- Netherlands

- /

- Capital Markets

- /

- ENXTAM:CVC

Assessing CVC Capital Partners After 7% Rally and Market Rebound in 2025

Reviewed by Bailey Pemberton

Let’s be honest. If you’re eyeing CVC Capital Partners’ stock, you’re probably wondering whether now is the right time to jump in or sit on your hands and watch. Over the last week, shares have bounced up 7.1%, sparking some excited chatter from investors who see potential for a rebound. Still, it’s hard to ignore that, shaking out over the last year, CVC’s stock is down 18.3% and, since the start of this year, has slid 25.7%. These are serious moves that can signal either emerging value or ongoing risks, depending on how you read the story behind the numbers.

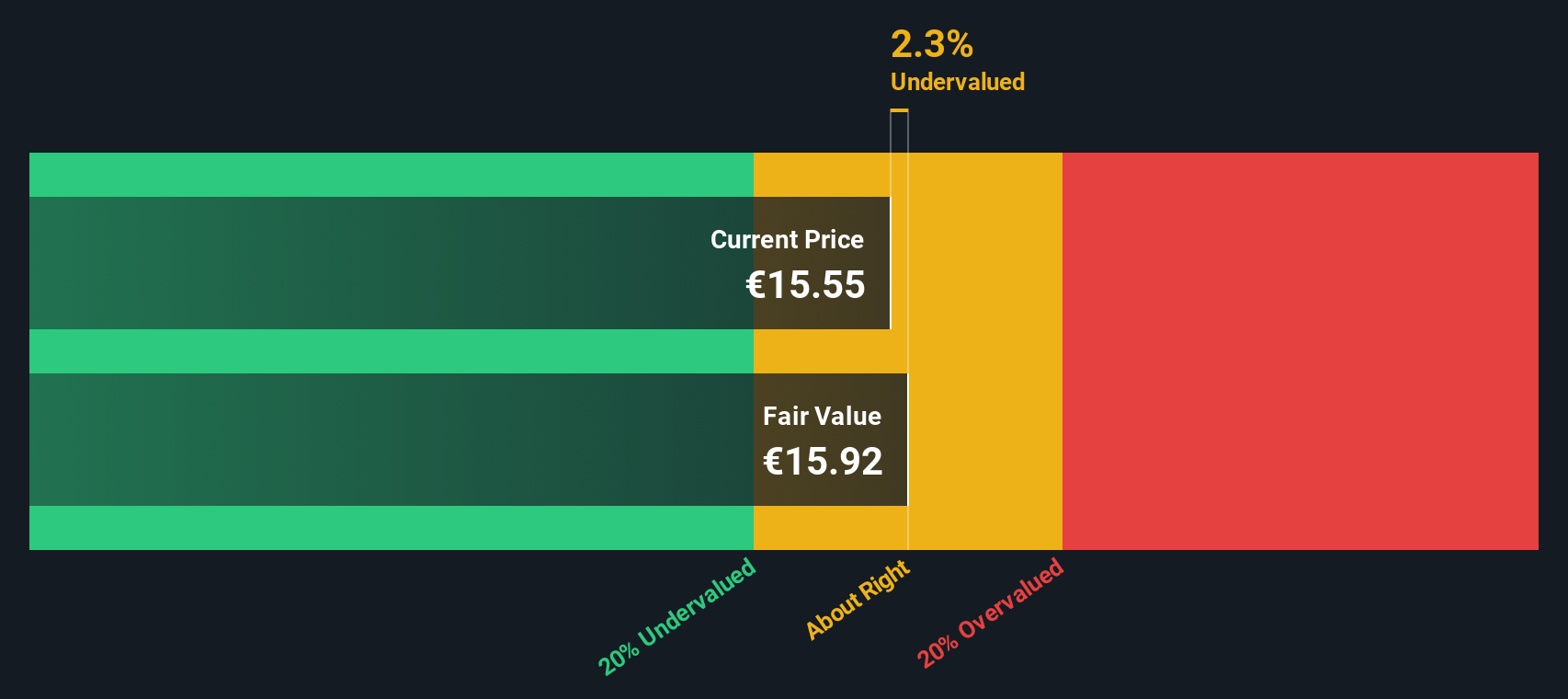

So, where does CVC sit when it comes to valuation? If you stack it up against six widely-used undervaluation checks, the company ticks the box on just 2 of them, earning a valuation score of 2. That’s not a slam dunk, but it’s also not a reason to write off the stock entirely. Clearly, there’s more to uncover before making a call, especially given the tug-of-war between recent short-term gains and its longer-term slump.

Get ready to dive deeper. We’ll walk through different valuation approaches to see what’s really priced in for CVC. And stick around, because there’s an even sharper lens I’ll share at the end to help you gauge whether CVC Capital Partners offers real value for your portfolio.

CVC Capital Partners scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CVC Capital Partners Excess Returns Analysis

The Excess Returns valuation method evaluates how much profit a company can generate on its invested capital above and beyond its cost of equity. For CVC Capital Partners, this approach highlights not just the scale of earnings, but also the efficiency with which those earnings are produced.

Here is how the numbers stack up: CVC has a Book Value of €1.18 per share, with analysts forecasting a stable EPS of €0.97 per share. This estimate is based on weighted future Return on Equity projections from nine analysts. The company’s Cost of Equity is €0.16 per share, producing an Excess Return of €0.81 per share. Notably, CVC boasts an average Return on Equity of 46.34%, indicating it is generating strong profits relative to its book value. Looking ahead, the stable Book Value is projected to rise to €2.08 per share, based on input from four analysts.

When these figures are run through the model, the resulting intrinsic value is just about in line with the current share price. The intrinsic discount implied by this approach is 1.7%, suggesting the stock is very close to fair value at current levels.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out CVC Capital Partners's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: CVC Capital Partners Price vs Earnings

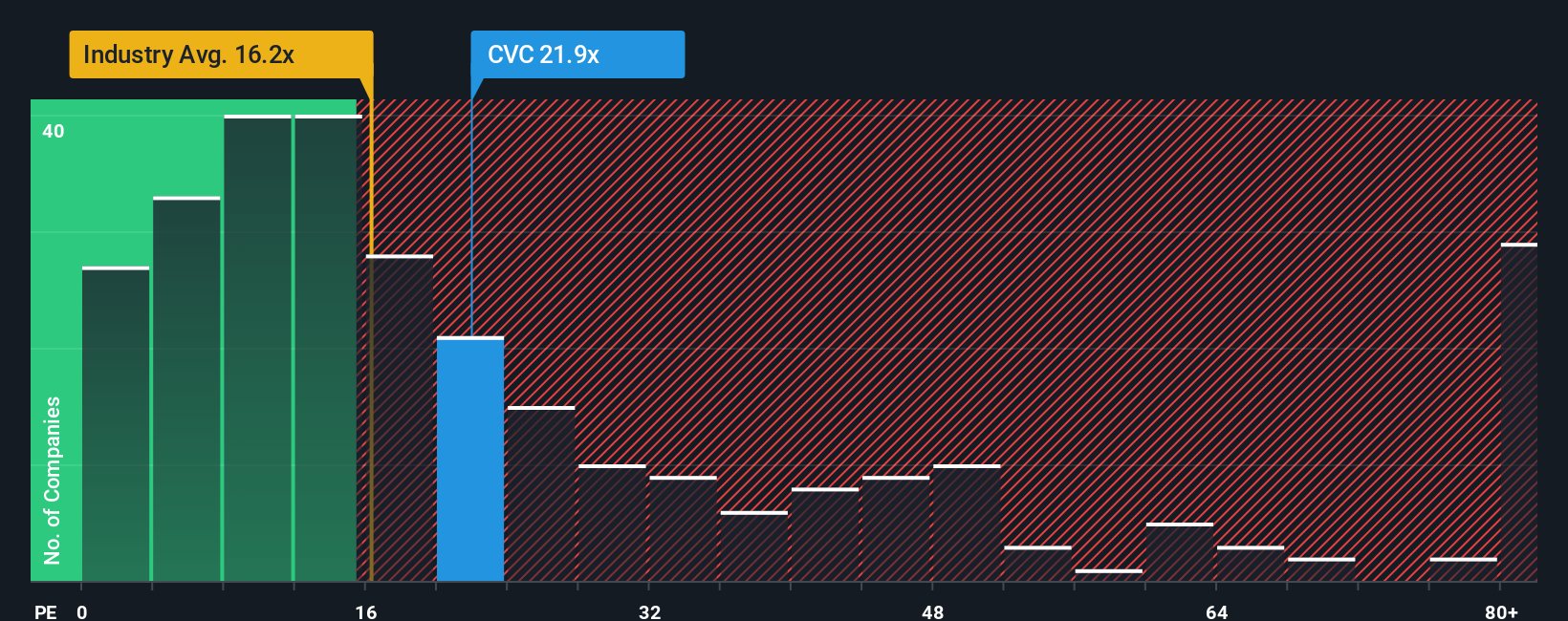

When analyzing CVC Capital Partners’ valuation, the Price-to-Earnings (PE) ratio stands out as the most relevant multiple for a profitable business. The PE ratio offers a quick snapshot of how much investors are willing to pay for a euro of earnings and acts as a common yardstick for comparing companies across sectors. A company’s “normal” or fair PE depends on expectations for future growth and the level of perceived risk. Higher anticipated growth and lower risk typically justify a higher PE multiple.

Currently, CVC trades at a PE ratio of 22.1x. This sits slightly above both the industry average for Capital Markets companies, which is 19.7x, and its direct peer group, averaging 21.6x. However, looking closer at nuanced factors like CVC’s earnings growth, profitability, industry, risk, and size, Simply Wall St’s proprietary Fair Ratio estimate comes in at 18.3x. This Fair Ratio provides a more tailored benchmark than simply comparing to peers or industry averages, as it specifically accounts for the company’s unique financial profile and risk factors.

Since CVC’s actual PE is only modestly higher than the Fair Ratio, by less than 0.1, the stock appears to be trading at about fair value on an earnings basis compared to what would be expected given its underlying fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CVC Capital Partners Narrative

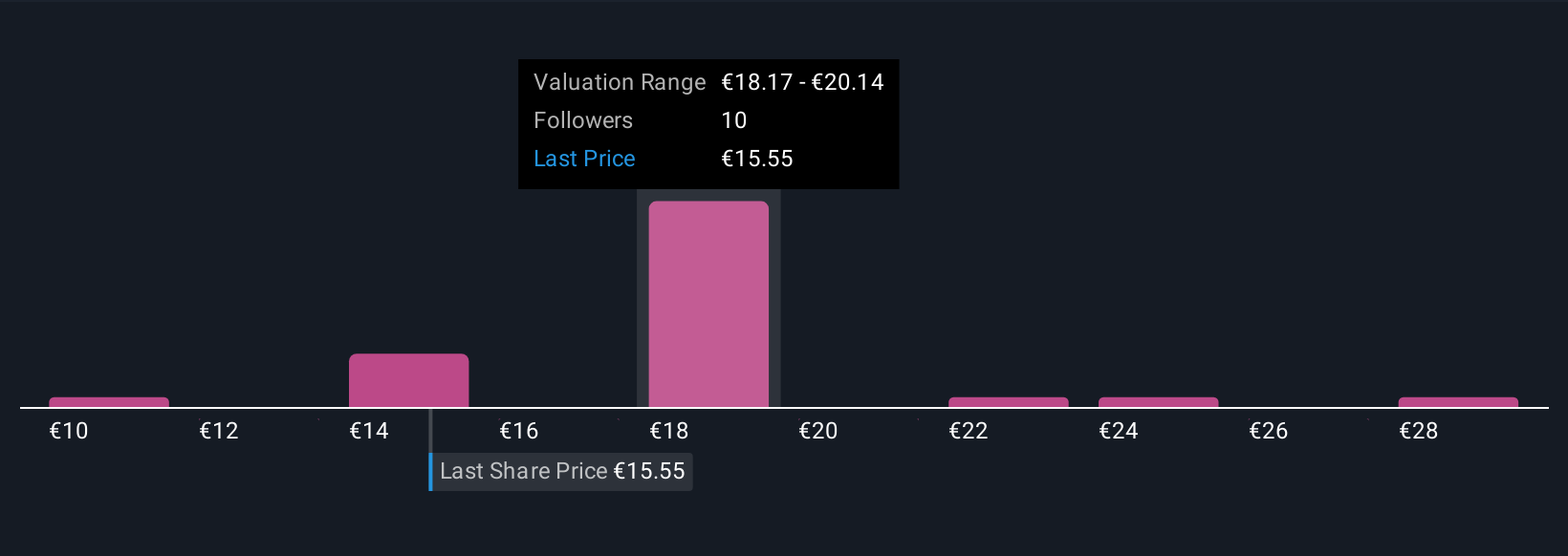

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative goes beyond raw numbers, allowing you to combine your story with your view of CVC Capital Partners’ future, whether bullish or cautious, along with your estimates for revenue, profit margins, and fair value. You can then see the financial model those assumptions create.

Each Narrative links a company’s real-world story to a financial forecast and calculates today’s fair value based on those expectations. Narratives are accessible and evolving tools available through Simply Wall St’s Community page, used by millions of investors for making sense of shares like CVC. By comparing Fair Value from your Narrative to the current price, you can make buy or sell decisions tailored to your perspective instead of just relying on consensus.

Best of all, Narratives update dynamically as soon as fresh news or results emerge, keeping your investment thesis current. For example, one Narrative on CVC might focus on predictable fees and global expansion, projecting a fair value of €22.0. Another narrative that is more cautious about fundraising risks and market exits could lead to a fair value as low as €17.2. Narratives empower you to connect your investment outlook directly to real financials and market action.

Do you think there's more to the story for CVC Capital Partners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CVC

CVC Capital Partners

A private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature, recapitalizations, strip sales, and spinouts.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives