks, momentum overall appears to be building. This is supported by a 17.96% year-to-date share price return and a 111% total shareholder return over three years.

If you’re interested in other technology and AI leaders showing eye-catching growth, it’s a great time to check out the full list through our See the full list for free..

With shares rallying so strongly, the big question is whether ASML Holding is now undervalued compared to its growth prospects or if the current stock price already reflects expectations for future gains. Could this be a real buying opportunity?

Most Popular Narrative: 18.6% Undervalued

According to Investingwilly's narrative, ASML Holding’s latest fair value sits well above the current share price. This suggests strong upside potential compared to what the market is currently pricing in. The gap between ambition and reality is significant enough to spark debate about whether investors are overlooking key drivers.

"ASML is the only company in the world producing EUV lithography tools. These machines are essential for making the world’s most powerful semiconductors. This gives ASML a near-monopoly in a fast-growing market driven by AI, 5G, and high-performance computing."

Want to see the engine powering this valuation? The narrative hints at exceptional recurring revenues, high profitability, and a technology moat that dominates its market. Which financial projections actually allow for such a premium over today’s price? Discover the bold assumptions and growth forecasts that set this estimate apart.

Result: Fair Value of $1000 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade tensions and possible export restrictions to China could challenge ASML’s lofty growth assumptions and could temper near-term investor optimism.

Find out about the key risks to this ASML Holding narrative.

Another Take: What Do Market Ratios Say?

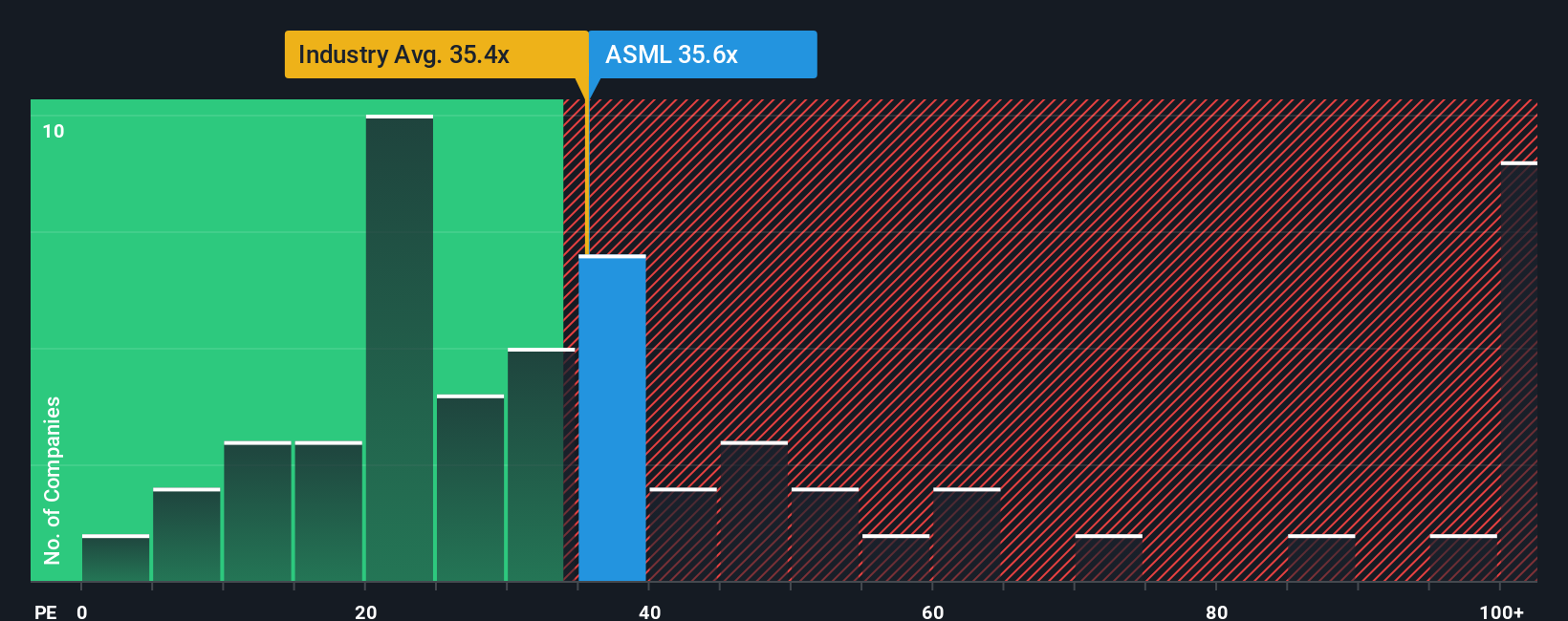

Looking at ASML’s price-to-earnings ratio of 33.5 times, it matches up exactly with the European semiconductor industry average. However, it sits below peers and is significantly under the "fair ratio" of 45.8 times projected for the market. This means the current price is not demanding a premium, but also is not presenting a classic bargain. Could cautious optimism be the healthiest approach here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ASML Holding Narrative

If you have your own perspective or want to dive into the numbers yourself, you can shape a fresh narrative in just a few minutes. Do it your way

A great starting point for your ASML Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Supercharge your search and get the edge by finding hidden gems and market leaders before the crowd does.

- Pinpoint stocks delivering powerful yields and steady income by checking out these 19 dividend stocks with yields > 3% with returns that stand out in any market.

- Seize the latest innovations in artificial intelligence by reviewing these 24 AI penny stocks, uncovering companies poised to lead the next technological surge.

- Target real potential by searching through these 892 undervalued stocks based on cash flows, where you can spot quality businesses trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives