- Netherlands

- /

- Biotech

- /

- ENXTAM:PHARM

We Think Pharming Group's (AMS:PHARM) Statutory Profit Might Understate Its Earnings Potential

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Pharming Group (AMS:PHARM).

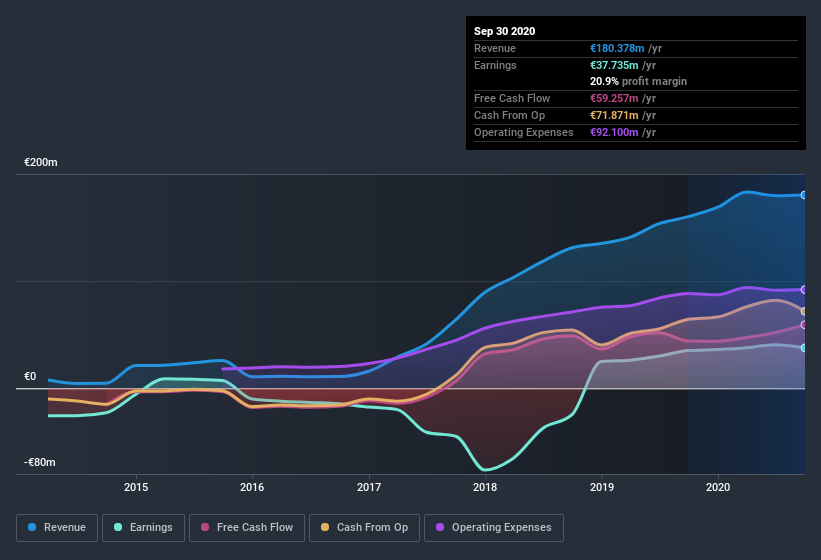

It's good to see that over the last twelve months Pharming Group made a profit of €37.7m on revenue of €180.4m. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

See our latest analysis for Pharming Group

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. So today we'll look at what Pharming Group's cashflow tells us about the quality of its earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Examining Cashflow Against Pharming Group's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to September 2020, Pharming Group recorded an accrual ratio of -0.23. Therefore, its statutory earnings were very significantly less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of €59m, well over the €37.7m it reported in profit. Pharming Group shareholders are no doubt pleased that free cash flow improved over the last twelve months.

Our Take On Pharming Group's Profit Performance

As we discussed above, Pharming Group's accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Because of this, we think Pharming Group's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 2 warning signs for Pharming Group you should know about.

This note has only looked at a single factor that sheds light on the nature of Pharming Group's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Pharming Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Pharming Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTAM:PHARM

Pharming Group

A biopharmaceutical company, develops and commercializes protein replacement therapies and precision medicines for the treatment of rare diseases in the United States, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives