- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

FDA-Cleared AI and New Product Launches Could Be a Game Changer for Philips (ENXTAM:PHIA)

Reviewed by Simply Wall St

- Royal Philips recently announced the release of three new products: the Transcend Plus cardiovascular ultrasound system with advanced FDA-cleared AI features, the Philips Norelco Head Shaver Pro Series for precision head shaving, and the Lumea IPL hair removal device entering the US market.

- This wave of innovation demonstrates Philips’ ability to expand its portfolio across healthcare and consumer segments while leveraging cutting-edge technology to address evolving medical and lifestyle needs.

- We'll examine how the integration of FDA-cleared AI in Transcend Plus could shape Philips' investment narrative moving forward.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

What Is Koninklijke Philips' Investment Narrative?

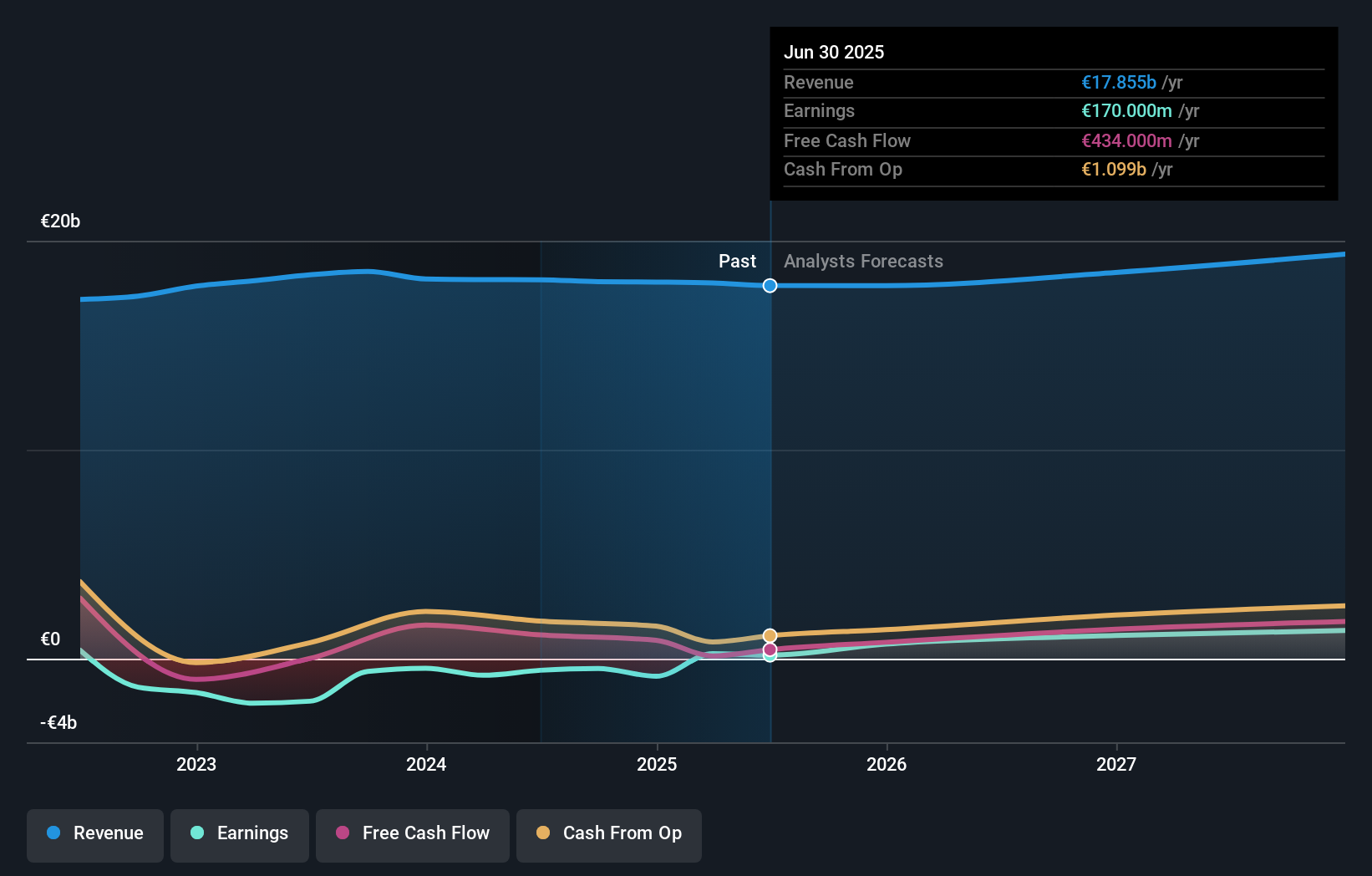

For shareholders in Koninklijke Philips, the core belief remains anchored in the company's ability to innovate and scale across health technology and personal care, against a backdrop of market pressures and legal uncertainties. The recent launch of the Transcend Plus cardiovascular ultrasound system, with its advanced FDA-cleared AI applications, could shape short-term sentiment by reinforcing Philips’ competitive advantage in diagnostic imaging. However, with sales and net income both declining year over year and the share price still trading below consensus fair value, the effect of these new releases may take time to significantly move financial metrics. Near-term catalysts to watch include traction from Philips’ AI-enabled products and expansion efforts, which must balance against key risks like the federal class action lawsuit and ongoing margin pressures. The latest wave of product launches may inject optimism, but it will be crucial to track whether these innovations lead to sustainable market share gains or meaningful revenue uplift.

Yet, outside this innovation story, the unresolved legal challenges remain a risk investors should not underestimate.

Exploring Other Perspectives

Explore 4 other fair value estimates on Koninklijke Philips - why the stock might be worth over 2x more than the current price!

Build Your Own Koninklijke Philips Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Koninklijke Philips research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Koninklijke Philips research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Koninklijke Philips' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives