- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:AD

Is There Still Value in Ahold Delhaize After Solid 2024 Price Gains?

Reviewed by Simply Wall St

Thinking about what to do with Koninklijke Ahold Delhaize stock? You are not alone. Whether you are considering making your first investment or deciding if it is time to take profits, it always pays to step back and look at the bigger picture. Over the past year, Ahold Delhaize has quietly delivered a 15.0% gain, with a solid 8.2% return so far this year. Even zooming out to a three- or five-year view, the stock is up 38.4% and 59.7% respectively. In the last month, things have been a bit flatter, with only a 0.4% dip, but the long-term story still seems encouraging.

Some of this steady growth can be chalked up to investor confidence in the resilience of food retail, especially as shoppers navigate changing economic conditions. While there may not have been big headlines driving price moves recently, the stock's gradual climb suggests that risk perceptions are shifting in Ahold Delhaize's favor. Behind the scenes, there is a compelling twist: on a scale with six key checks for undervaluation, the company scores five, signaling possible upside if the market is missing something.

So, how does that value score stack up, and what exactly are those checks? Let us dig into the different ways analysts decide if a stock like Ahold Delhaize is undervalued, and later, we will explore a slightly unconventional approach that might offer even more insight.

Koninklijke Ahold Delhaize delivered 15.0% returns over the last year. See how this stacks up to the rest of the Consumer Retailing industry.Approach 1: Koninklijke Ahold Delhaize Discounted Cash Flow (DCF) Analysis

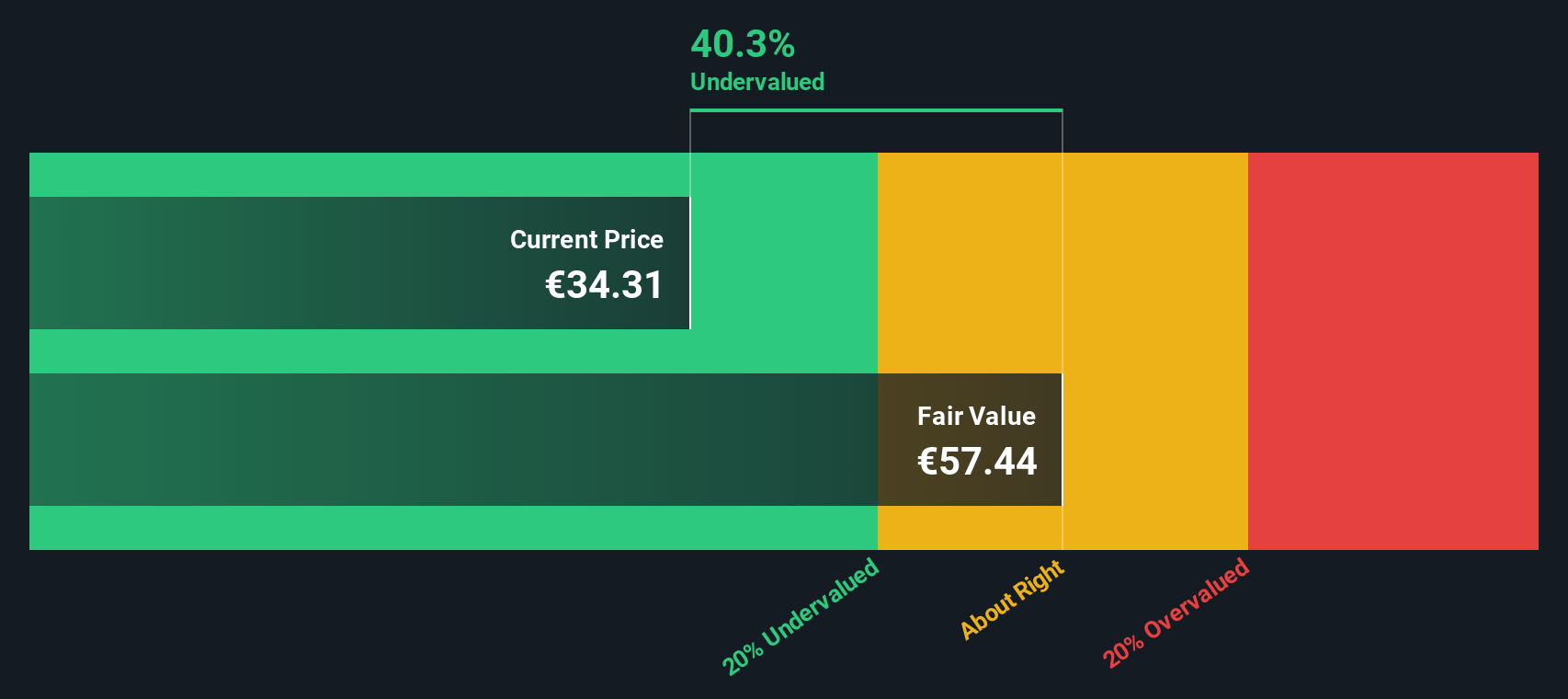

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic worth by projecting its future free cash flows and then discounting those figures back to their value today. For Koninklijke Ahold Delhaize, this model provides a window into its financial future based on both analyst forecasts and extrapolated trends.

Currently, Ahold Delhaize generates free cash flow of approximately €4.03 billion, a level that underpins both stability and the company’s resilience in a shifting retail environment. Looking ahead, analyst estimates are available for the next five years. After that, future projections rely on extrapolation. Free cash flow is still forecast to be around €2.20 billion by 2035. This suggests a company expected to remain a strong cash generator throughout the next decade.

According to the DCF analysis, the intrinsic value per share is estimated at €51.24. Compared to recent market pricing, this implies the stock is trading at a significant 33.0% discount to its projected worth.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Koninklijke Ahold Delhaize.

Approach 2: Koninklijke Ahold Delhaize Price vs Earnings

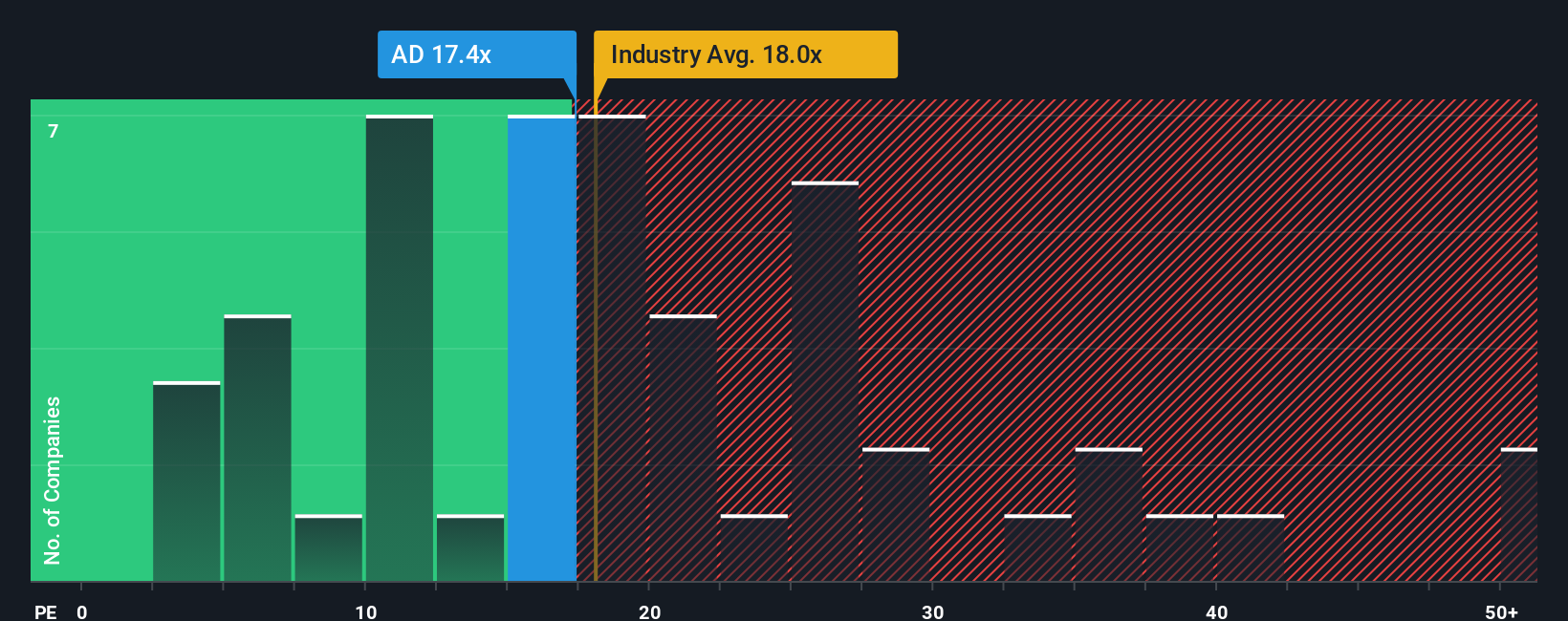

For profitable companies like Koninklijke Ahold Delhaize, the Price-to-Earnings (PE) ratio is a popular and relevant way to assess valuation. This ratio captures how much investors are willing to pay for each euro of earnings, making it especially useful for businesses with stable and consistent profits.

What constitutes a “normal” or “fair” PE ratio depends on several factors. Companies with faster earnings growth or lower risk typically command higher PE ratios, as investors are willing to pay a premium for future potential or stability. In contrast, slower-growing or riskier companies usually trade at lower multiples.

Currently, Ahold Delhaize trades at a PE ratio of 16.7x, which is slightly below the Consumer Retailing industry average of 17.2x and notably lower than the average for its direct peers, which stands at 21.4x. This initial comparison might suggest the stock is conservatively priced.

However, it is important to look beyond simple averages. Simply Wall St’s proprietary “Fair Ratio” was developed for this reason. The Fair Ratio (in this case, 18.8x) adjusts for a company’s specific characteristics, such as its earnings growth prospects, profit margins, industry positioning, size, and risk factors. By taking these unique aspects into account, the Fair Ratio offers a more meaningful and personalized benchmark than a broad peer or industry average ever could.

Comparing the actual PE of 16.7x to the Fair Ratio of 18.8x, Ahold Delhaize appears to be undervalued using this approach, trading at a modest discount to what a fair price might imply.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Koninklijke Ahold Delhaize Narrative

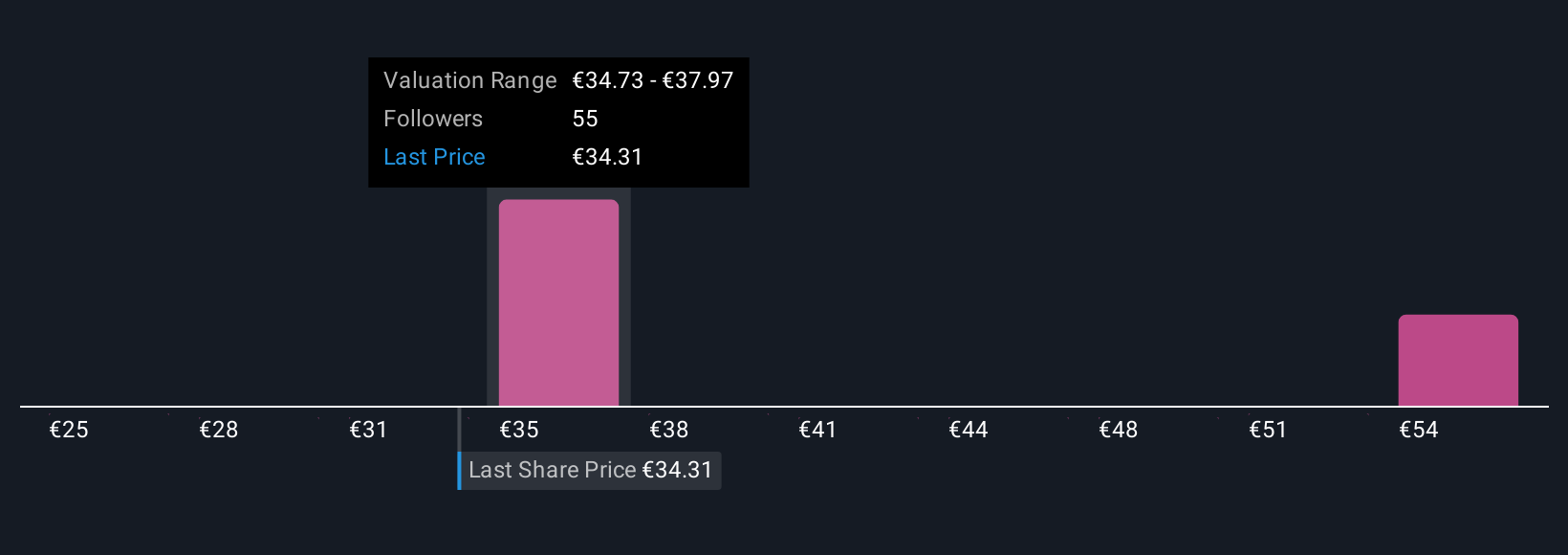

As promised earlier, there is an even better way to understand valuation that goes beyond ratios or models, and that is through Narratives. A Narrative is a simple, approachable way to capture your perspective or “story” about a company, tying together your assumptions about its future revenue, earnings, margins, and what you believe is a fair value.

Narratives directly connect the story you see unfolding for a business with real financial forecasts, letting you estimate what the company should be worth today. This method moves beyond just looking at historical data, allowing you to easily create and track your outlook right on Simply Wall St’s Community page, where millions of investors share and compare their viewpoints.

With Narratives, you get a dynamic and living investment tool. When news breaks or earnings are released, your Narrative (and its fair value calculation) updates automatically, helping you decide if it is time to buy, hold, or sell, simply by comparing your Fair Value to the current share price.

For example, when it comes to Koninklijke Ahold Delhaize, the most optimistic investors currently see a fair value up at €43.00, while the most cautious assign just €24.65, showing how even the same data can produce very different stories and price expectations.

Do you think there's more to the story for Koninklijke Ahold Delhaize? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Koninklijke Ahold Delhaize might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AD

Koninklijke Ahold Delhaize

Operates retail food stores and e-commerce in the Netherlands, the United States, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion