As the European markets continue to show resilience, with the STOXX Europe 600 Index climbing 2.35% and major indices across Germany, Italy, France, and the UK posting gains, investors are increasingly looking toward opportunities that might have been overlooked in more stable times. Penny stocks—often associated with smaller or newer companies—remain an intriguing area for those seeking growth potential at lower price points. Despite being a somewhat outdated term, these stocks can offer substantial value when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.64 | €82.4M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.94 | €13.96M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €228.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Enervit (BIT:ENV) | €3.80 | €67.64M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.06 | €64.91M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.345 | €384.03M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.91 | €76.25M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.255 | €311.69M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.818 | €27.39M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 280 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

DigiTouch (BIT:DGT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DigiTouch S.p.A. offers digital marketing and transformation services in Italy with a market cap of €27.64 million.

Operations: The company's revenue is derived from Marketing Services (€10.89 million), E-Commerce Services (€3.16 million), and Technology Services (€24.65 million).

Market Cap: €27.64M

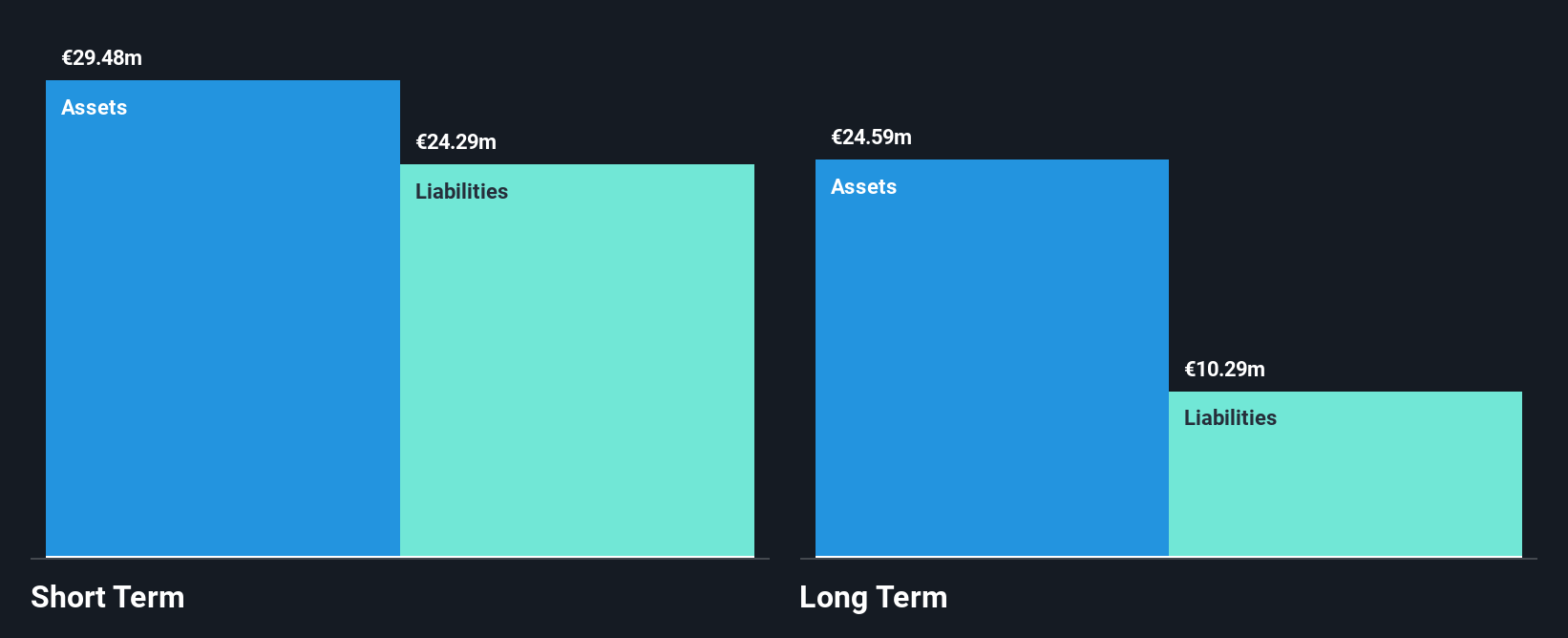

DigiTouch S.p.A. presents a mixed picture for penny stock investors, with strengths in financial stability and earnings growth. The company reported half-year revenue of €19.8 million, showing slight improvement from the previous year. Its short-term assets comfortably cover both short and long-term liabilities, indicating solid liquidity management. Earnings have grown significantly over five years but slowed to 6.6% last year, below its historical average yet outperforming industry trends. With interest payments well-covered by EBIT and debt levels reduced over time, DigiTouch trades at 52% below estimated fair value but has a low return on equity at 8.5%.

- Jump into the full analysis health report here for a deeper understanding of DigiTouch.

- Gain insights into DigiTouch's outlook and expected performance with our report on the company's earnings estimates.

Hawick Data (ENXTAM:HWK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hawick Data N.V. operates in the media advertising industry in the Netherlands, with a market cap of €9.28 million.

Operations: There are no reported revenue segments for this company.

Market Cap: €9.28M

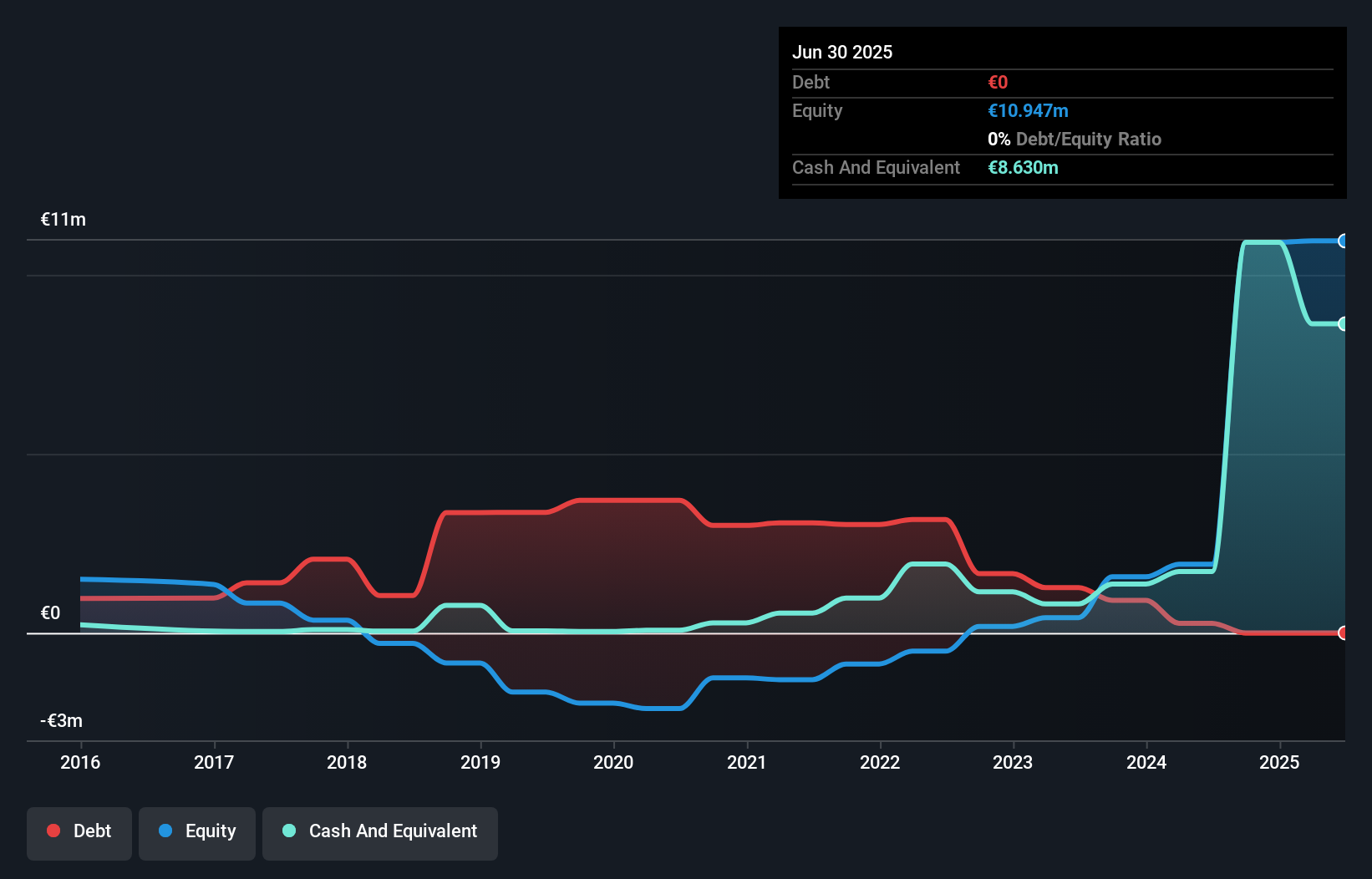

Hawick Data N.V. offers a compelling yet complex profile for penny stock investors. Despite being pre-revenue with €2 million in revenue, it boasts significant earnings growth of 505.2% over the past year, surpassing its five-year average of 76.1%. The company operates debt-free, with short-term assets of €11 million exceeding liabilities significantly, suggesting strong liquidity management. However, recent earnings have declined to €0.04 million from €0.352 million a year ago, indicating potential volatility in profitability despite an outstanding return on equity at 82.5%. Trading at 29% below estimated fair value may present opportunities for risk-tolerant investors.

- Click here to discover the nuances of Hawick Data with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Hawick Data's track record.

Glycorex Transplantation (NGM:GTAB B)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Glycorex Transplantation AB (publ) is a medical technology company specializing in transplantation, blood transfusion, and autoimmune diseases, with a market cap of SEK131.69 million.

Operations: The company generates revenue of SEK40.04 million from its Organ Transplantation segment.

Market Cap: SEK131.69M

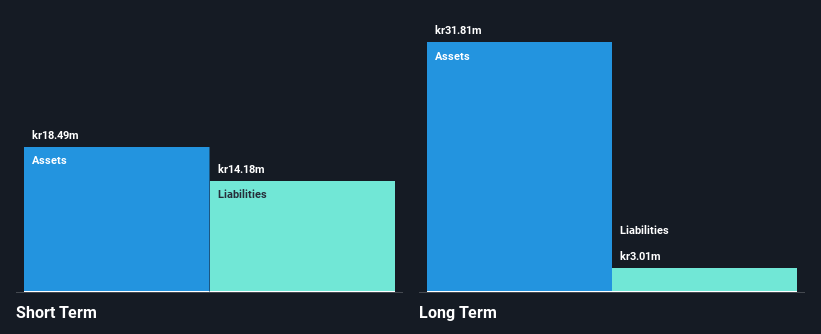

Glycorex Transplantation AB presents a mixed picture for penny stock investors. The company is unprofitable, with a net loss of SEK 5.04 million over nine months, though this is an improvement from the previous year's SEK 8.92 million loss. Despite its unprofitability, Glycorex has a robust cash runway exceeding three years and maintains positive free cash flow, indicating financial resilience. Its short-term assets significantly surpass both short and long-term liabilities, suggesting sound liquidity management. However, the board's inexperience and lack of meaningful revenue growth remain concerns for potential investors seeking stability in their investments.

- Navigate through the intricacies of Glycorex Transplantation with our comprehensive balance sheet health report here.

- Gain insights into Glycorex Transplantation's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Click this link to deep-dive into the 280 companies within our European Penny Stocks screener.

- Looking For Alternative Opportunities? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DGT

DigiTouch

Provides digital marketing and transformation services in Italy.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026