- Netherlands

- /

- Retail REITs

- /

- ENXTAM:VASTN

Vastned Retail N.V. (AMS:VASTN) Full-Year Results Just Came Out: Here's What Analysts Are Forecasting For This Year

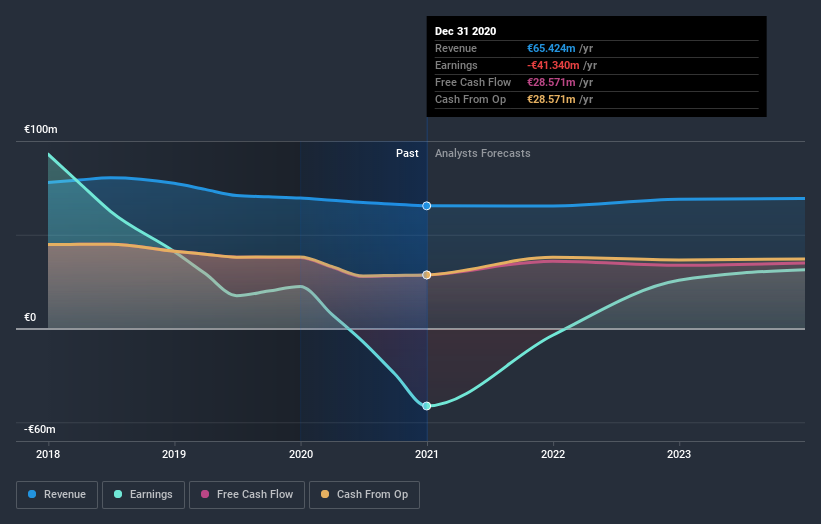

Investors in Vastned Retail N.V. (AMS:VASTN) had a good week, as its shares rose 2.7% to close at €24.90 following the release of its annual results. Revenues were in line with expectations, at €65m, while statutory losses ballooned to €2.41 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for Vastned Retail

Following last week's earnings report, Vastned Retail's three analysts are forecasting 2021 revenues to be €65.4m, approximately in line with the last 12 months. Earnings are expected to improve, with Vastned Retail forecast to report a statutory profit of €1.03 per share. In the lead-up to this report, the analysts had been modelling revenues of €62.2m and earnings per share (EPS) of €1.11 in 2021. So it's pretty clear consensus is mixed on Vastned Retail after the latest results; whilethe analysts lifted revenue numbers, they also administered a small dip in per-share earnings expectations.

The consensus price target was unchanged at €26.25, suggesting the business is performing roughly in line with expectations, despite some adjustments to profit and revenue forecasts. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Vastned Retail, with the most bullish analyst valuing it at €30.00 and the most bearish at €24.00 per share. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would also point out that the forecast 0.1% annualised revenue decline to the end of 2021 is better than the historical trend, which saw revenues shrink 6.6% annually over the past five years Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 6.1% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Vastned Retail to suffer worse than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Vastned Retail. Fortunately, they also upgraded their revenue estimates, although our data indicates sales are expected to perform worse than the wider industry. The consensus price target held steady at €26.25, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Vastned Retail analysts - going out to 2023, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Vastned Retail (1 is a bit concerning) you should be aware of.

If you’re looking to trade Vastned Retail, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTAM:VASTN

Vastned Retail

Vastned is a European publicly listed property company (Euronext Amsterdam: VASTN) focusing on the best property in the popular shopping areas of selected European cities with a historic city centre where shopping, living, working and leisure meet.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives