- Netherlands

- /

- Beverage

- /

- ENXTAM:CCEP

Coca-Cola Europacific Partners PLC's (AMS:CCEP) Shareholders Might Be Looking For Exit

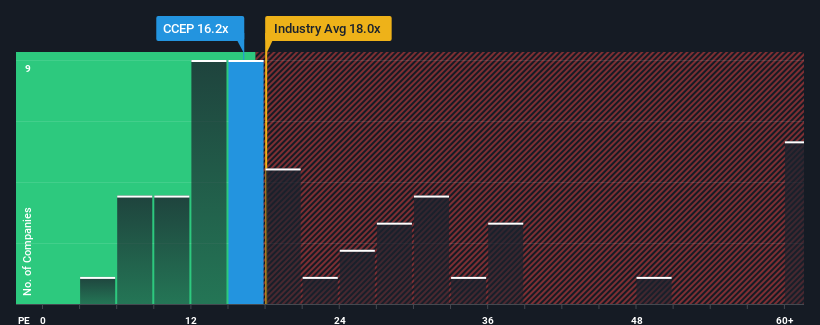

There wouldn't be many who think Coca-Cola Europacific Partners PLC's (AMS:CCEP) price-to-earnings (or "P/E") ratio of 16.2x is worth a mention when the median P/E in the Netherlands is similar at about 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been pleasing for Coca-Cola Europacific Partners as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Coca-Cola Europacific Partners

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Coca-Cola Europacific Partners would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 21%. Pleasingly, EPS has also lifted 139% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 7.6% each year during the coming three years according to the analysts following the company. With the market predicted to deliver 17% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's curious that Coca-Cola Europacific Partners' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Coca-Cola Europacific Partners' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for Coca-Cola Europacific Partners that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:CCEP

Coca-Cola Europacific Partners

Produces, distributes, and sells a range of non-alcoholic ready to drink beverages.

Good value second-rate dividend payer.