- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Does Adyen’s Premium Valuation Still Make Sense After Its Strategic Enterprise Push?

Reviewed by Bailey Pemberton

- Wondering if Adyen is a bargain or a value trap at today’s price? You are not alone, and in this article we will unpack what the current share price actually implies.

- After a volatile few years, Adyen now trades around €1,352, with the stock up 2.0% over the last week but still down 9.2% over 30 days and modestly negative over 1 year and 5 years.

- Recent headlines have focused on Adyen’s strategic push to deepen its footprint with global enterprise merchants and sharpen its pricing and product offering, which has helped restore some confidence after earlier sell offs. At the same time, the broader debate about competition in payments and fintech regulation continues to swing sentiment back and forth around the stock.

- On our framework, Adyen scores just 1/6 on valuation checks, which suggests the market may be pricing in a lot of optimism already, but headline ratios never tell the whole story. Next we will walk through different valuation approaches to see what they imply for Adyen, before finishing with a more powerful way to think about what the stock is really worth.

Adyen scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Adyen Excess Returns Analysis

The Excess Returns model looks at how much value Adyen can create above the minimum return that equity investors require. Instead of focusing on cash flows, it asks whether management can keep reinvesting capital at attractive rates over time.

For Adyen, the starting Book Value is €148.38 per share, with an estimated Stable Book Value of €215.06 per share, based on forecasts from 11 analysts. On that equity base, analysts expect Stable EPS of €46.30 per share, implying an Average Return on Equity of 21.53%, which is comfortably above the assumed Cost of Equity of €11.86 per share.

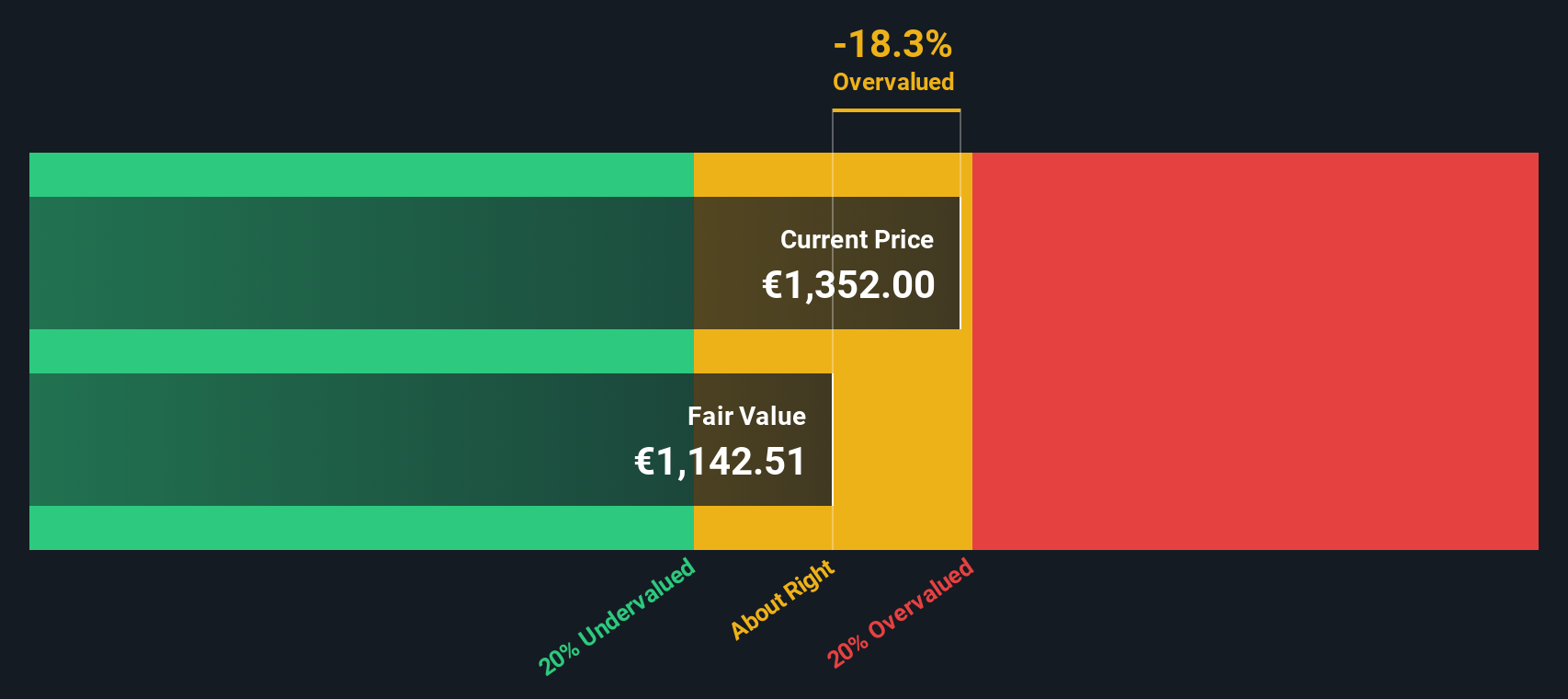

The gap between what Adyen is expected to earn and what investors require translates into an Excess Return of €34.44 per share. When these excess returns are projected forward and discounted, the model arrives at an intrinsic value of about €1,143 per share.

With the current share price around €1,352, this implies the stock is roughly 18.3% overvalued on this framework.

Result: OVERVALUED

Our Excess Returns analysis suggests Adyen may be overvalued by 18.3%. Discover 925 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Adyen Price vs Earnings

For profitable businesses like Adyen, the Price to Earnings, or PE, ratio is a useful way to gauge how much investors are paying for each euro of current profit. A higher PE can be justified when a company is growing quickly and has relatively low risk. Slower growth or higher uncertainty typically calls for a lower, more conservative multiple.

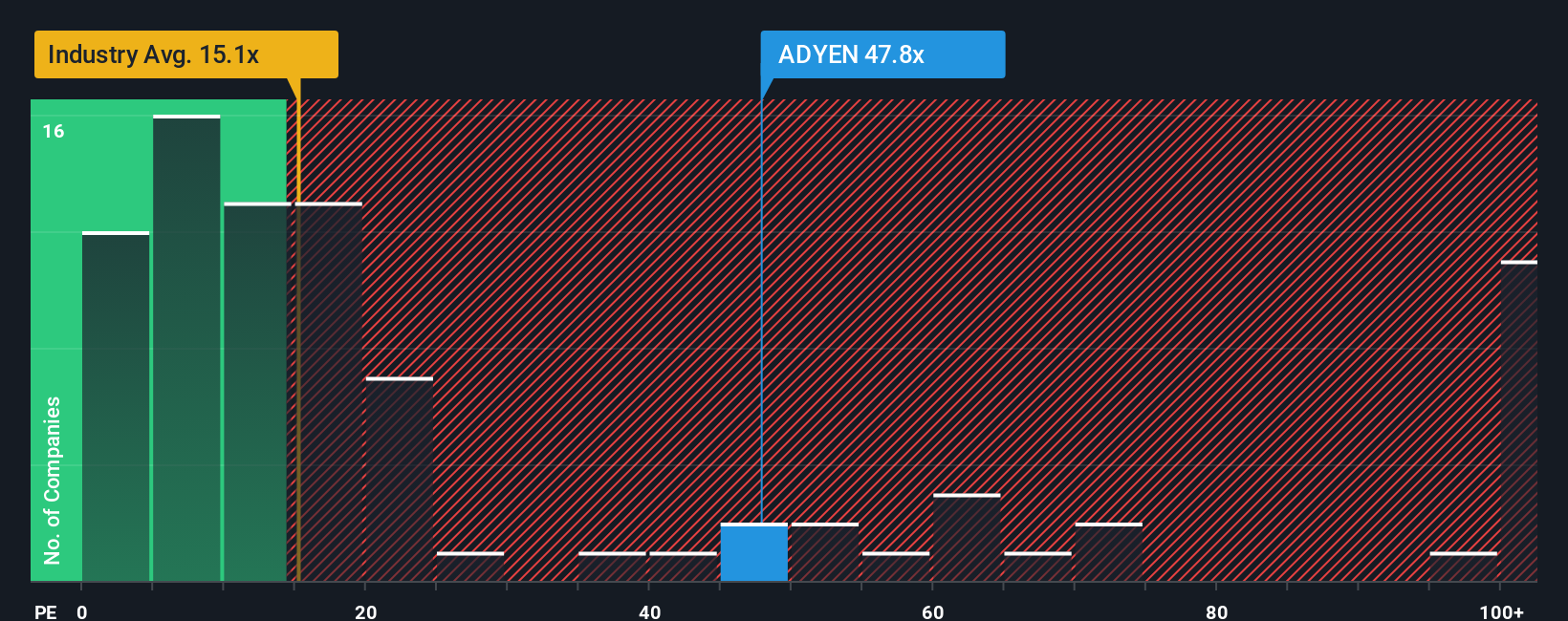

Adyen currently trades on a PE of about 42.7x, which is well above both the Diversified Financial industry average of roughly 14.3x and the broader peer group average of about 12.8x. On the surface, that gap suggests the market is already embedding a premium for Adyen’s growth profile and business quality.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE Adyen should trade on, after adjusting for its earnings growth outlook, profitability, industry, market cap and specific risks. For Adyen, this Fair Ratio comes out at 20.8x, which is far below the current 42.7x. That implies the shares are pricing in materially richer expectations than what this fundamentals based model supports.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Adyen Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you describe the story you believe about a company and link it directly to your own forecasts for revenue, earnings and margins. These then roll up into a Fair Value you can compare to today’s share price to decide whether to buy, hold or sell.

Instead of staring at static ratios, a Narrative connects three things: the business story you believe, the numbers that flow from that story, and the fair value that drops out of those numbers. It then updates dynamically as new information such as earnings, guidance or news arrives so your thesis never goes stale.

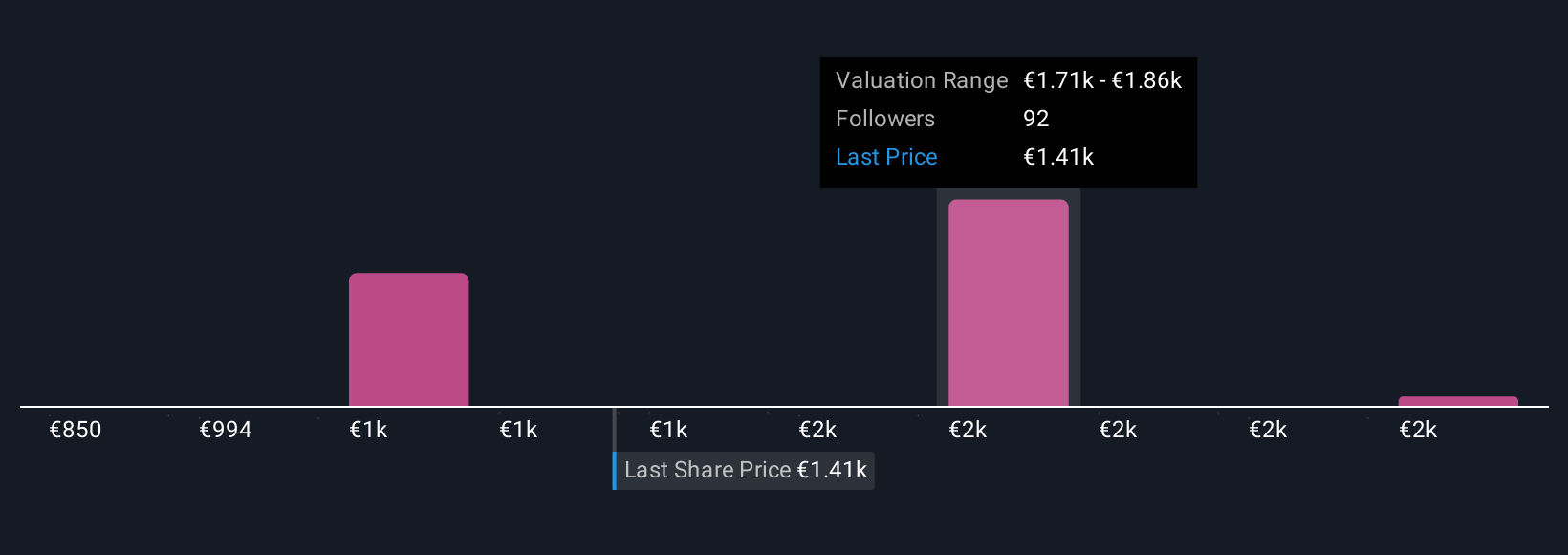

For Adyen, one investor’s Narrative might assume that modular services keep margins near 45%, revenue compounds above 20% and the stock is worth closer to the bullish €2,450 target. Another might focus on competitive and regulatory risks, expect slower growth, lower profitability and a fair value nearer the bearish €1,400 view. Narratives makes both perspectives transparent and directly comparable to the current price.

Do you think there's more to the story for Adyen? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026