- Netherlands

- /

- Food

- /

- ENXTAM:JDEP

JDE Peet's (ENXTAM:JDEP): Assessing Current Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for JDE Peet's.

JDE Peet's momentum has been quietly building, with a strong 90-day share price return of 27.5%, contributing to a steady uptrend over the past year. The company’s total shareholder return also reflects mild gains, suggesting investors see steady, if unspectacular, long-term value.

If you’re weighing other opportunities in today’s market, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

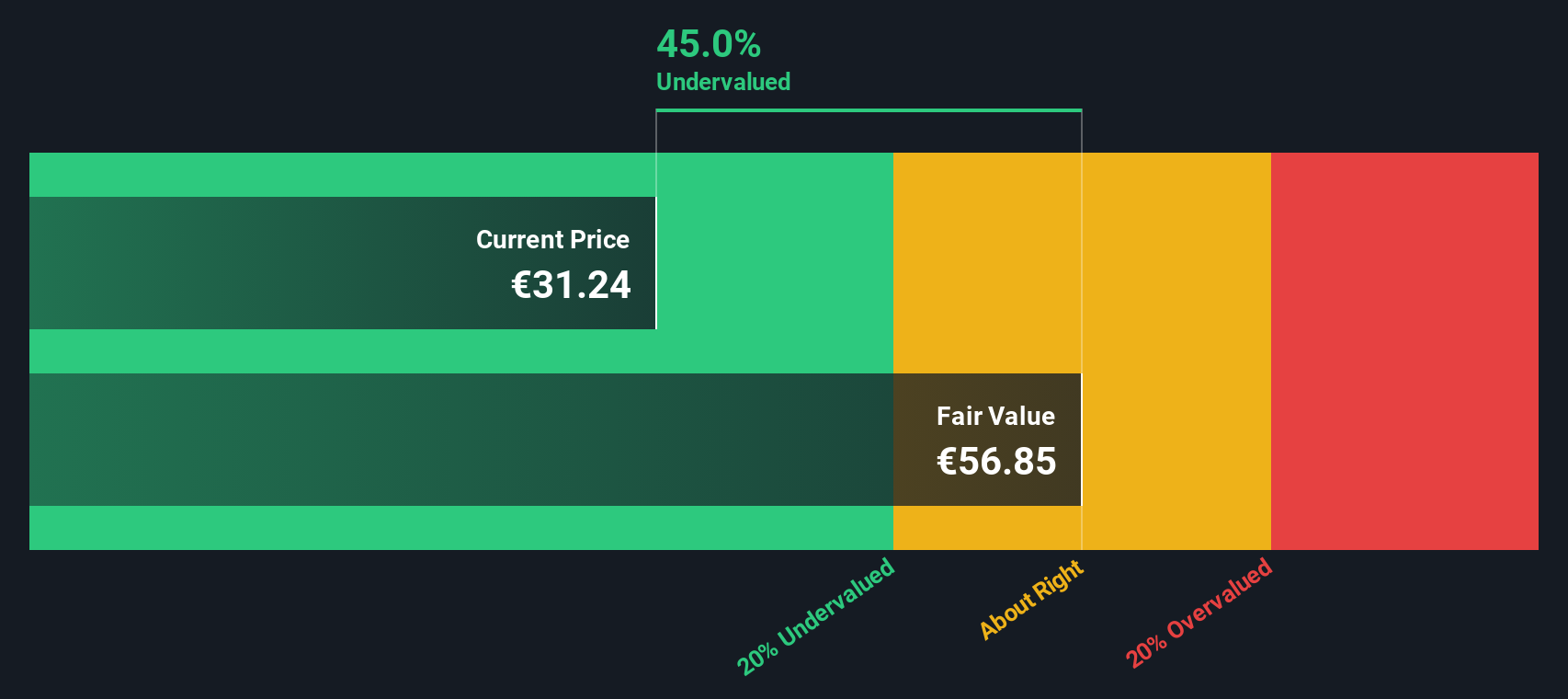

With shares continuing to rise, the question for investors is clear: Is JDE Peet's still trading below its true worth, or has the recent momentum already baked future growth into the current price?

Most Popular Narrative: 6% Overvalued

Analyst consensus fair value for JDE Peet's sits slightly below the latest closing price, suggesting the current rally may have pushed shares a bit beyond what is justified by future fundamentals. The gap is small, but it signals expectations of only modest upside absent fresh growth drivers.

Investments in brand strength, marketing, and a global revenue growth management platform are increasing pricing power and commercial resilience. This is demonstrated by the ability to pass through substantial price increases with limited volume declines, supporting both revenue and margin protection in inflationary or volatile input cost environments.

Curious how analysts defend their higher valuation even with muted revenue growth and only modest margin expansion? There is a set of surprising assumptions about JDE Peet's profit power and how its premium strategy will bend the market in its favor. Dive into the full narrative to uncover the analytical leaps behind this overvalued call.

Result: Fair Value of $29.39 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly high input costs or consumer pushback on further price increases could quickly challenge this optimistic outlook and put pressure on both growth and margins.

Find out about the key risks to this JDE Peet's narrative.

Another View: Discounted Cash Flow Points to Value Upside

Taking a different approach, our DCF model estimates JDE Peet's fair value at €57.24. This is markedly higher than the current share price. This implies the market may be undervaluing the company's future cash flows. Is this an overlooked opportunity, or is there something the market sees that the model misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JDE Peet's for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JDE Peet's Narrative

If you have a different perspective or want to investigate the numbers yourself, it only takes a few minutes to craft your own view of JDE Peet's. Do it your way

A great starting point for your JDE Peet's research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not wait for opportunities to pass them by. Use the Simply Wall Street Screener now to track lucrative trends and pinpoint stocks with real momentum before others catch on.

- Jumpstart your search for digital innovation by checking out these 24 AI penny stocks; these are set to disrupt markets with automation, machine learning, and next-gen technology.

- Grab income potential with these 19 dividend stocks with yields > 3%, which delivers attractive yields above 3% and is suitable for those seeking steady returns in today's market.

- Stay ahead of the trend in financial evolution and discover what is powering these 78 cryptocurrency and blockchain stocks as blockchain transforms the landscape of payments and decentralized apps.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:JDEP

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives