- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:APAM

January 2025's Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic signals, investors are keenly observing the performance of major indices like the Nasdaq Composite and S&P 500, which have shown moderate gains despite recent volatility. In this environment, dividend stocks can offer a compelling option for those seeking steady income streams, as they often provide a cushion against market uncertainty while potentially benefiting from any upward momentum in stock prices.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.79% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

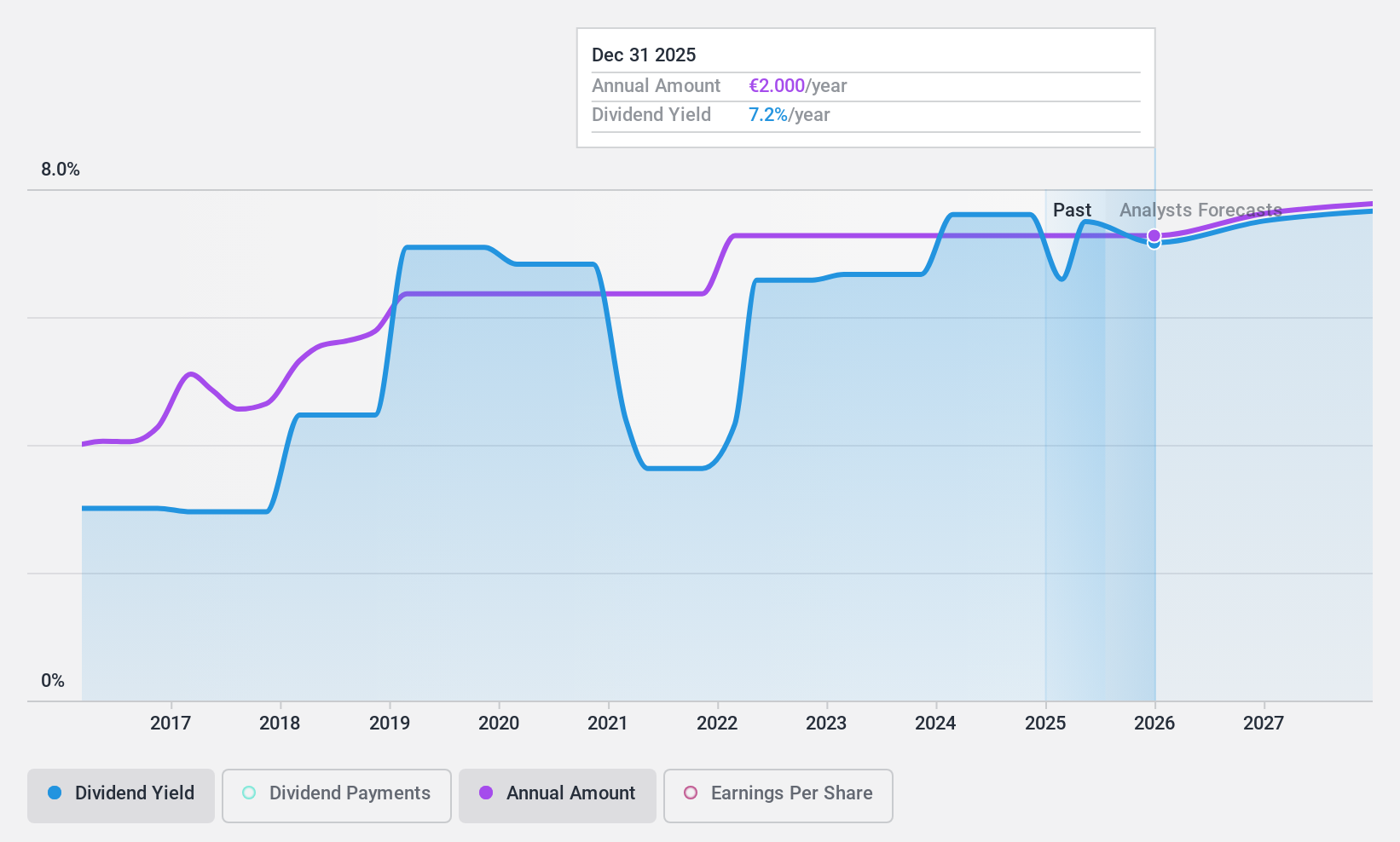

Mapfre (BME:MAP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Mapfre, S.A. operates globally in the insurance, finance, securities, investment, and services sectors with a market capitalization of approximately €7.60 billion.

Operations: Mapfre, S.A. generates its revenue primarily from its operations in Iberia (€8.97 billion), Brazil (€3.43 billion), North America (€2.67 billion), and Mapfre Asistencia-Mawdy (€171.90 million).

Dividend Yield: 6.3%

Mapfre's dividend profile is strong, with stable and growing payments over the past decade. The company recently approved an interim dividend against 2024 results, reflecting its commitment to shareholders. With a payout ratio of 56.4% and cash payout ratio of 47.8%, dividends are well-covered by earnings and cash flow, ensuring sustainability. Trading at good value compared to peers, Mapfre offers an attractive dividend yield of 6.26%, ranking in the top tier in Spain's market.

- Click here to discover the nuances of Mapfre with our detailed analytical dividend report.

- The analysis detailed in our Mapfre valuation report hints at an deflated share price compared to its estimated value.

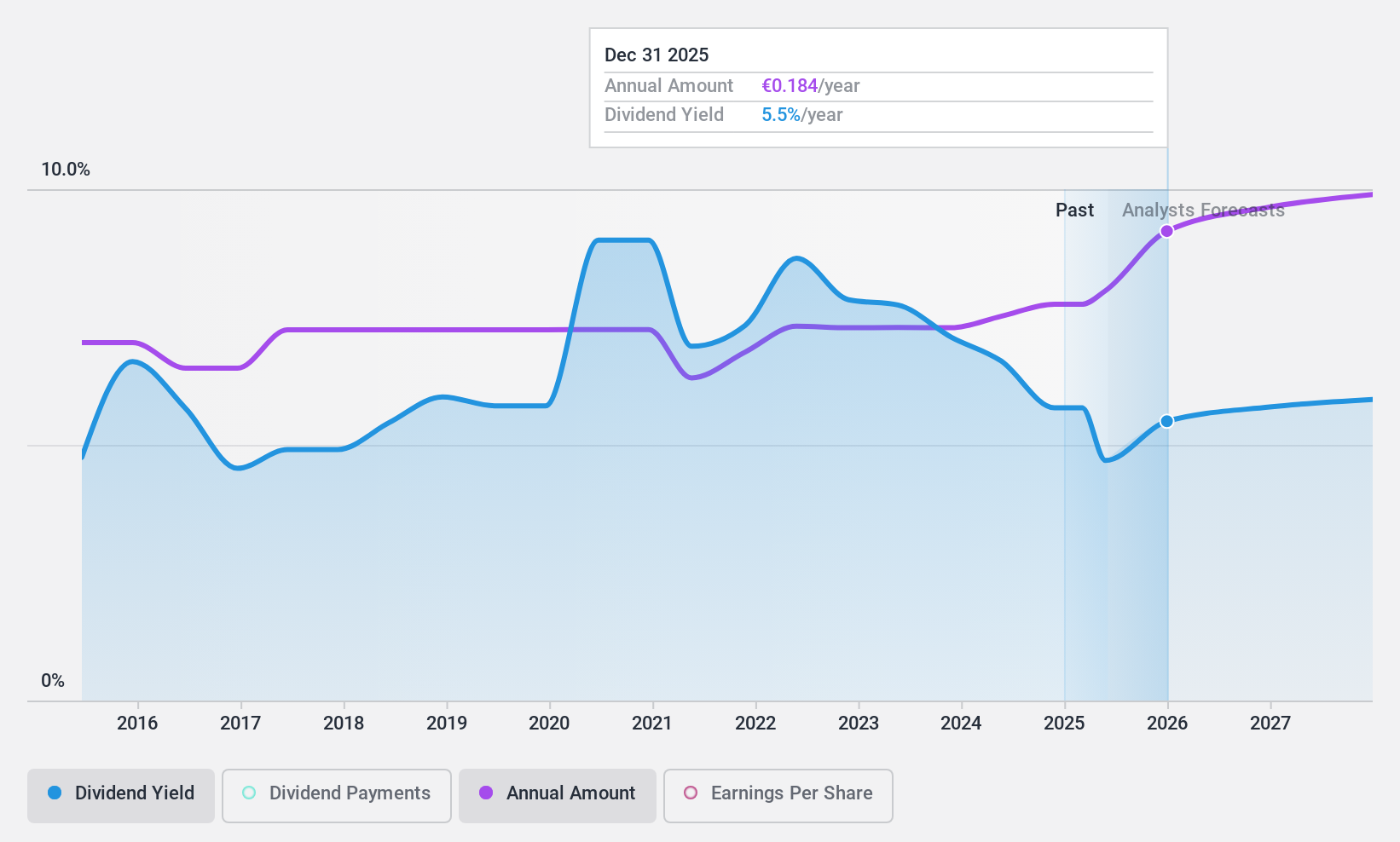

Aperam (ENXTAM:APAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aperam S.A., along with its subsidiaries, operates globally in the production and sale of stainless and specialty steel products, with a market capitalization of €1.84 billion.

Operations: Aperam's revenue is primarily derived from four segments: Stainless & Electrical Steel (€4.03 billion), Services & Solutions (€2.36 billion), Recycling & Renewables (€2.00 billion), and Alloys & Specialties (€943 million).

Dividend Yield: 7.8%

Aperam offers a compelling dividend profile with its payments covered by both earnings and cash flows, featuring payout ratios of 50% and 73%, respectively. Despite only nine years of dividend history, its yield ranks in the top 25% in the Dutch market. Recent financials show significant earnings growth, enhancing dividend reliability. Trading at a substantial discount to fair value and below analyst targets, Aperam presents potential value for income-focused investors.

- Get an in-depth perspective on Aperam's performance by reading our dividend report here.

- Our valuation report here indicates Aperam may be undervalued.

Rejlers (OM:REJL B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rejlers AB (publ) provides technical and engineering consultancy services in Sweden, Finland, Norway, and the United Arab Emirates, with a market cap of SEK3.25 billion.

Operations: Rejlers AB (publ) generates its revenue from various regions, with SEK2.66 billion from Sweden, SEK1.39 billion from Finland, and SEK309.80 million from Norway (including Embriq), along with a Group Wide contribution of SEK44.30 million.

Dividend Yield: 3.1%

Rejlers provides a mixed dividend profile with payments well-covered by earnings and cash flows, maintaining payout ratios of 47.6% and 35.7%, respectively. Despite a decade of increasing dividends, the yield remains low compared to top Swedish payers and has been volatile over the past ten years. However, Rejlers' strategic agreements with companies like E.ON and St1 Refinery highlight its commitment to sustainable energy solutions, potentially supporting future financial stability and dividend sustainability.

- Click to explore a detailed breakdown of our findings in Rejlers' dividend report.

- Our comprehensive valuation report raises the possibility that Rejlers is priced lower than what may be justified by its financials.

Where To Now?

- Click here to access our complete index of 1963 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:APAM

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives