- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Adyen N.V.'s (AMS:ADYEN) Popularity With Investors Is Clear

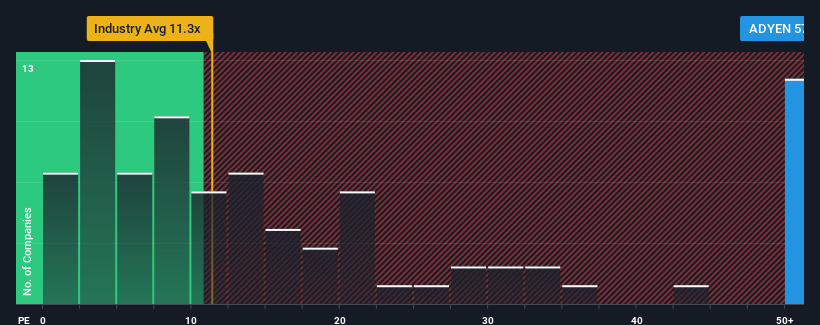

Adyen N.V.'s (AMS:ADYEN) price-to-earnings (or "P/E") ratio of 57x might make it look like a strong sell right now compared to the market in the Netherlands, where around half of the companies have P/E ratios below 16x and even P/E's below 10x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Adyen certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Adyen

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Adyen's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 46%. The latest three year period has also seen an excellent 116% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 23% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 13% per year, which is noticeably less attractive.

In light of this, it's understandable that Adyen's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Adyen's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Adyen maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Adyen with six simple checks.

If these risks are making you reconsider your opinion on Adyen, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives