- Netherlands

- /

- Professional Services

- /

- ENXTAM:AVTX

Shareholders in Avantium (AMS:AVTX) have lost 48%, as stock drops 12% this past week

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Avantium N.V. (AMS:AVTX) have tasted that bitter downside in the last year, as the share price dropped 56%. That falls noticeably short of the market return of around 11%. We note that it has not been easy for shareholders over three years, either; the share price is down 48% in that time. Unfortunately the share price momentum is still quite negative, with prices down 21% in thirty days.

If the past week is anything to go by, investor sentiment for Avantium isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Avantium

Given that Avantium didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Avantium grew its revenue by 6.4% over the last year. While that may seem decent it isn't great considering the company is still making a loss. Without profits, and with revenue growth sluggish, you get a 56% loss for shareholders, over the year. We'd want to see evidence that future revenue growth will be stronger before getting too interested. Of course, the market can be too impatient at times. Why not take a closer look at this one so you're ready to pounce if growth does accelerate.

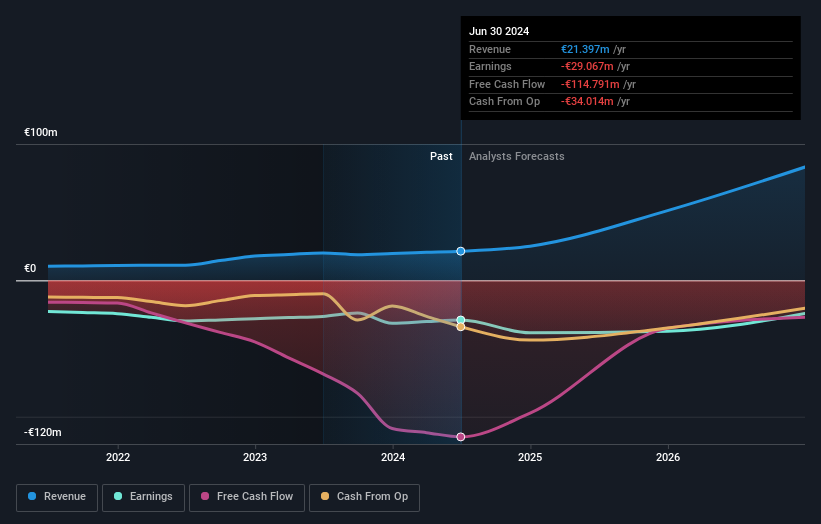

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Avantium's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Avantium's TSR, at -48% is higher than its share price return of -56%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Investors in Avantium had a tough year, with a total loss of 48%, against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for Avantium (2 can't be ignored!) that you should be aware of before investing here.

Avantium is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:AVTX

Avantium

A chemical technology company, develops and commercializes renewable chemistry solutions in the Netherlands.

Mediocre balance sheet with limited growth.

Market Insights

Community Narratives