ForFarmers N.V.'s (AMS:FFARM) investors are due to receive a payment of €0.29 per share on 28th of April. This makes the dividend yield 7.9%, which will augment investor returns quite nicely.

View our latest analysis for ForFarmers

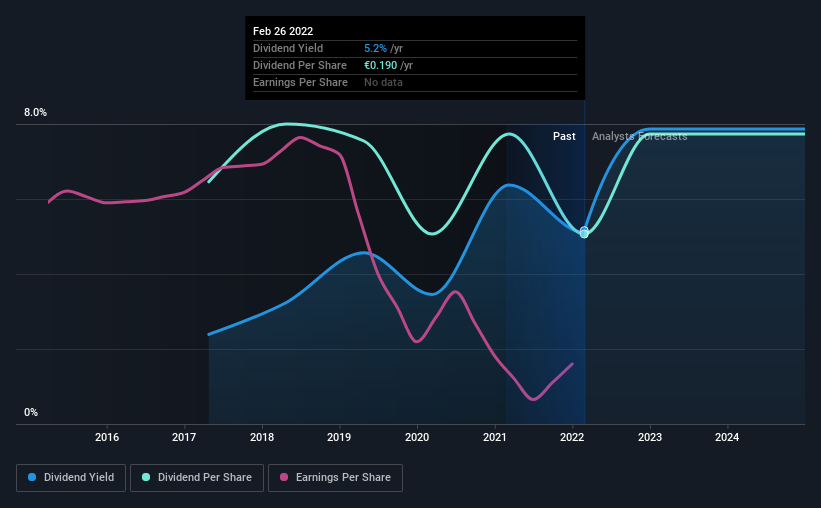

ForFarmers Is Paying Out More Than It Is Earning

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Based on the last payment, the company wasn't making enough to cover what it was paying to shareholders. It will be difficult to sustain this level of payout so we wouldn't be confident about this continuing.

Over the next year, EPS is forecast to expand by 30.8%. Assuming the dividend continues along recent trends, we think the payout ratio could reach 173%, which probably can't continue putting some pressure on the balance sheet.

ForFarmers' Dividend Has Lacked Consistency

Looking back, ForFarmers' dividend hasn't been particularly consistent. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The first annual payment during the last 5 years was €0.24 in 2017, and the most recent fiscal year payment was €0.19. Doing the maths, this is a decline of about 4.7% per year. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Over the past five years, it looks as though ForFarmers' EPS has declined at around 24% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

We're Not Big Fans Of ForFarmers' Dividend

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for ForFarmers that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:FFARM

ForFarmers

Provides feed solutions for conventional and organic livestock farming under the ForFarmers brand in the Netherlands, the United Kingdom, Germany, Poland, Belgium, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives