- Ireland

- /

- Consumer Durables

- /

- ISE:GVR

3 European Penny Stocks With Market Caps Over €300M

Reviewed by Simply Wall St

The European market has recently experienced a slight downturn, with the pan-European STOXX Europe 600 Index ending lower amid ongoing uncertainty about U.S. trade policy. Despite these challenges, there remains significant interest in penny stocks—a term that may seem outdated but continues to highlight opportunities for growth within smaller or newer companies. These stocks can be particularly attractive when they exhibit strong financial health and fundamentals, offering potential upside without some of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.99 | €33.15M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK3.98 | SEK242.14M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.67 | €52.44M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.24 | SEK210.19M | ★★★★★☆ |

| Deceuninck (ENXTBR:DECB) | €2.215 | €306.55M | ★★★★★★ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.38 | €23.9M | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.08 | SEK1.99B | ★★★★☆☆ |

| Riber (ENXTPA:ALRIB) | €3.04 | €63.7M | ★★★★★☆ |

| IMS (WSE:IMS) | PLN3.66 | PLN124.05M | ★★★★☆☆ |

Click here to see the full list of 433 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Pharming Group (ENXTAM:PHARM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pharming Group N.V. is a biopharmaceutical company focused on developing and commercializing protein replacement therapies and precision medicines for rare diseases across the United States, Europe, and internationally, with a market cap of approximately €569.08 million.

Operations: Pharming Group N.V. has not reported any specific revenue segments.

Market Cap: €569.08M

Pharming Group N.V. recently reported a significant increase in quarterly sales, reaching US$92.7 million, with net income turning positive at US$3.7 million compared to a loss the previous year. Despite being unprofitable overall, the company maintains more cash than debt and has a robust cash runway exceeding three years. The stock is trading significantly below its estimated fair value and has reduced its debt-to-equity ratio over five years. Recent leadership changes include appointing Fabrice Chouraqui as CEO, which may influence strategic direction as Pharming anticipates revenue growth of 6% to 13% for 2025.

- Navigate through the intricacies of Pharming Group with our comprehensive balance sheet health report here.

- Explore Pharming Group's analyst forecasts in our growth report.

Deceuninck (ENXTBR:DECB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deceuninck NV is involved in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions across Europe, North America, Turkey, and other international markets with a market cap of €306.55 million.

Operations: The company's revenue is segmented as follows: €369.8 million from Europe, €305.7 million from Turkey & Emerging Markets, and €163.8 million from North America.

Market Cap: €306.55M

Deceuninck NV, with a market cap of €306.55 million, has shown resilience despite a slight dip in annual sales to €827 million from €866.1 million. The company reported an increase in net income to €15.9 million and improved earnings per share. Trading below its estimated fair value, Deceuninck's debt is well-managed with operating cash flow covering 60.4% of it, and its net debt to equity ratio is satisfactory at 24%. While the board is experienced, the management team lacks tenure stability. Earnings growth outpaced industry averages significantly over the past year at 67.7%.

- Unlock comprehensive insights into our analysis of Deceuninck stock in this financial health report.

- Understand Deceuninck's earnings outlook by examining our growth report.

Glenveagh Properties (ISE:GVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Glenveagh Properties PLC, with a market cap of €819.89 million, constructs and sells houses and apartments to private buyers, local authorities, and the private rental sector in Ireland.

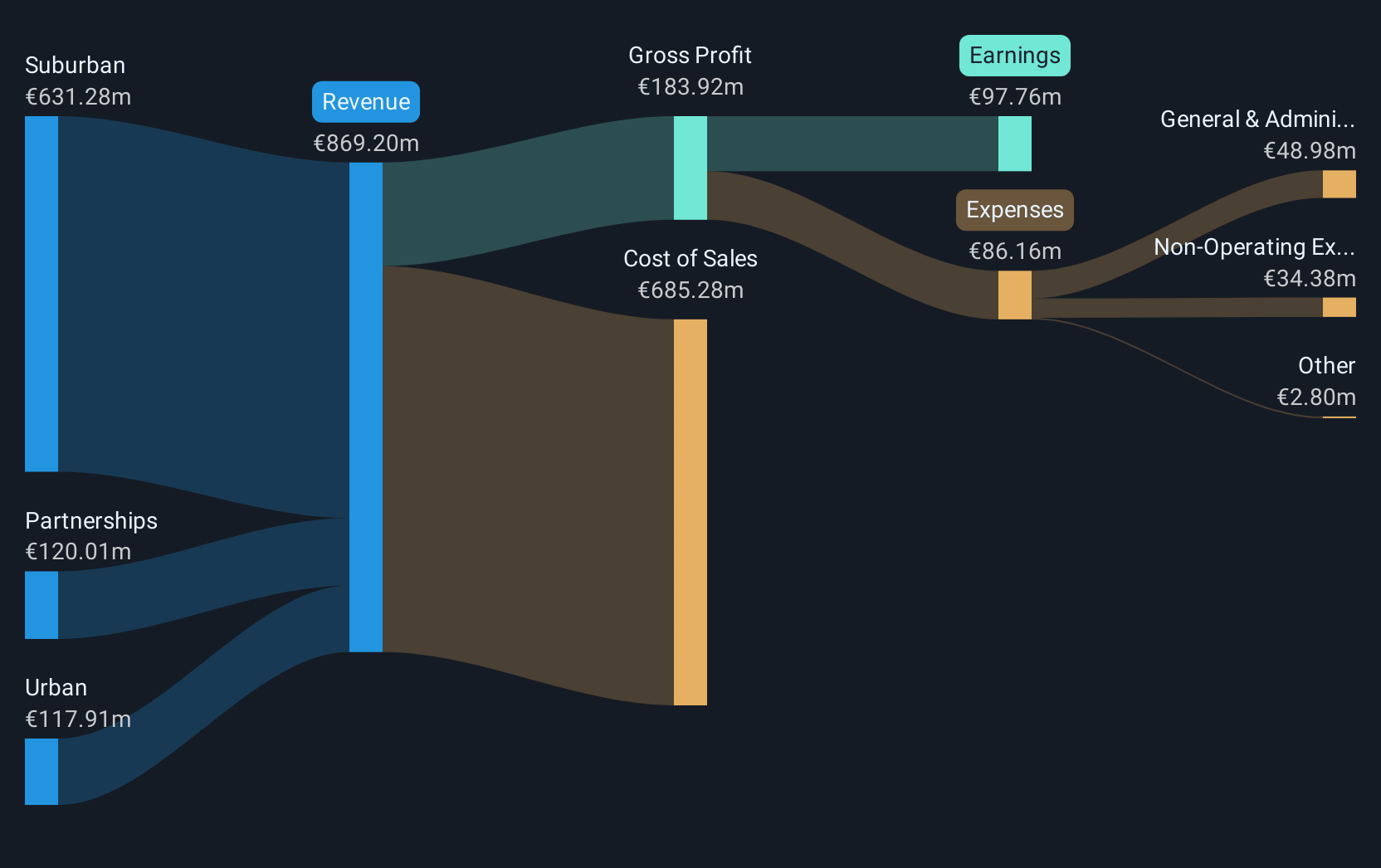

Operations: Glenveagh Properties PLC does not report specific revenue segments, focusing instead on constructing and selling residential properties in Ireland.

Market Cap: €819.89M

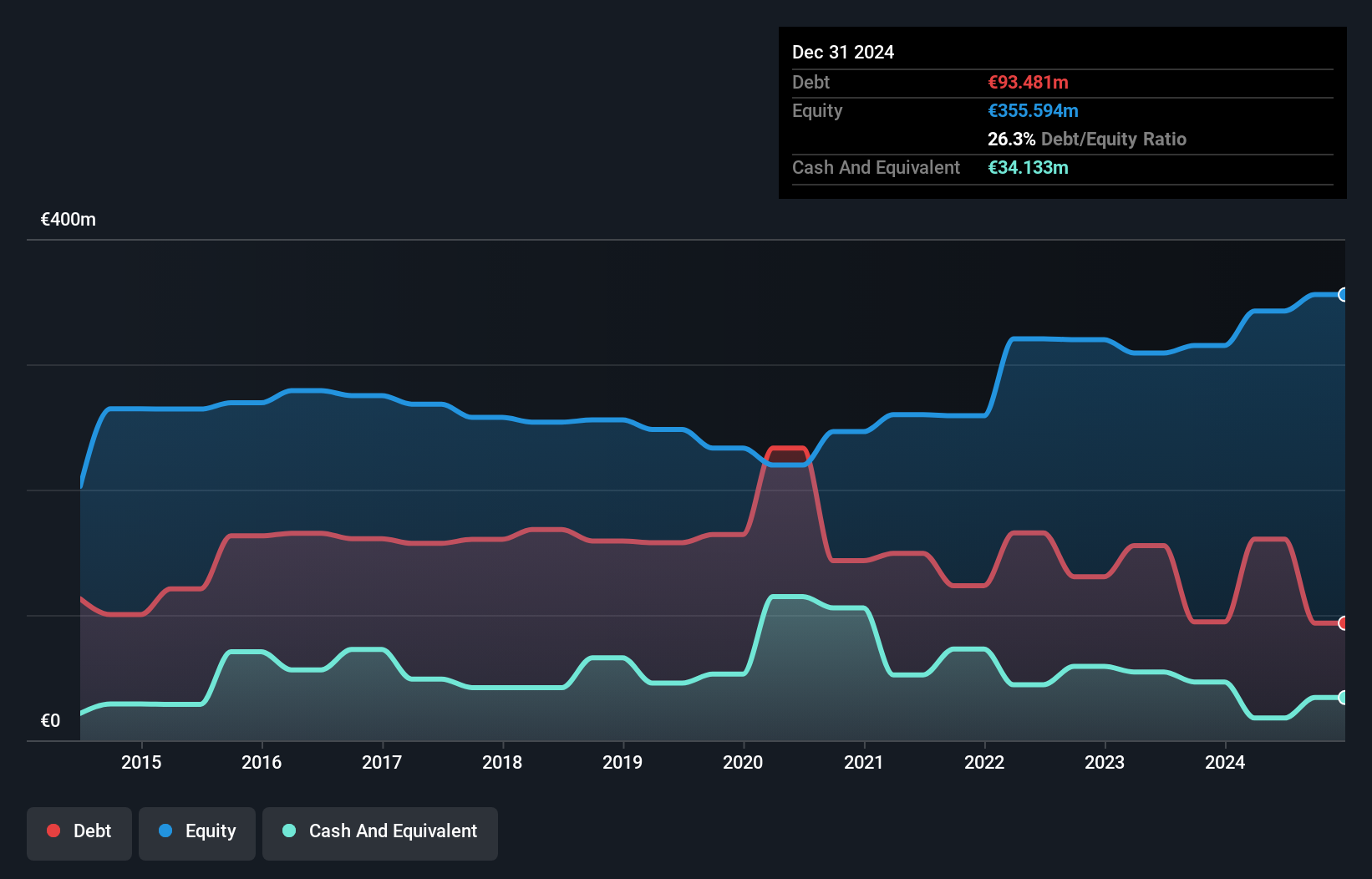

Glenveagh Properties PLC, with a market cap of €819.89 million, has demonstrated robust financial performance with sales reaching €869.2 million and net income at €97.76 million for 2024. The company benefits from a strong land portfolio and planning permissions, supporting its EPS guidance of 19.5 cents for 2025. Despite an increase in debt to equity ratio over five years, short-term assets significantly exceed liabilities, indicating sound liquidity management. Earnings growth at 107.5% surpasses industry averages and reflects accelerated profit growth compared to its five-year average of 40.2%. However, negative operating cash flow suggests challenges in covering debt obligations fully.

- Dive into the specifics of Glenveagh Properties here with our thorough balance sheet health report.

- Learn about Glenveagh Properties' future growth trajectory here.

Where To Now?

- Click through to start exploring the rest of the 430 European Penny Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:GVR

Glenveagh Properties

Glenveagh Properties PLC, together with its subsidiaries, constructs and sells houses and apartments for the private buyers, local authorities, and the private rental sector in Ireland.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives