- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

Philips Valuation in Focus After Recent FDA Clearance for Sleep Device in 2025

Reviewed by Bailey Pemberton

If you're eyeing Koninklijke Philips and wondering if it's time to buy, hold, or sell, you're in good company. Investors have watched this stock swing in both directions, with the past week showing a 4.2% pop, adding onto the modest 2.6% lift over the past month. Of course, looking further back tells a different story. Philips has dipped 14.0% over the last year and sits nearly 30% lower than it did five years ago. Yet, anyone who stuck around for the last three years would have captured a remarkable 101.3% gain, making short-term dips feel like just a blip for the most patient shareholders.

It's not uncommon to see this kind of volatility for a company navigating big shifts in healthcare technology and consumer markets. Wide swings like these reflect changing risk perceptions, investor sentiment, and sometimes, broader trends in international health policy or global supply chains. These are all significant factors for a multinational like Philips.

The big question is whether Philips is fairly valued at current prices, especially as the world keeps a watchful eye on innovation in health tech. Our quick valuation check gives Philips a score of 2 out of 6, meaning it's undervalued in just two of the six key metrics analysts use. Is that score telling the whole story, though? Let's break down the numbers with some popular valuation tools, and stay tuned, because there's a smarter way to look at valuation that we'll cover at the end.

Koninklijke Philips scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Koninklijke Philips Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and then discounting them to today's value. Simply put, it tries to answer, "What are all of Philips' future earnings worth in today's money?"

For Koninklijke Philips, the most recent twelve months saw a Free Cash Flow (FCF) of €415 Million. Analysts expect Philips' annual FCF to increase, projecting approximately €2.1 Billion by 2029. These growth estimates are based on analyst coverage for the first five years, with later years extrapolated according to industry trends.

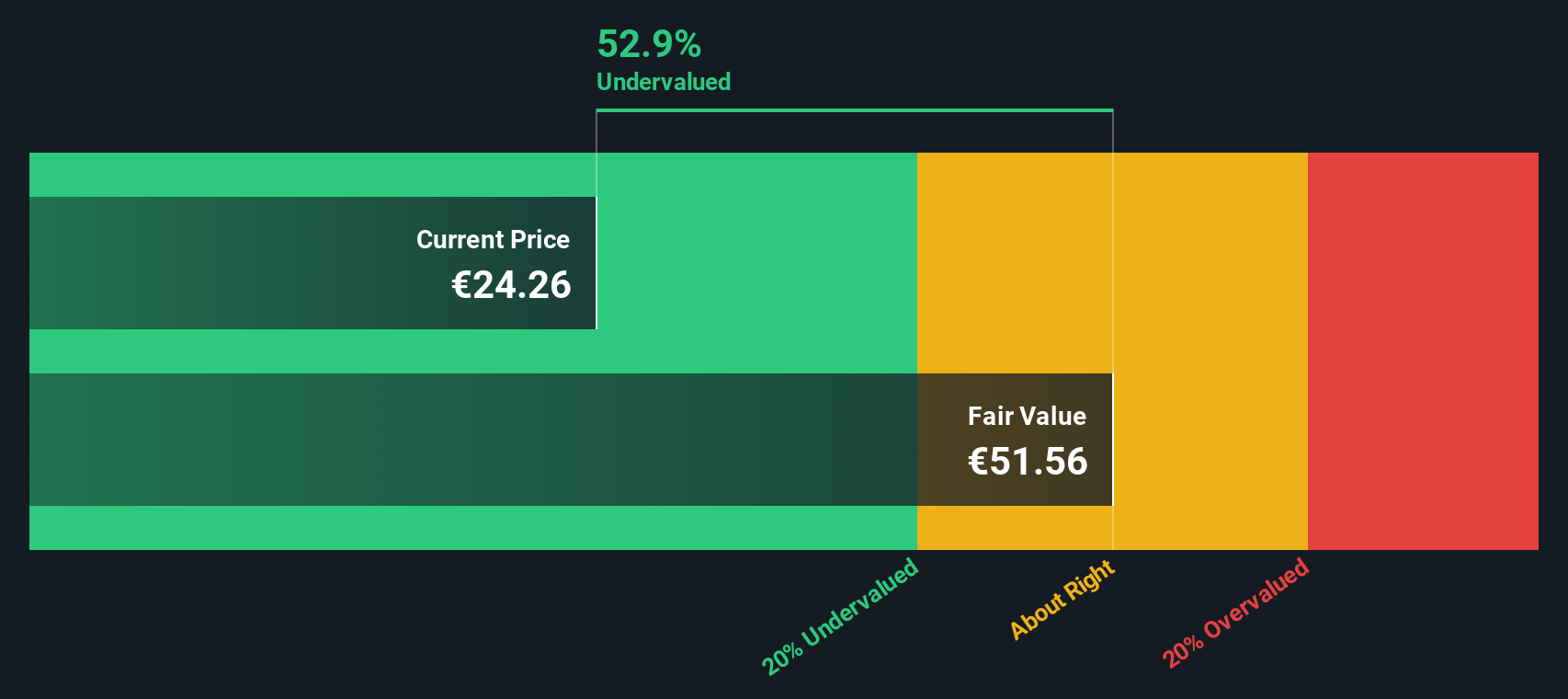

Using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for Philips comes out to €51.62 per share. When compared to its current trading price, this suggests that Koninklijke Philips is around 52.9% undervalued based on future cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Koninklijke Philips is undervalued by 52.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Koninklijke Philips Price vs Earnings

The Price-to-Earnings (PE) ratio remains a go-to metric for valuing profitable companies because it directly relates a company’s stock price to its bottom-line earnings. It helps investors quickly gauge how much they are paying for each euro of current profits. This is a particularly useful approach when a business, like Philips, is generating positive earnings.

However, a company’s “normal” or “fair” PE ratio is not set in stone. Expectations for future earnings growth, profit stability, and risk all play a part. Higher growth prospects or lower perceived risk often justify higher PE ratios, while slower-growing or riskier companies usually see lower multiples assigned by the market.

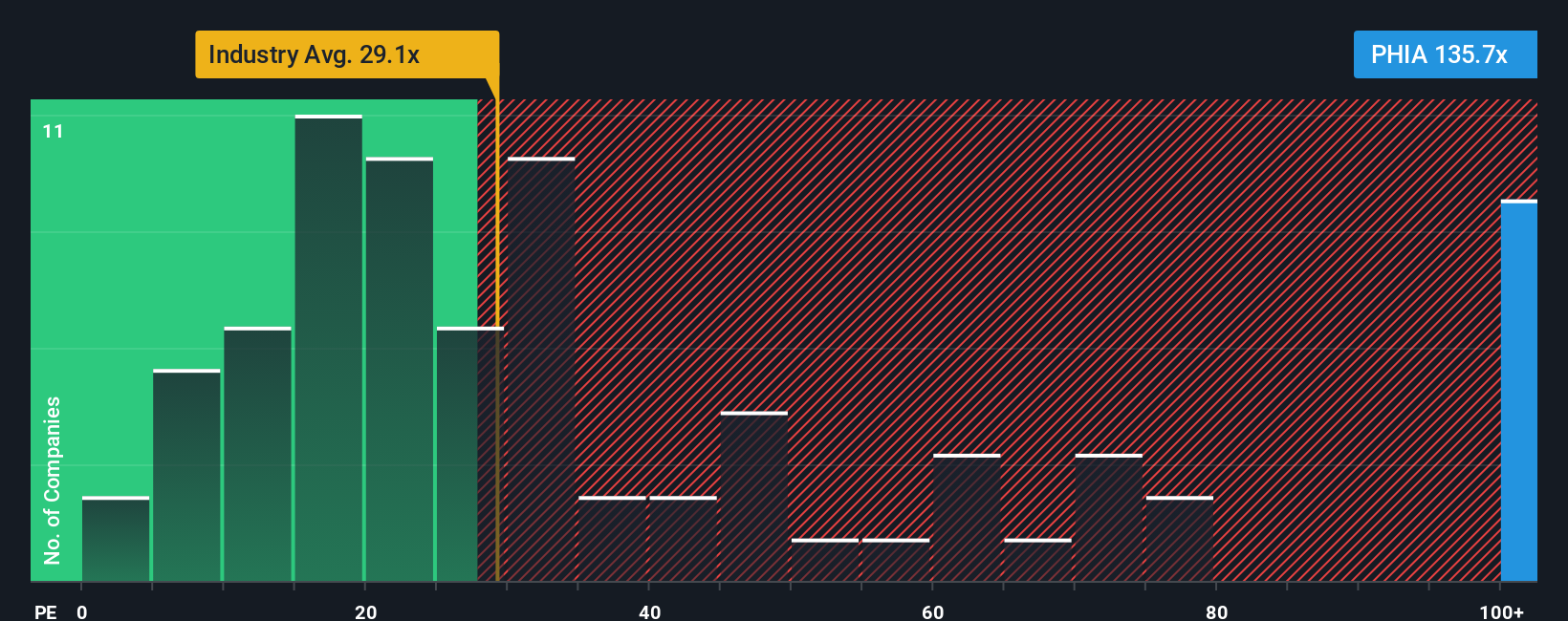

Right now, Koninklijke Philips trades at a PE ratio of 135.93x, which sits well above both the Medical Equipment industry average of 28.30x and the peer average of 26.46x. This is a substantial premium, signaling that investors expect strong earnings growth or see unique qualities in Philips compared to its peers.

To address whether that premium is justified, Simply Wall St’s “Fair Ratio” provides a more dynamic benchmark. Unlike broad industry or peer averages, the Fair Ratio evaluates a company’s valuation based on its own growth profile, profit margins, industry characteristics, risk factors, and market cap. This results in a fairer, more tailored estimate of what a company’s PE should be and offers investors a more reliable indicator than straightforward comparisons.

Comparing Philips’ current PE with its Fair Ratio, the numbers suggest that its stock is overvalued, far above what Simply Wall St’s holistic model would recommend for its current financial and growth outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Koninklijke Philips Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective on a company, your story about what you expect for its future revenue, profits, and margins, which leads to your own fair value estimate. Narratives bridge the gap between a company's story and its numbers, connecting your expectations directly to a dynamic fair value. On Simply Wall St's Community page, Narratives make sophisticated analysis accessible for everyone and guide millions of investors in framing their decisions.

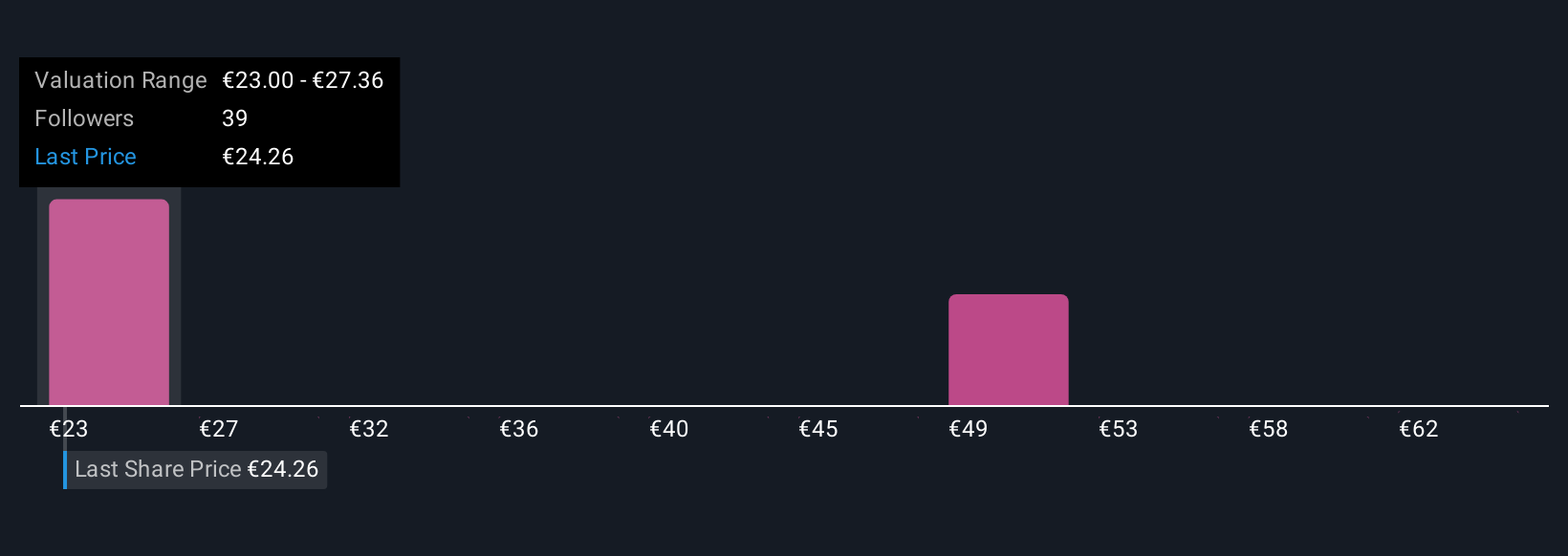

With Narratives, you can quickly compare your fair value with the current market price to see if now is a good time to buy or sell. These estimates update automatically as new events, earnings, or news shape the company's outlook, keeping you ahead of market changes. For example, some investors see Koninklijke Philips as a turnaround story worth €60 per share, while others remain cautious and value it closer to €29, reflecting different convictions about its future. Narratives put you in control, letting you track, adjust, and learn from a wide range of informed viewpoints.

Do you think there's more to the story for Koninklijke Philips? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives