- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Heineken (ENXTAM:HEIA): Exploring Valuation After Recent Share Price Swings

Reviewed by Simply Wall St

Most Popular Narrative: 25.3% Undervalued

According to the most popular narrative, Heineken is trading at a meaningful discount to its fair value. Analysts see clear upside potential, based on a blend of business drivers and projected growth.

Investments in digital transformation, including scaling digital backbones, advanced route-to-market models, and data-driven productivity (targeting over €500M in gross savings for 2025), are laying the groundwork for long-term operational leverage and net margin expansion.

Want to know what underpins this bullish narrative? There is a hidden playbook fueling Heineken's future price target, with ambitious forecasts and bold market moves at its core. Curious how rapidly changing margins and future earnings projections combine to create this undervaluation? The narrative points to one big swing factor you will not want to miss.

Result: Fair Value of €89.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, structural declines in mature European markets and volatile currencies in key growth regions could quickly undermine this bullish case.

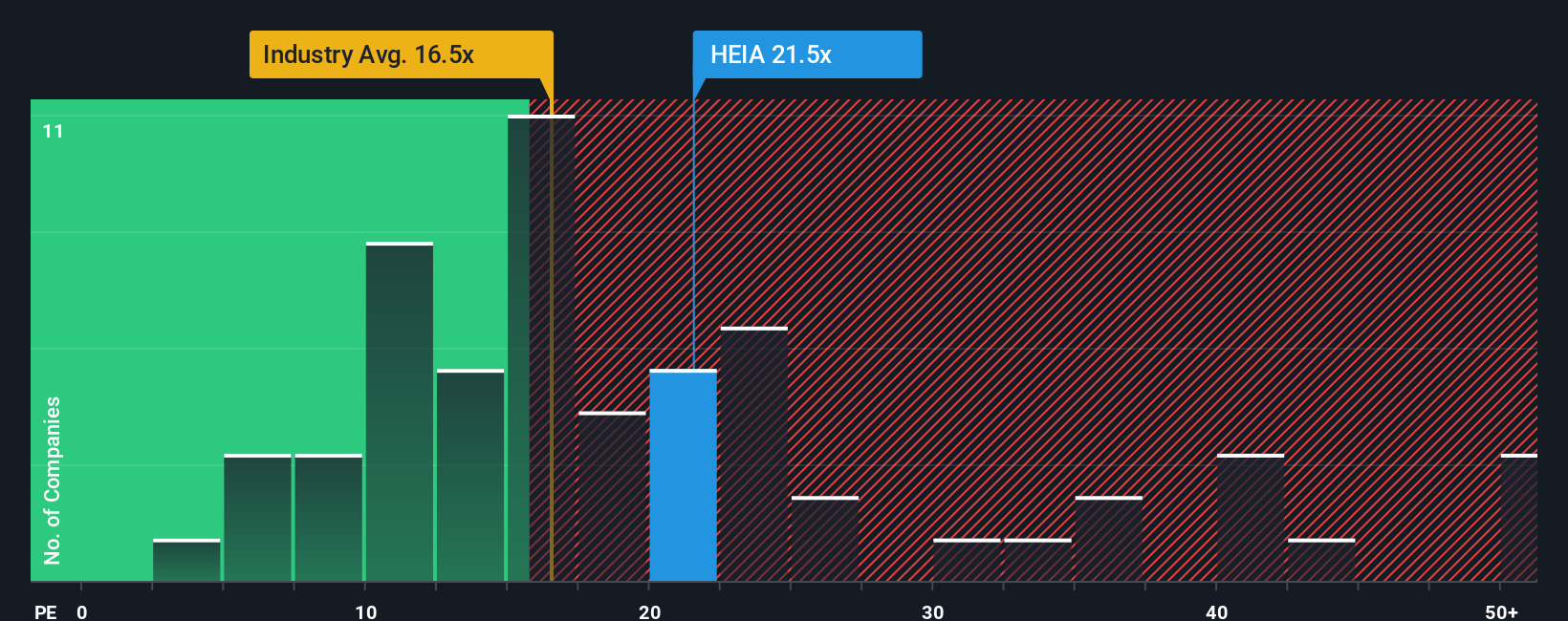

Find out about the key risks to this Heineken narrative.Another View: Pricing Based on Peers

A look at how Heineken is valued compared to others in its sector tells a different story. On this basis, the stock appears more expensive than its industry average. Which approach will the market trust?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Heineken to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Heineken Narrative

If you see things differently or want to dive into the numbers on your own terms, you can shape your own perspective in just a few minutes with Do it your way.

A great starting point for your Heineken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step beyond Heineken and seize the chance to tap into fast-moving markets. The right stock leads can set you ahead of the crowd this year.

- Spot early-stage winners powering ahead with strong financials when you use our penny stocks with strong financials.

- Harness the potential of healthcare breakthroughs and innovation in medicine with guidance from our healthcare AI stocks.

- Jump on rare value picks by searching for stocks that are truly undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives