- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIO

Heineken Holding (ENXTAM:HEIO): Exploring Valuation After Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

Heineken Holding (ENXTAM:HEIO) shares have experienced some movement over the past month, prompting investors to consider recent trends in its business and valuation. Let's take a closer look at how returns and growth are stacking up.

See our latest analysis for Heineken Holding.

Heineken Holding’s share price has wobbled lately, with a mild gain year-to-date but a total shareholder return of -7.8% over the past twelve months. While recent movement hints at renewed optimism, long-term holders will be hoping momentum continues to build from here.

If you’re curious about what else could be gathering momentum right now, this is the perfect chance to discover fast growing stocks with high insider ownership

With Heineken Holding trading well below analyst price targets but showing sluggish longer-term returns, the key question is whether the stock is truly undervalued or if the market has already factored in all future growth prospects.

Most Popular Narrative: 43.2% Undervalued

Heineken Holding’s most widely followed narrative values the shares much higher than today’s closing price, highlighting confidence in future growth and profitability. This sharp discount between price and estimate creates a compelling focal point for further analysis.

Strategic investments in digitalization and supply chain productivity (including planned deployment of a "digital backbone" across key markets) are projected to unlock material, recurring cost savings and operational efficiencies. These developments support improved operating margin and long-term earnings growth.

Why does this narrative see so much more value than the market? What critical drivers support such a bold premium to today’s share price? Uncover the forecasting secrets and future assumptions that power this valuation. Find out what might be getting overlooked before everyone else does.

Result: Fair Value of €104.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as persistent currency swings in key markets or slower digital transformation could quickly undermine these upbeat forecasts and future valuations.

Find out about the key risks to this Heineken Holding narrative.

Another View: What Do Multiples Suggest?

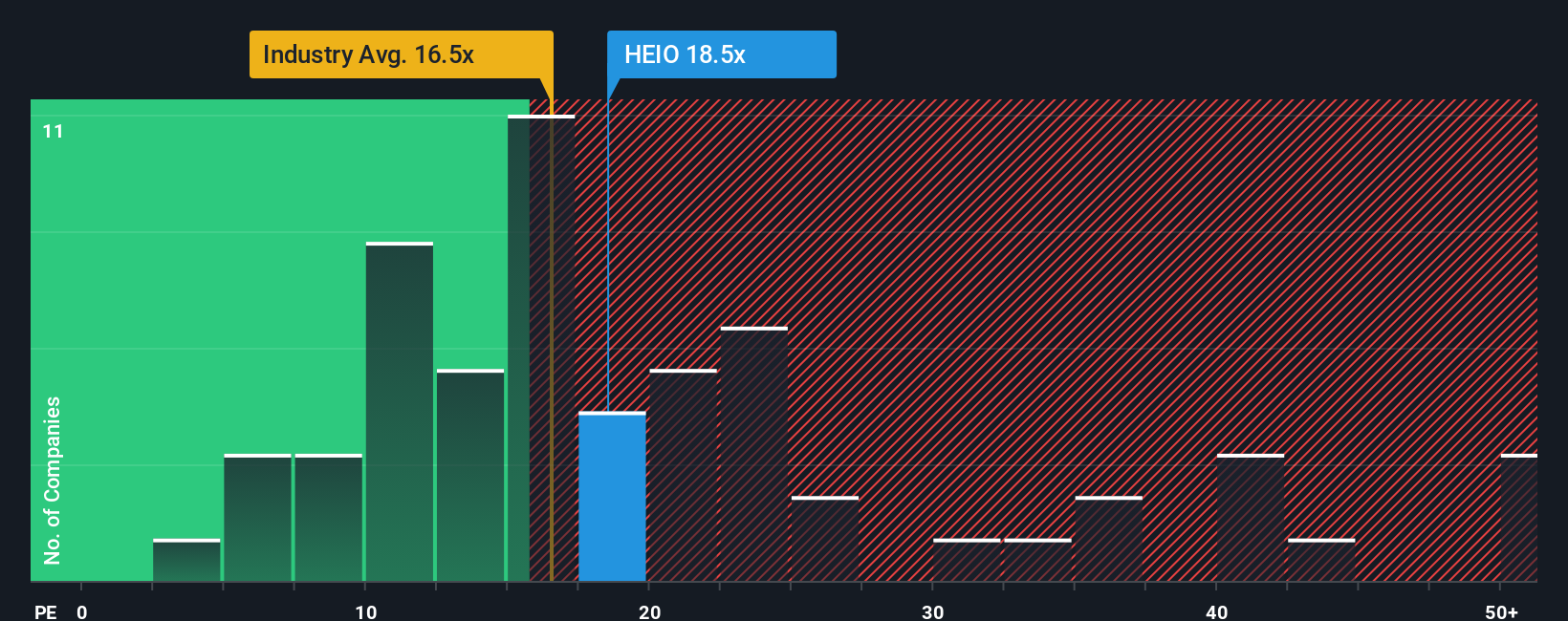

Looking at valuation through one common industry yardstick, Heineken Holding trades on a price-to-earnings ratio of 17.9x. That's higher than the European Beverage industry average of 16.4x, but below its peer average of 20.6x and well under a fair ratio of 22.7x. This mixed picture hints at both value and risk, so which signal should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Heineken Holding Narrative

If you have your own perspective on Heineken Holding or want to dig deeper into the numbers, you can easily build a personalized narrative in just minutes. Do it your way

A great starting point for your Heineken Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Every investor knows big opportunities come from thinking outside the obvious. If you want your next portfolio move to stand out, don’t scroll past these unique selections powered by the Simply Wall St Screener:

- Unlock growth by seeking out these 24 AI penny stocks with explosive potential and a front-row seat to artificial intelligence innovation you won’t want to miss.

- Boost your income strategy with these 19 dividend stocks with yields > 3% offering reliable yields over 3%. This can be a useful approach for building steady returns even in unpredictable markets.

- Capture tomorrow’s leaders early by targeting these 79 cryptocurrency and blockchain stocks shaping the evolution of payments, data security, and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIO

Heineken Holding

Engages in brewing and selling beer and cider in the Netherlands and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives