- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

Philips (ENXTAM:PHIA): Examining the Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Koninklijke Philips (ENXTAM:PHIA) shares edged up in recent trading, sparking renewed interest in the stock’s performance over the past month and beyond. Investors are watching the company’s upcoming events for signals about its direction.

See our latest analysis for Koninklijke Philips.

Philips’ recent share price climb comes after a challenging stretch. The stock has rebounded 12.7% over the past three months but still posts a 1-year total shareholder return of -16.3%. Momentum appears to be building in the short term as buyers respond to improved sentiment and developments within the company. However, the longer-term performance reminds investors of the volatility in this space.

If today’s moves have you rethinking your exposure to innovative healthcare names, it’s worth exploring what else is out there with our See the full list for free.

With shares still trading below analyst targets and recent gains following a difficult year, the key question is whether Philips is now undervalued or if the market has already taken its recovery prospects into account.

Price-to-Earnings of 133.6x: Is it justified?

Koninklijke Philips currently trades at a lofty price-to-earnings (P/E) ratio of 133.6x, significantly above the industry and peer benchmarks. The last close was €23.89, with peers in the sector trading closer to 31.3x on average.

The price-to-earnings multiple compares a company’s market price per share to its earnings per share. A higher ratio typically suggests greater expectations for future growth, but it can also be a sign that a stock is expensive. For Koninklijke Philips, such a steep P/E could mean the market is pricing in a strong profit rebound or overlooking recent downside risks.

The industry comparison is stark. Koninklijke Philips’s P/E ratio of 133.6x far exceeds the 29.1x average for the European Medical Equipment industry. This suggests the shares are trading at a significant premium and, unless earnings rebound at an unusually rapid pace, the valuation may be difficult to justify.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 133.6x (OVERVALUED)

However, slower revenue growth and a relatively modest net income suggest Philips may struggle to justify its premium valuation if industry conditions soften.

Find out about the key risks to this Koninklijke Philips narrative.

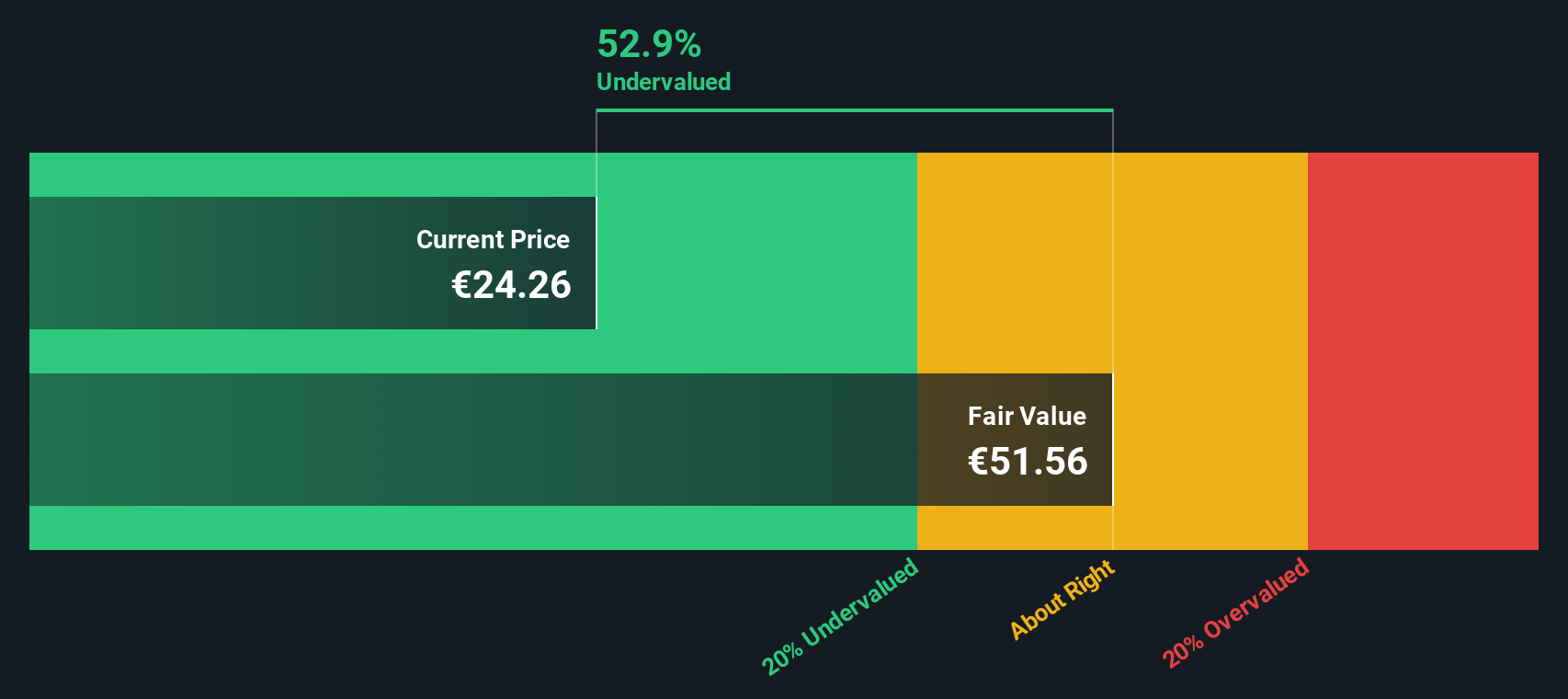

Another View: Discounted Cash Flow Suggests Undervaluation

While the high price-to-earnings ratio points to an expensive stock, our DCF model offers a different perspective. It estimates Koninklijke Philips's fair value at €51.49 compared to the current price of €23.89, indicating significant undervaluation. Could the market be underestimating Philips’s recovery prospects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Koninklijke Philips for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Koninklijke Philips Narrative

If you want to take a different approach or prefer hands-on analysis, you can quickly craft your own narrative in just a few minutes with Do it your way

A great starting point for your Koninklijke Philips research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always on the lookout for new opportunities beyond the obvious. Discover where momentum is building, spot under-the-radar themes, and stay ahead of major trends before the crowd catches on.

- Unlock the potential of innovative tech by analyzing these 24 AI penny stocks that are shaping tomorrow’s industries.

- Catch undervalued opportunities that the market may be overlooking, starting with these 871 undervalued stocks based on cash flows.

- Access passive income ideas designed for stable growth by exploring these 18 dividend stocks with yields > 3% with attractive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives